$2,000,000,000,000 – 2 Trillion Dollars!

Two TRILLION dollars is an unfathomable amount of money. It represents the value currently held inside of deferred annuities, and it is very likely that you have a client (or ten!) that is counted in this sum. Furthermore, a Gallup poll found that 73% of clients who hold nonqualified annuities view their contracts as an emergency fund – set aside for Long Term Care (LTC) events like an extended nursing home stay or a catastrophic illness. In other words, this is money just sitting on the table! Make sure your clients are IDEALLY positioned to meet the challenge of a Long Term Care event or need.

Two TRILLION dollars is an unfathomable amount of money. It represents the value currently held inside of deferred annuities, and it is very likely that you have a client (or ten!) that is counted in this sum. Furthermore, a Gallup poll found that 73% of clients who hold nonqualified annuities view their contracts as an emergency fund – set aside for Long Term Care (LTC) events like an extended nursing home stay or a catastrophic illness. In other words, this is money just sitting on the table! Make sure your clients are IDEALLY positioned to meet the challenge of a Long Term Care event or need.

What These Inforce Contracts Look Like

Many of these policies are:

- Expensive variable annuities;

- Indexed annuities that are crediting guaranteed minimum rates; or

- Fixed annuities that are not competitive in today’s marketplace.

As a result, you may have a client with a policy that has been forgotten about or hasn’t been looked at in ages. These policies may be easy replacement opportunities. Perhaps it is an older policy that has been accumulating cash for years. Such a contract may have accrued substantial deferred gains and may represent a looming tax liability for your clients!

If any of this sounds like a client(s) you know, there may be a tremendous opportunity for you to help them reposition their assets by doing a tax-free exchange from their existing annuity policy to a fixed annuity policy designed specifically to pay for Long Term Care needs. Though, to put it that simply would be selling the opportunity short. With a LTC fixed annuity, your clients can leverage their existing account values to create a significantly larger (or even UNLIMITED) available pool of money to pay for long term care needs.

If any of this sounds like a client(s) you know, there may be a tremendous opportunity for you to help them reposition their assets by doing a tax-free exchange from their existing annuity policy to a fixed annuity policy designed specifically to pay for Long Term Care needs. Though, to put it that simply would be selling the opportunity short. With a LTC fixed annuity, your clients can leverage their existing account values to create a significantly larger (or even UNLIMITED) available pool of money to pay for long term care needs.

Thanks to the 2010 Pension Protection Act (PPA), clients may do a 1035 exchange from an existing nonqualified annuity into a PPA-compliant annuity designed for extended LTC needs. When the money is used for LTC, all benefits will be tax-free. Suddenly, the tax liability of those accrued gains doesn’t seem so scary!

Case Study

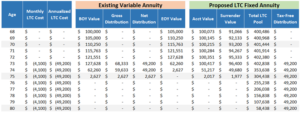

Sandy has a variable annuity that she purchased in 2003 with a $25,000 premium at the age of 48. It has performed well over the years and has grown to just over $100,000! That’s the good news, but on the other hand, her policy now represents a $75,000 tax liability. On the advice of her advisor, Sandy decided to purchase a PPA-compliant fixed annuity with LTC benefits. But will that decision provide additional meaningful benefits to Sandy?

Let’s take a look at a hypothetical LTC claim to see the added value of the recommended planning. At age 73, Sandy develops a condition that requires home healthcare. At a monthly cost of $4,100, her variable annuity account is depleted in just over 2 years. After a 1035 exchange to a PPA compliant product, she is able to claim 8 years of benefits from the policy. The power of leverage and tax-advantages distributions is clear!

Did you know?

Did you know?

A deferred annuity is generally taxed on a last in, first out (LIFO) basis. This means that the first withdrawals your clients take from their policy need to be grossed-up to account for the taxes on the gains that have accrued during all of those years of deferral. By repositioning your clients’ assets into a fixed annuity with LTC benefits, you can give them a larger pool of LTC funds, and make their money go further with tax-advantaged distributions.

Ask your client during your next meeting the following question – “do you currently have a nonqualified annuity?”. The answer may surprise you and you may uncover an easy opportunity to set your clients up for success while also establishing yourself as a hero for helping to eliminate their concerns. AgencyONE will provide you with all the options available to satisfy your clients’ financial needs and ensure they make the best possible use of the money on the table.