Alternative Solution to Roth Conversion

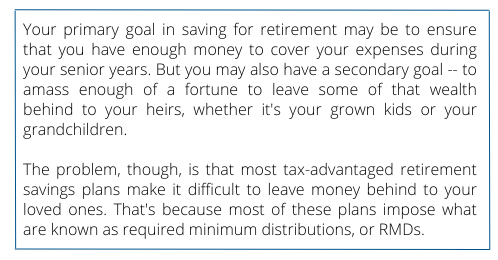

I just read an article from Maurie Backman (TMFBookNerd) at The Motley Fool which provides good advice but ignores the most logical of solutions. The article is titled “Want to Leave Money Behind to Your Heirs? Keep Your Money in This Retirement Account.” Ms. Backman is talking about Roth IRAs as a better way to leave legacy assets to children and grandchildren than traditional pre-tax qualified plans. She states:

The Joke’s On Us

The Joke’s On Us

The reality is that many people have been contributing to 401Ks or other pre-tax plans for years accumulating substantial sums and are now just realizing that the US Department of Treasury has played a joke on us – the American taxpayer. We diligently deferred income and grew retirement plan balances since being introduced to the 401K plan in 1978. As of the end of the third quarter of 2021, according to the Investment Company Institute (ICI), all IRA and Defined Contribution Plans totaled approximately $23.6 Trillion – that is a “T”! To put that number in perspective, if we forced EVERYONE to take their money out today, it would wipe-out just under 1/3 of the US Federal deficit!

Tax Rates & RMDs

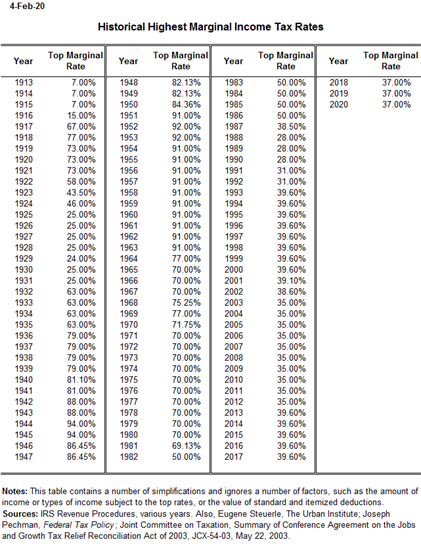

In 1978 (see the adjacent table), the maximum income tax bracket was 70%, and it made perfect sense to defer income in hopes of lower rates in the future. In fact, from 1932 (63%) until 1980 (70%), the highest marginal income tax rate was NEVER less than 63% and peaked at a high of 94% in 1943-1944. In 1982 it had dropped to 50%, and by 1988 it was 28%. What is interesting about the drop from 50% to 28%, according to a blog on The Opportunity Cost website, is that the Required Minimum Distribution (RMD) rules and their revenue positive affect for the government helped offset the other tax cuts included in the bull market by requiring these taxable withdrawals on saved retirement assets. What does that really mean? Congress, in its infinite wisdom, cut income taxes (from 50% to 28%) and THEN decided to tax retirees beyond age 70½ on the retirement money they had saved by forcing them to take taxable distributions. Don’t get me started on that!

So, if you deferred taxable income at 70% and then received your income at 28% or 31%, you were a GENIUS! But then what happened? Tax rates started going up and have remained moderate (low by historical standards) since 1993 ranging from a low of 35% to a high of 39.6%. If someone deferred income at 28% or 31% for 5 years and then retired, they would have paid tax at 39.6%, 35%, or 37%. Remember that this is the tax, not only on what you contributed, but also on all growth of the account.

Who Wants to Defer Taking Plan Balances?

People who thought that they would defer plan balances forever, and pass assets on to their kids or grandkids, were surprised when the Tax Reform Act of 1986 laid out the rules requiring an annual distribution for all taxpayers who had reached age 70½. Basically, the IRS said “no, no, no – we want our taxes.” As a clarifying point, the SECURE Act of 2020 increased the RMD age to 72.

People who thought that they would defer plan balances forever, and pass assets on to their kids or grandkids, were surprised when the Tax Reform Act of 1986 laid out the rules requiring an annual distribution for all taxpayers who had reached age 70½. Basically, the IRS said “no, no, no – we want our taxes.” As a clarifying point, the SECURE Act of 2020 increased the RMD age to 72.

But who wants to defer taking their plan balances for as long as they can? The people with substantial assets and incomes who have enough money to live on WITHOUT taking their 401K or IRA balances, that’s who. We just don’t know whether taxes will be lower when we retire, as rates continue to change throughout our lifetimes. Where will taxes go in the future now that we are deferring income in the 30-40% range? Who knows? But it seems that Congress makes deficits a part of our budget process and, at some point, we will all need to pay (at least some of it) back.

The Crux of the Matter

Let’s get to the crux of the matter and back to Maurie Backman and her article. There is little doubt that a Roth IRA is a much more efficient legacy asset than a traditional IRA. She makes a great case of that fact.

The Roth IRA became available in 1998 followed by the Roth 401K in 2006. