Underwriting Anxiety & Depression

Tis the season of STRESS!!! The hustle and bustle of the holiday season is upon us, and this time of year can cause increased anxiety and even depression. Both are common diagnoses and are not just considered seasonal. As with any condition, there are varying levels of severity. In this ONE Idea, we will discuss the differences between anxiety and depression and how they are viewed during underwriting.

Tis the season of STRESS!!! The hustle and bustle of the holiday season is upon us, and this time of year can cause increased anxiety and even depression. Both are common diagnoses and are not just considered seasonal. As with any condition, there are varying levels of severity. In this ONE Idea, we will discuss the differences between anxiety and depression and how they are viewed during underwriting.

Anxiety Is a Normal Emotion

Everyone deals with some level of anxiety in their lives. However, when a person continuously feels disproportionate amounts of anxiety, specialists might view this as a medical disorder. Anxiety affects an alarming forty million people in the United States according to the National Alliance on Mental Illness (NAMI), and COVID concerns have caused higher levels of stress for many people. As a result, AgencyONE’s Underwriting team is seeing an INCREASE in medical records that have ANXIETY notations.

Excessive Anxiety

Anxiety disorders are characterized by excessive nervousness, fear, apprehension, and worry that does not go away and may cause:

- increased alertness;

- fear;

- panic; and

- physical signs such as a rapid heart rate and breathing, sweating, etc.

An anxiety disorder can also affect how a person processes emotions and reacts (or overreacts) to certain situations. The condition can vary from mild to severe and include obsessive-compulsive behaviors and even post-traumatic stress disorders.

Anxiety Treatment

As the most common group of mental illnesses in the country, anxiety is treatable by safe and available medications. Surprisingly, less than 50% of Americans seek the necessary treatment. Anxiety by itself, if considered “controlled” with mild medications, is a LESSER underwriting concern. However, many times it is paired with a second diagnosis of depression which can be a GREATER underwriting concern.

As the most common group of mental illnesses in the country, anxiety is treatable by safe and available medications. Surprisingly, less than 50% of Americans seek the necessary treatment. Anxiety by itself, if considered “controlled” with mild medications, is a LESSER underwriting concern. However, many times it is paired with a second diagnosis of depression which can be a GREATER underwriting concern.

Characteristics of Depression

Depression affects adults, adolescents, and children. It is a condition characterized by ongoing feelings of sadness and loss of interest or pleasure in daily activities. Common symptoms include irritability, anxiety, disinterest, fatigue, insomnia, change in appetite, avoiding people, feelings of worthlessness or guilt, difficulty thinking, concentrating, or making decisions, and excessive crying. The most concerning is when the patient has recurrent thoughts of death or suicide, or a suicide attempt.

include irritability, anxiety, disinterest, fatigue, insomnia, change in appetite, avoiding people, feelings of worthlessness or guilt, difficulty thinking, concentrating, or making decisions, and excessive crying. The most concerning is when the patient has recurrent thoughts of death or suicide, or a suicide attempt.

Causes of Depression

Depression can be influenced by many factors such as environment, genetics, hormones, or simply changes in how our brains function over time. Along with anxiety, depression has varying levels of severity from mild and situational (like a grief reaction), to major and recurrent. Treatment strategies for anxiety and depression can range from psychotherapy, diet, exercise, brain stimulation therapies or prescription medications. Depressive/anxiety conditions may require multiple medications, dosage adjustments, and for some it can be an ongoing challenge to manage.

Depression can be influenced by many factors such as environment, genetics, hormones, or simply changes in how our brains function over time. Along with anxiety, depression has varying levels of severity from mild and situational (like a grief reaction), to major and recurrent. Treatment strategies for anxiety and depression can range from psychotherapy, diet, exercise, brain stimulation therapies or prescription medications. Depressive/anxiety conditions may require multiple medications, dosage adjustments, and for some it can be an ongoing challenge to manage.

Underwriting Specifics

No two cases are alike. So, WHAT makes for a better or worse mortality risk? First, the diagnosis. Is it considered mild, moderate, severe, recurrent, or in remission? How long has the applicant carried the diagnosis? What treatment (medication) is the client taking and has the dose changed recently? A client taking the same medication long term with no changes means STABILITY and underwriters LIKE stability.

Carriers also will want to know about:

- Any history of drug or alcohol misuse

- Any history of an adverse driving record

- Any history of hospitalizations for mental illness, attempted suicide, or missed work or school of greater than a week

- Any recurring symptoms within the past year

- A stable social situation including marital status, occupation

- Any co-existing physical illnesses, especially chronic, persistent pain

- Any other co-existing mental illness or personality disorder

- Any suicidal tendencies, previous attempts, family history, or access to firearms

Case Study

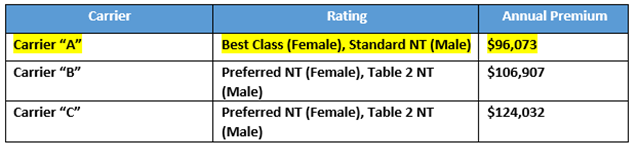

The Turners are a married couple who own a successful tech-related business and are seeking $10MM of Survivorship Indexed Universal Life Insurance coverage for the benefit of their two children.

Mrs. Turner is a 55-year-old healthy woman with no significant medical history aside from a diagnosis of generalized anxiety disorder. She has no history of depressive symptoms but does complain of excessive worrying related to her health, her family’s health, and her finances/business’ success. Mrs. Turner has experienced a significant improvement in these symptoms with the help of monthly cognitive behavioral therapy. Due to therapy, she is able to effectively manage her symptoms without the need for a daily prescription medication. She has a prescription for Xanax to be used only as needed, for example when flying or public speaking. AgencyONE negotiated a BEST CLASS offer with Carrier A, while Carrier B and C held her offer to Preferred Non-Tobacco rates due to her anxiety history and Xanax prescription.

Mr. Turner is a 60-year-old man with a history of both anxiety and MAJOR depressive disorder. He does not have any history of suicidal thoughts or attempts but does require daily Zoloft to effectively manage his depressive symptoms. He also has a prescription for Xanax to take, as needed, for anxiety and a prescription for Adderall to take daily for a history of ADHD. Mr. Turner’s depression was successfully under control for several years and considered in remission, but he did experience an increase in depressive symptoms during the height of the pandemic. This resulted in an increase of his Zoloft dosage and a recommendation to start therapy. Mr. Turner followed through with this recommendation and is back on track with his treatment plan. AgencyONE was successful in negotiating a Standard Non-Tobacco offer at Carrier A. Carrier B and C held their offer to Table 2 Non-Tobacco due to the recent dosage change and the need for three psych-related medications.

*These are all carrier SIUL products solving for coverage to 121.

AgencyONE’s Underwriting Team consistently offers experienced, knowledgeable and “think outside the box” underwriting to their AgencyONE 100 Advisors and clients and provides the best offers available in the marketplace.