Underwriting When Physician Records Are Not Accurate

Physician records (APS-Attending Physician Statements) are an important and material part of your client’s underwriting files. However, physician records have also been known to contribute to UNFAIR underwriting assessments. This ONE Idea will focus on underwriting when when physician records are not accurate or have been interpreted incorrectly.

Not Always Accurate?

Physician records are NOT always accurate or reflective of a client’s health. But how can YOU tell? One of the more common underwriting stumbling blocks is a note of “Chest Pain” in a client’s medical records. For a physician, this note may be justification for performing cardiac testing. Similarly, Shortness of Breath is often noted to justify health insurance reimbursements for pulmonary studies. While physician notations are necessary for medical administration reasons, they may complicate the insurance underwriting process if not understood or interpreted properly.

Medical Training & Experience is Key

The underwriting team at AgencyONE is medically trained and has years of experience in reading and understanding medical/ APS records. Many brokerage firms and even direct writing agents simply forward medical records out to targeted carriers and HOPE FOR THE BEST! This is not a recommended practice and may leave you wondering WHY your Preferred Risk or Super Preferred client’s case suddenly runs into underwriting problems.

Collaboration & Clarification

Collaboration & Clarification

AgencyONE often gets clients and their physicians involved in medical record clarification BEFORE we ever submit to the carrier underwriter for review. EVERY client should be given the BEST SHOT at BEST CLASS underwriting which can only be done if you medically understand the records. A thorough review is imperative to presenting a valid and complete case to the carrier underwriter or arguing against an incorrect carrier underwriting assessment! AgencyONE does every step of the advance work to make sure that your client’s case is being presented in the best possible light to the right carrier EVERY TIME.

From HIGHLY RATED to PREFERRED! An Underwriting Success Story

When the medical record says, “past history of STROKE”, what do you do? When underwriting goes sideways and substandard, how do you counter the underwriter’s assessment, especially when we don’t get to SEE the medical records because of accelerated underwriting, drop tickets, etc. AgencyONE has the answers and the carrier underwriting direct lines of communication to help your “problem” cases.

Obstacle #1

Mr. Smith is a 74-year-old nonsmoking male who was presented to us by one of our AgencyONE 100 Advisors. He had applied for $400,000 of 15-year term life insurance coverage. After the carrier underwriter’s first review, they relayed a rated offer of TABLE 8 due to, “stroke and build.” STROKE?! Mind you, Mr. Smith had no personal history of significant medical problems, no hypertension, no diabetes mellitus, and no dyslipidemia. By all accounts, he is a healthy and physically active man. An abnormal brain MRI in his file from October 2020 that (on the surface) seemed indicative of a stroke diagnosis sparked this series of unfortunate underwriting events. AgencyONE’s underwriting team put the time and effort into researching this apparent diagnosis. After discussing the full history with the advisor, his client, and the client’s neurologist, we discovered that Mr. Smith sustained some injuries when he was hit by a car on his scooter at the age of 14. He was in a semi-comatose state for 2 weeks and, after regaining consciousness, had no recollection of any events leading up to his accident. He made a remarkable recovery and has had NO medical problems related to the injury since that time. That “stroke” was merely the lasting signs of his injury from the scooter accident 60 years ago. The neurologist amended his file to note that the abnormal MRI is related to the trauma from the accident. His record was now clearly resolved of any stroke issues and the resolution took us from a Table 8 to a Table 4. We are making progress!

Obstacle #2

Another obstacle occurred with the incidental finding of a PFO (Patent Foramen Ovale – a small opening in the heart that prevents blood flow) in a 2019 echocardiogram suggesting AGAIN a possible previous stroke. Mr. Smith had NO neurological symptoms documented by the neurologist to support this finding. In fact, he has not had ANY symptoms since his accident at age 14. A second round of discussions initiated by AgencyONE with the neurologist and carrier underwriter transpired and ultimately resulted in a PREFERRED OFFER for Mr. Smith!

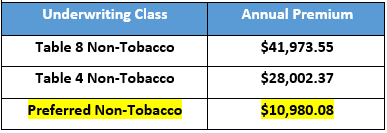

How does that translate into savings for the client? His annual premium dropped from $41,973.55 to $10,980.08! Nearly $31,000 of annual premium was saved for Mr. Smith!

The AgencyONE Underwriting team is hands-on and proactive. We are here to help you and your clients through the ENTIRE underwriting process.