AgencyONE’s 2024 Annuity Outlook

The start of a new year is always a good time to reflect on the past and look ahead to the future in both the near and long term. When I reflect on recent annuity performance, an old adage comes to mind: “The best time to plant a tree was 20 years ago, the second-best time is today”. That quote feels especially poignant today when looking at the sharp rise in popularity and competitiveness of fixed annuities over the last year. The best time to buy an annuity might have been last October, but the second-best time very well may be today!

What’s happening with interest rates? The expectation among many economic pundits in the coming year seems to be reflected in fixed-rate decreases at most annuity carriers. At its peak, a 5-year MYGA could be purchased at an impressive 6.15%; the same product is now available at around 5.20%. While this may seem like a large decline, these rates are still some of the highest in recent memory – higher than at the same time last year and nearly 2 percentage points greater than the same time in 2022!

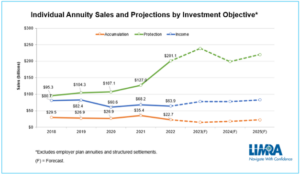

So, if 2023 was a record year, what do the industry experts think is in store for the annuity marketplace in 2024? In short, another strong year: LIMRA forecasts annuity products offering investment protection will continue to drive sales growth.

Product rates and features, while slightly down from recent highs, are still historically competitive. But that is only one piece of the puzzle. Much of the market optimism is driven by individuals who are retiring now, are planning for retirement, or are in the early stages of retirement. An InvestmentNews.com article dated December 18, 2023 reports that as many as 22% of Americans and 31% of Boomers who are still working plan to retire in 2024.

Let’s not forget that annuities are primarily an insurance vehicle. How should you position product features around client objectives to meet the needs of those who are around retirement age? Following is a quick refresher on key annuity product features, where the opportunities lie, and the talking points you might employ to show how annuities can help your clients succeed in retirement.

Income Annuities

- Opportunities – Consider for clients who have benefitted from market rallies and want to lock in those gains in the form of guaranteed lifetime income. An old life insurance policy with more cost basis than cash value can carry over that original basis to reduce taxable portions of income.

- Talking Points – The floor of guaranteed income that annuities offer may help your clients feel comfortable investing their other assets more aggressively – a plan that may potentially improve their overall portfolio performance. These annuities offer a guaranteed income that will last as long as the client or their spouse is alive. Clients can give themselves a raise every year in retirement with an increasing income option.

Fixed-Rate Deferred Annuities (Multi-Year Guarantee)

- Opportunities – Ideal for clients who are looking for a safe place to park funds and earn a competitive return. Changing risk tolerance? Offer an alternative that is entirely predictable.

- Talking Points – Clients can park their money for 3-7 years and lock in a 5.0%+ competitive guaranteed crediting rate with tax-deferred growth and have access to funds if a need arises. The product is available for clients up to age 90 with no underwriting.

Fixed Indexed Annuities

-

Opportunities – Consider for clients approaching or in early retirement who do not have the same risk tolerance that they once did. Can their portfolios weather a market decline, or would they benefit from the principal protection of a 0% floor and market upside?

- Talking Points – S&P 500 caps are in the 10% range, which is still twice as high as a year or two ago. Uncapped accounts offer diversification and additional upside. Income Riders provide guaranteed competitive payouts with flexibility to activate a guaranteed lifetime income stream when the client wants, while still retaining access to cash value.

Long-Term Care Annuities

- Opportunities – Consider for clients who have an inforce policy with significant taxable gains. They can potentially avoid future taxes on distributions by utilizing a policy with leveraged tax-free benefits for LTC expenses.

- Talking Points – Guaranteed long-term care benefits can increase as the client ages or offer an unlimited total benefit pool.

Bottom line: Over the last year, our AgencyONE 100 advisors and their clients have become more active and knowledgeable in the annuity space. If you are still not talking to your clients about annuities in 2024, someone else will be. Continue to educate yourself about annuities so that you do not leave opportunities on the table!

Please call AgencyONE’s Annuity Department at 301.803.7500 for more information

or to discuss a case.