Colon Cancer Screening & the Underwriting Implications

Underwriting colon cancer cases requires a unique expertise and your Underwriting team at AgencyONE stands ready to review these cases, match them with the appropriate carrier(s) and negotiate on your behalf to obtain the best offers for your clients. However, testing and treatment protocols are constantly changing and AgencyONE believes that you should know the basics in order to properly advise your clients.

The American Cancer Society (ACS) CHANGED their guidelines this year for colorectal cancer screening from age 50 to 45 for people of average risk. This change is due to recent data that shows a rise in the incidence of new colorectal cancer cases among younger adults. If you or your clients are within the new screening age group and have not had a colonoscopy or cancer screening within the past 5 years, it is recommended that you do so.

Colon Cancer Screening Options

There are several stool-based and visual screening options available today.

Stool Based Tests:

- FIT (gFOBT) is a stool-based test that checks for hidden blood in the stool. This test can be purchased at your local pharmacy or on Amazon.

- Cologuard (MT-sDNA) is a stool-based test that screens the stool for abnormal DNA from cancer or polyp cells. This test is available by prescription only.

- Stool-based tests can be conducted in the privacy of your own home or in a physician’s office.

Visual Screening Tests:

- A CT Colonography, or virtual colonoscopy, is a visual test that uses x-ray technology to examine the large intestine for cancer and polyps.

- A flexible Sigmoidoscopy is a more invasive visual test which limits the exam to the rectum and lower, sigmoid-colon.

- A Colonoscopy is the most thorough of all these tests and allows the physician to view the entire large intestine, take tissue samples, and remove polyps for biopsy if necessary.

- Visual screening tests are conducted in a radiology facility, outpatient surgery center or hospital.

Not all polyps are the same. Most colon cancers begin as a polyp (a small clump of cells that forms on the lining of the colon). In many cases, if the polyp is removed so is the cancer risk. When a colonoscopy screening reports that tissue or a polyp(s) were removed, a pathology report for the polyp(s) will be required by underwriters. Multiple polyps, and those polyps with certain cellular components carry a higher risk for cancer and require short-term follow-up, even when cancer is not identified. For example, a tubular adenoma carries a minimal risk for malignancy, whereas an adenomatous polyp with certain features, or dysplasia, is a significant concern.

Underwriting Colon Cancer

Screening tests are a good thing and underwriters like to see them. Many carriers allow negative colonoscopies to be used as a Lifestyle/Healthstyle CREDIT which can IMPROVE the underwriting rate class!

AgencyONE expects to see an increase in these screening tests being ordered by physicians and, with a rise in cancer among younger adults, the test results including any pathology reports will be required for a thorough underwriting evaluation. A positive stool-based test necessitates a follow-up, a comment from the physician and often leads to a request for visual screening.

Colon Cancer is an Insurable Condition…EVENTUALLY. Clients with a history of colon cancer ARE insurable, depending on the details. Underwriters need to know the date of diagnosis, cancer staging including any pathology reports, the date treatment was completed, any reports of follow-up colonoscopy and/or related tests, and whether there is a family history of colon cancer. The “cancer-free” clock begins on the date treatment (surgery, chemo and/or radiation) was completed.

Case Study – Colon Cancer

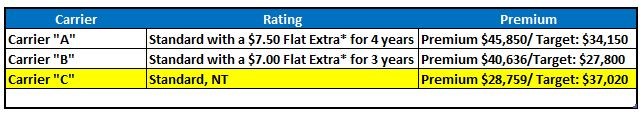

A 55-year-old, non-smoking male applied for $2,000,000 of Guaranteed Universal Life (GUL) coverage. The client admitted to a history of colon cancer. The APS revealed a Stage 1 tumor without lymph node involvement that had been surgically removed 3 years prior. A follow-up colonoscopy was negative, and the client had no significant family history.

*MANY Flat extras are non–commissionable.

Every case is different with unique circumstances and histories and AgencyONE knows which carriers are best for considering your clients’ specific cases. As you would expect, some carriers are more competitive with these conditions. Armed with the necessary information, we can direct these cases properly and save your clients money.