A Rational Approach to Premium Financing

With the recent addition of the Annexus IUL product line to the AgencyONE product suite, we have been getting many more calls about using these unique Indexed Universal Life (IUL) products in accumulation sales for tax free distributions. This week (July 8, 2020) we held a premium financing webinar with representatives from Securian, Wintrust Bank and Annexus which generated a lot of interest. This week’s ONEIdea is an example of how to leverage accumulation and tax-free distribution sales with premium financing in what we feel is a rational and responsible way. More on that later.

SAMPLE LIFE INSURANCE RETIREMENT PLAN – LIRP

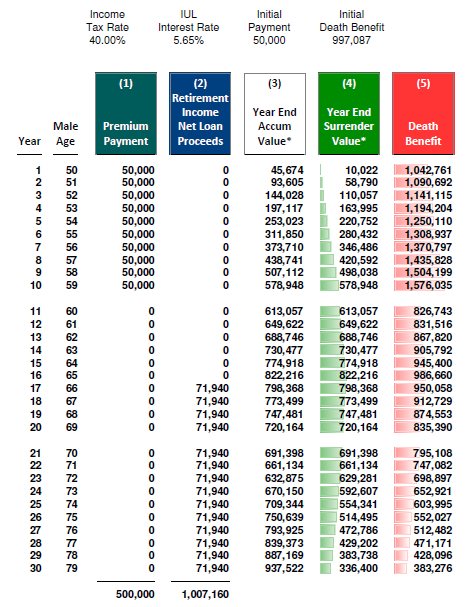

In our example, we have a male client, age 50, who has committed $50,000 per year to a supplemental retirement tax-free income plan using life insurance (commonly referred to as a Life Insurance Retirement Plan or LIRP). To be conservative, we have used withdrawals to basis and loans thereafter. We are using Par Loans (or Index loans) in our example but ONLY after we have withdrawn the total basis.

As you can see in the table below, the projected income solve is $71,940 per year. While not illustrated beyond year 30, distributions continue until age 85, for a total of 20 years of distributions. The contract stays in force until maturity based on current assumptions.

Many clients may want to leverage these sales to get greater income, and premium financing is an excellent way to accomplish this given today’s historically low interest rates.

Furthermore, with the consistent and non-volatile returns offered by the Securian BGA product in their Prism II proprietary index strategy, in addition to their low lost cost structure, this product is ideally suited for financing.

PREMIUM FINANCE FOR LIFE INSURANCE

AgencyONE has a long history in the premium finance business, however, we are very cautious about how we illustrate premium financing so as to not overstate the benefits relative to the inherent risks in such transactions. These risks include:

- Interest rate risk

- Collateral risk

- Policy performance risk

- Loan renewal risk

As highlighted during our July 8th webinar, (to listen to replay login to your AgencyONE Advisor Dashboard and navigate to “webinar and video recording” under the Sales & Marketing tab), a strong lender, a suitable carrier and a product that delivers long term consistent performance are critical to the success of any premium financing transaction.

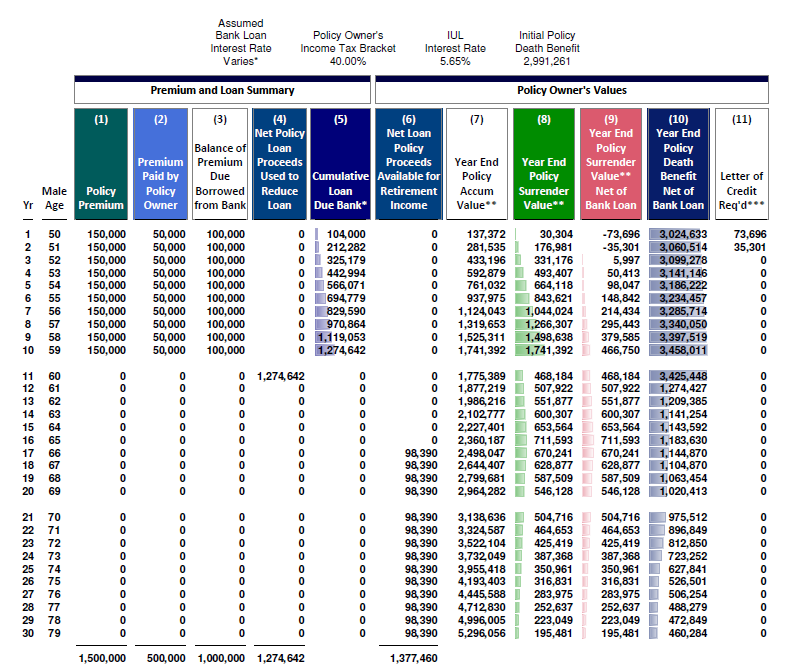

We’ve seen many premium finance illustrations that go over the top on assumptions such as the one shown below. Most advisors and premium finance vendors show a participating\index loan early, such as in year 11 to pay back the bank loan – see column 4 below.

The idea of paying one loan off with another, especially a participating or index loan from an IUL product, which is subject to product performance risk, is a mystery to us. The difference in projected income, all things being equal, is $26,450 or the difference between no financing and financing as illustrated here. To take on the aforementioned risks of a premium finance transaction to get $26,000 more of income, when so many things can go wrong, does not appear to be worth it.

