A Roadmap To An AFFORDABLE Whole Life Sale

AgencyONE’s Case Design team gets quite a few requests to illustrate Whole Life solutions. Short Pay Whole Life (ten pay) is the most requested option followed by level pay and then projected vanish options. Advisors who sell Whole Life recognize its value but also register objections about its price as compared to other solutions such as UL, IUL or GUL. Sometimes clients make a choice based on price alone which can be a mistake if they don’t understand the values that a Whole Life product provides and how the product solution works. This is precisely why it is so important to have an AgencyONE case design advocate working with you and your client.

AgencyONE believes in the value of Whole Life. A managed Whole Life policy with a premium that is paid as scheduled can build a well-valued policy that can provide benefits in the future. Preset short pay periods (10-pay, 15-pay, 20-pay, pay to 65) tend to perform better than a level pay and have higher dividend rates as compared to level-pay Whole Life products. AgencyONE is not a fan of blending Whole Life with Term since that can create an issue in the future if the policy is not properly managed.

This ONE Idea will discuss a case that involved an advisor who advocated for Whole Life but then could not meet the client’s budget limit. The advisor requested a Whole Life design and Whole Life benefits but when presented with the design then requested a much lower premium than was available for the product.

Step 1 – Illustrated Whole Life

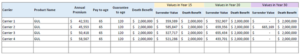

The advisor presented a male age 52, preferred client, who initially wanted $2,000,000 of Whole Life. At the advisor’s request, AgencyONE illustrated a solution paid to age 65:

The Whole Life paid-to-65 solution met the advisor’s initial request and provided great projected cash value and an increasing death benefit. However, upon review the advisor stated that the premium was beyond the client’s acceptable range.

Step 2 – Illustrated Whole Life & GUL

AgencyONE’s next step was to find a solution with a lower cost. We reviewed a variety of lower cost GUL options:

These scenarios were also paid-up at age 65 and provided a lifetime guarantee for about 50% of the Whole Life premium! While this was a positive, the advisor was dissatisfied that the solution did not show any accessible cash value or an increasing death benefit. Since cash value and dividends were now identified as a priority, we needed to find a different solution.

Step 3 – Split Design

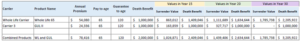

For the third round of options, AgencyONE illustrated a 50-50 split design using $1MM of the Whole Life 65 and $1MM of GUL. The $1MM of Whole Life would provide the growth and cash values for future performance. The GUL product would be a permanent blend to decrease the overall cost.

This split design dropped the premium by about 25%! This design would provide the client with:

- access to cash value;

- an increasing death benefit; and

- a diversified plan using two carriers and two different solutions.

The premium, however, was still beyond the comfort level of the client. Could AgencyONE possibly find a way to lower it still? Remembering how the advisor liked cash value and the dividends that Whole Life offers, AgencyONE redesigned the case for a fourth time.

Step 4 – Split Design with a Twist

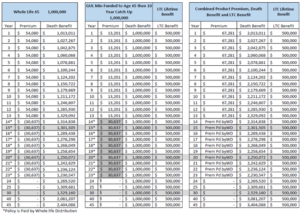

If we could lower the initial premium to keep costs down now AND use some of the later Whole Life values to catch-up the shortfall of the premium, AgencyONE could satisfy the premium objection AND keep both the cash values and the increasing death benefit in the design. To build cash and death benefit, we kept the Whole Life premium the same as in Step 3 ($54,080/year) but changed the GUL to a lifetime premium of $13,201 (instead of paid up at age 65). This premium also included a $500,000 long-term care benefit on the GUL policy. At age 66 when the Whole Life policy is paid up, the design uses distributions/dividends from the Whole Life policy to pay the GUL catch-up premium for 10 years. This final design lowers the client’s initial premium to age 65 to $67,281 per year – 38% less than Whole Life premium in the stand-alone Whole Life design set forth in Step 1!

The table above shows the transaction along with the premiums and death benefits. Even though the design used Whole Life distributions to pay the catch-up premiums on the GUL policy (years 14-23 or ages 66-75), the client still had over $850,000 of projected cash value in the Whole Life contract at age 75 with a projected dividend at around $27,000. Both contracts are fully paid-up at age 75 under this scenario.

AgencyONE satisfied the request from the advisor and successfully delivered the following:

- Whole Life benefits;

- Case diversification by using two carrier partners and two product solutions; and

- Added benefits including an LTC rider AND a return of premium rider on the GUL policy that refunds the majority of premiums paid on that policy in year 20 if the client chooses to surrender the contract.

While the final solution required multiple steps, AgencyONE’s willingness to collaborate with the advisor, work to identify the needs and goals of the client, and explore the various carrier solutions available, enabled us to successfully deliver a case that exceeded the expectations of BOTH the advisor and client.

Please contact the AgencyONE Case Design Department at 301.803.7500

for more information or to discuss a case.