One 1035 – Two Solutions

During one of your clients’ annual reviews, you discover that that they have an old inforce policy that may or may not be underperforming with a substantial cash value. You’ve also determined during the review that the existing policy does not meet all of your client’s current needs. However, with value in your client’s existing policy, you may be able to provide some important options to consider – such as 1035-ing a policy– and features to add that will better meet your clients financial planning needs.

What are your next steps? Obtain the needed inforce information for a thorough review of the current contract. This should include an annual statement and 1-2 inforce ledgers to show the long-term performance projections. Most older policies don’t include options that are currently available. One type of coverage that is worth looking at is Long-Term Care or Chronic Care coverage. These options increase the flexibility of an insurance solution AND ultimately benefit your clients’ overall financial plans.

What are your next steps? Obtain the needed inforce information for a thorough review of the current contract. This should include an annual statement and 1-2 inforce ledgers to show the long-term performance projections. Most older policies don’t include options that are currently available. One type of coverage that is worth looking at is Long-Term Care or Chronic Care coverage. These options increase the flexibility of an insurance solution AND ultimately benefit your clients’ overall financial plans.

Let’s assume for this ONE Idea that your client would still like a policy that accumulates cash value. You could use one policy that includes a cash accumulation indexed solution and just add the LTC rider. This type of policy provides death benefit, options to build cash value, projected income, and a long-term care benefit. However, as an acceleration of the death benefit, the payment of the LTC rider benefits will reduce BOTH the death benefit and cash surrender value of the policy. Withdrawals and loans will also reduce BOTH the cash value and the death benefit which will also impact the LTC benefits available. Additionally, the policyowner may not be able to take any income while the long-term care benefits are being received. Is there a solution if your client wants BOTH income AND guaranteed Long Term Care benefits?

indexed solution and just add the LTC rider. This type of policy provides death benefit, options to build cash value, projected income, and a long-term care benefit. However, as an acceleration of the death benefit, the payment of the LTC rider benefits will reduce BOTH the death benefit and cash surrender value of the policy. Withdrawals and loans will also reduce BOTH the cash value and the death benefit which will also impact the LTC benefits available. Additionally, the policyowner may not be able to take any income while the long-term care benefits are being received. Is there a solution if your client wants BOTH income AND guaranteed Long Term Care benefits?

The Solution

A possible solution is to 1035 the existing contract and split the proceeds to purchase two different policy types. One policy would accumulate cash value and provide income while the other would provide a long-term care benefit that increases over time. Having two policies will give your client an income stream AND long term care benefits if needed!

Accumulation Life Design

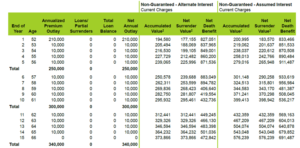

Let’s have a look at the numbers. Mr. Smith is a 51-year-old Preferred NT male with a 1035 exchange of $300,000 and an annual premium of $10,000 per year paid to age 65.

For the first part of the case, AgencyONE designed an increasing death benefit contract using $200,000 of the 1035 plus $10,000 of premium to age 65. The goal of this product is to accumulate cash value for future distributions. Without the LTC rider, there will not be a rider charge to draw down or decrease the cash value. See the projected non-guaranteed cash values and death benefits in the far-right columns.

For the first part of the case, AgencyONE designed an increasing death benefit contract using $200,000 of the 1035 plus $10,000 of premium to age 65. The goal of this product is to accumulate cash value for future distributions. Without the LTC rider, there will not be a rider charge to draw down or decrease the cash value. See the projected non-guaranteed cash values and death benefits in the far-right columns.

Next, AgencyONE solved for income (withdrawals to basis then standard loans) at current max AG49A crediting rates from ages 67-85. This illustrates $49,548 of income per year.

Hybrid Long Term Care Design

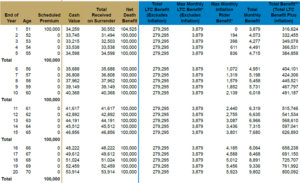

For the second Hybrid/LTC portion, AgencyONE used the remaining $100,000 of the 1035 as a single pay. Since the client is younger, AgencyONE solved for 6 years of benefits with a 5% compounded rate.

The monthly LTC benefit starts at $3,879 and grows each year guaranteed:

- By age 70, the benefit is $9,802 monthly

- By age 75, the benefit is $12,510 monthly

- By age 80, the benefit is $15,967 monthly

This design is flexible and can be split into different income and LTC benefit amounts as long as you maintain product minimum limits. The split plan keeps each piece separate and provides both income and LTC benefits as needed. You may be wondering which carrier allows this split design. The good news is that AgencyONE has three carrier partners that will allow this 1035 split into a life and hybrid product.

This design is flexible and can be split into different income and LTC benefit amounts as long as you maintain product minimum limits. The split plan keeps each piece separate and provides both income and LTC benefits as needed. You may be wondering which carrier allows this split design. The good news is that AgencyONE has three carrier partners that will allow this 1035 split into a life and hybrid product.

AgencyONE’s Case Design Department is available to collaborate with you and your clients on their inforce policy evaluations. Our superior knowledge of carrier solutions and product intelligence help to ensure that your clients get the solutions that meet their insurance needs and financial planning goals.

Please contact AgencyONE’s Case Design Department at 301.803.7500 for more information or to discuss a case.