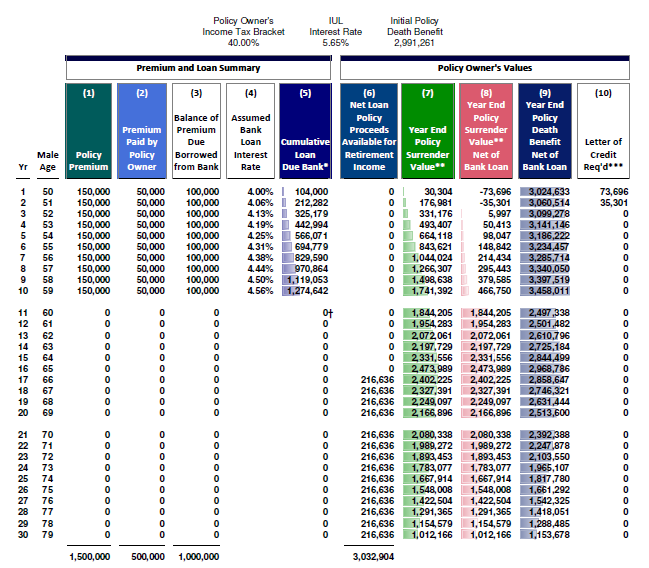

Furthermore, AgencyONE often sees financing illustrations that start at a very low borrowing rate and never account for interest rate increases. We are not suggesting that interest rates will always increase, but have you ever seen them lower than today? Stress testing borrowing rates should be an important part of your due diligence for your clients.

These illustrations look very compelling, but have you ever had someone run an IUL illustration for you or a client where a few ZERO’s were inserted into the assumptions after a massive loan has been taken to pay off a bank loan? Does anyone really think that returns in an IUL product are sequential as shown in any illustration that you have ever seen? With AG49, as we know it today, there is ALWAYS a positive arbitrage between the loan rate and the assumed index return, likely of at least 1%, and maybe more where leveraged or enhanced multipliers are part of the product construct. What could possibly go wrong in a year when the actual return is dictated by a negative market and a “floor” return of ZERO is obtained AND a spread or multiplier fee is charged, PLUS the interest charge for a massive loan? If this scenario plays out for a couple of years in succession, such as between the years 2000-2002, the “lofty” projections will be in trouble.

An ideal candidate for a premium financing arrangement is NOT someone who CANNOT afford the premium, but rather someone who has plenty of money and is invested in a closely held business, or a stock portfolio or commercial real estate portfolio and would rather use their capital for higher return endeavors in which they are already involved. The higher the client states that he/she can earn on his/her “investments”, the more arbitrage will be created between today’s low borrowing rates and his/her financial endeavors. The concept of a “retained capital account” is very important. That account could be the client’s own business, as indicated above. To make things simple, if your client can borrow money at 3% and earn 10% in his/her business, he/she is fundamentally making 7% on his/her money via a spread.

THE FINAL STEP

If for 10 or 15 years, such as with the 50-year-old sample client we have been discussing, the client has been making money on the retained capital account – call it his/her business – would it make sense to use that capital account to pay off the loan in part or in full?

The client is entering a complex transaction that he/she likely understands. He or she may or may not have plans to sell the business at some point or liquidate a commercial property or sell some of his/her stock portfolio. If the bank loan can be paid off by outside funds, the cash value that we worked so hard to accumulate in the IUL product for tax free income, and took quite a bit or risk for, is fully available for tax-free distributions to the client during retirement. The amount is meaningfully different as seen in the illustration below. Notice that we do not take a distribution from the policy to pay the bank loan off. It is assumed that the loan is paid from outside or other assets.

The assumed retirement income is now $216,636 for 20 years – more than double the scenario where a loan from the policy is taken to pay back the bank loan. If we are going to work that hard on a transaction and take on some meaningful risk, would this not make more sense?

Remember – the client commitment to the “plan” was to invest $50,000 per year for 10 years. That has not changed. We just leveraged his commitment up 2:1, allowed him/her to arbitrage those additional funds in a venture that he/she is VERY familiar with and already doing, and taking the loan risk out of the policy.

AgencyONE is not suggesting that par or index loans are a bad thing; they can be used strategically on and off as the policy performs, but to take a massive loan in year 11 and subject the client to that much risk for a long period of time puts the best intentioned plans in great peril.

To summarize, the Securian Balanced Growth Accumulator (BGA) II Indexed Universal Life Insurance product is ideally suited for premium financing transactions for several reasons:

- Securian is a mutual company with extraordinary ratings (Comdex of 96) and is the highest rated insurance company with an Index Universal Life product in the market.

- The underlying costs of the BGA II product are among the lowest in the market in terms of loads, fees and costs of insurance. If you do not know how to determine that, ask for the cost and expenses report from any IUL product that you are looking at and do the comparison yourself.

- The PRISM Index is a uniquely managed multi-asset class that has exceeded illustrated rates consistently in a variety of market conditions.

- The PRISM Index has no spread fees and no asset charges – guaranteed.

- The PRISM Index is designed to deliver consistent returns reducing market volatility.

AgencyONE is proud to be one of a select group of Brokerage General Agencies with the distribution rights for this product.