A Solution to Lock in Chronic Illness Coverage on a Budget

Do you have clients that are looking for permanent life insurance coverage with living benefits? Perhaps you’ve quoted carriers and shopped around but the premiums still fall outside of the client’s budget. Maybe they will come back to the decision in a few years. However, as we’ve seen all too often, a client’s health can change dramatically in a brief period of time – your client who is insurable now may not be insurable in the future.

This ONEIdea offers a case study and shows how a case might progress. Our AgencyONE 100 Advisor was able to find a solution that worked within their client’s budget, provided the death benefit needed, and locked in their insurability for living benefits coverage.

Case Study

Linda, age 50 is a single mother of two. She has one child in their last year of college and another just starting. Needless to say, her budget will be tight for the next few years. That said, Linda recognizes the value of having permanent life insurance, specifically insurance that can provide a living benefit should she later have an accident or develop a chronic condition that would require ongoing care.

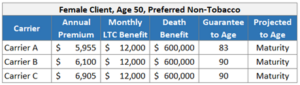

After doing some fact-finding and submitting an informal inquiry, AgencyONE helped the advisor price several options for Linda including $600,000 of coverage with a long-term care rider that would provide a maximum monthly benefit of $12,000 per month. The premiums and features are summarized in the table below:

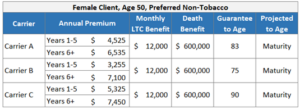

Linda thinks these are great options that meet her needs, but there is just one issue – the price. These premiums are too much for her to afford while the kids are in college. She recognizes the need to put coverage inforce and lock in insurability for living benefits, but her budget will not allow it for another few years. Luckily, the advisor recalled a previous ONEIdea where AgencyONE discussed that there are many flexible premium products that can be designed with a “stepped” premium. In these design scenarios, the coverage can be placed inforce at the minimum initial premium with a “catch up” later on to continue coverage to the desired duration. With that in mind, the advisor presented a second set of options summarized below:

We are getting closer. These initial premiums are more affordable for Linda, but they are still a little outside of her budget and in some cases, the secondary guarantees suffer in this type of solve. Before giving up on the case, the advisor made a call to the AgencyONE Case Design Department and learned that one of our carrier partners has a product with a little-known feature that can save the day and the case!

The Solution

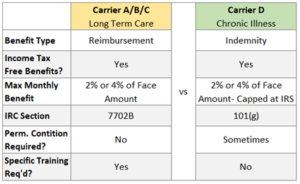

The advisor ultimately recommended a plan for Linda that will issue term coverage now at a fraction of the permanent insurance premium. While this seems simple, the product is a strategically chosen option that is convertible to any of the carrier’s permanent products, AND most important, guarantees that a chronic illness rider can be included on the conversion policy with no additional underwriting or evidence of insurability! After thoroughly reviewing and discussing the different product features and the contrast between the long-term care and chronic illness riders, the AgencyONE 100 Advisor was confident that the recommended solution will meet Linda’s need for a budget friendly death benefit in the short term and living benefits coverage in the long run.

The advisor ultimately recommended a plan for Linda that will issue term coverage now at a fraction of the permanent insurance premium. While this seems simple, the product is a strategically chosen option that is convertible to any of the carrier’s permanent products, AND most important, guarantees that a chronic illness rider can be included on the conversion policy with no additional underwriting or evidence of insurability! After thoroughly reviewing and discussing the different product features and the contrast between the long-term care and chronic illness riders, the AgencyONE 100 Advisor was confident that the recommended solution will meet Linda’s need for a budget friendly death benefit in the short term and living benefits coverage in the long run.

Why It Works

While some carriers will allow an LTC or chronic illness rider to be added on conversion – the additional living benefit often requires additional underwriting. Something as innocent as physical therapy for a sports injury would have no bearing on a client’s mortality but could cause a decline for an LTC or chronic illness rider and potentially derail your client’s plans. Having a contractual right to include a chronic illness rider is incredibly valuable!

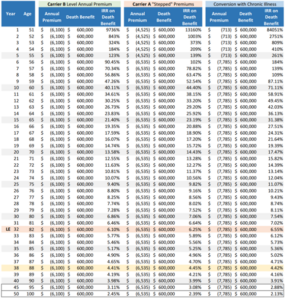

With this plan, AgencyONE has helped the advisor solve the issue of premium and living benefits insurability, but is this plan still a good deal for Linda? Let’s take a look at how the internal rates of return (IRRs) stack up for all 3 options:

Through age 88 (which is beyond life expectancy for a 50-year-old female) the IRRs for the conversion solution exceed both the level premium and stepped premium plans.

LTC vs Chronic Illness – Know the Difference!

While it used to be the case that chronic illness riders required a permanent condition before benefits could be claimed, many carriers have interpreted section 101g in a way that allows them to pay out chronic illness benefits for conditions that may require temporary care.

The key takeaways for Linda’s plan are:

- a low initial premium to help when she is already stretched financially;

- flexibility that allows for policy convertibility and to pay catch-up premiums later when her budget is not as tight; and

- to lock in insurability for Linda to add a chronic illness rider at a later date.

AgencyONE takes the time to work with our advisors to find the right carrier, product solution, and design for their clients.

Please contact the AgencyONE Case Design Department at 301.803.7500 for more information

or to discuss a case.