A Pacific Life Solution You Need to Know About – Horizon IUL 2

This week’s ONE Idea is product-specific and highlights an exciting IUL solution that Pacific Life launched earlier this year – Horizon IUL 2 – a product built on the most successful features of Pacific Life’s previous IUL products. AgencyONE is also hosting a webinar with Pacific Life on October 1 @ Noon to take a deeper dive into this solution and we encourage you to register HERE!

The new Horizon IUL 2 makes it much easier to choose the correct option for your cases with its choices and versatility. It replaces the original Horizon and Pacific Discovery Xelerator 2 IULs, 2 of the various products Pacific Life has offered over the years – many available at the same time – which made the case illustrator’s job more challenging.

Pacific Life has always offered blendable term product solutions that allow for lower client costs in exchange for reduced targets. I cannot remember the last time I ran a non-blended option since it is harder to benchmark with other carriers. Most of my personal solves start with a 60% base/40% term design or a 75% base/ 25% term on increasing death benefit solves which puts the product into a competitive premium range. Underwriting has been competitive in the cases we have seen, which has resulted in successful sales on larger cases.

Let’s explore features of Pacific Life’s new Horizon IUL 2 solution:

- Greater Design Versatility

- Age 90 No-Lapse Guarantee Rider

- Flexible Duration No Lapse Guarantee Rider

- A Fixed Charge Index Loan

- A New Enhanced Performance Factor Rider (EPFR)

- A Choice of 3 Living Benefit Riders

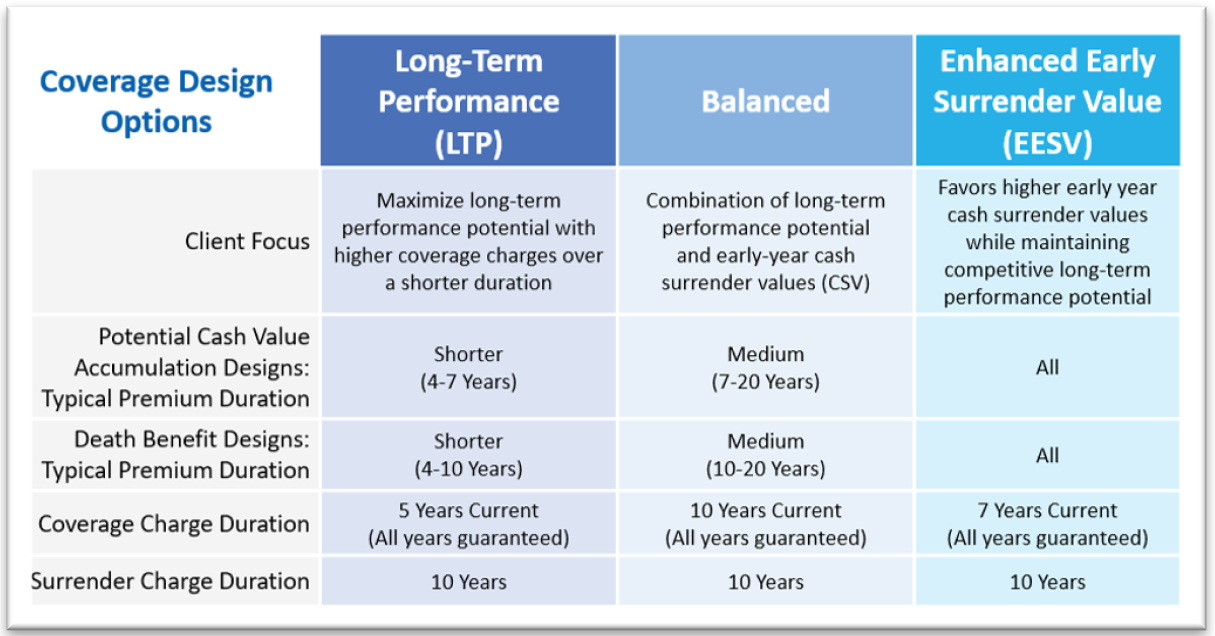

Greater Design Versatility: There are three options to choose from depending on the solve requested. Is your client’s planning goal cash accumulation or death benefit-oriented? The table below shows the premium duration that makes the most sense for each option. All of them have a 10-year surrender charge.

The Long-Term Performance (LTP) design works best for single pay scenarios and for most other solves except early cash values, although individual designs including dump-ins may change that.

Age 90 No-Lapse Guarantee Rider: Horizon 2 offers a guarantee based on cumulative premiums paid. It is automatically added to the policy up to a maximum issue age of 79 and provides a guarantee up to the insured’s age of 90. This makes it a strong product to provide a possible LE-based guarantee.

Flexible Duration No-Lapse Guarantee Rider: This rider guarantees that the policy will not lapse up to the insured’s lifetime. The available issue ages are 18-90 with no indexed account restrictions.

A Fixed Charge Index Loan: Horizon 2 offers three (3) different loan types:

- Standard loans – 2.25% Current rate with a 2% crediting rate for years 1-5 and then 2.25% for years 6+.

- Indexed loans – 4.9% Current (8% Guaranteed max). Loaned values can be in the 1-year indexed account only.

- (NEW) Fixed Charge Indexed Loan – 4.5% Current/ Guaranteed. The loaned values remain in the Loaned 1-Year Volatility Control index account.

Enhanced Performance Factor Rider (EPFR): This is an optional rider which may enhance performance by increasing overall indexed credits. There are four (4) EPFR rider designs: Classic, Plus, Performance, and Performance Plus. See attached collateral entitled Get More Upside Potential for more detailed information.

Choice of 3 Living Benefit Riders: Horizon 2 offers three (3) strong Living Benefit Rider options.

1. Premier LTC Rider – Provides up to $3 million of accelerated benefit limited by policy face amount.

a. Monthly Indemnity with no permanent requirement

b. 2% or 4% option

c. Provides lapse protection while on claim

d. Benefit reduces the death benefit dollar for dollar

e. See Using the Premier LTC Rider collateral for more information

2. Premier Chronic Illness Rider – Provides up to $3 million of accelerated benefit limited by policy face amount.

a. Monthly Indemnity with no permanent requirement

b. 2% and 4% option

c. Provides lapse protection while on claim

d. Benefit reduces the death benefit dollar for dollar

3. Premier Living Benefits Rider 2 – Provides up to $1.5 million of accelerated benefit limited by policy face amount.

a. Monthly or Annual Indemnity benefit

b. Requires a permanent condition

c. Death benefit is reduced by an amount greater than the rider benefit payment

Don’t forget to REGISTER for our October 1 webinar with Pacific Life at 12:00pm ET. Please make sure to register AND attend to find out:

- HOW Pacific Life’s new Horizon IUL 2 stacks up competitively against other carrier products;

- WHAT is happening in the marketplace that makes this solution an attractive option for diverse types of cases; and

- MORE details about this solution to help you determine how its features will benefit your clients’ financial and risk management planning.

Register for the October 1 webinar at 12:00pm NOW!

Contact AgencyONE’s Case Design department at 301.803.7500 for more information or to discuss a case.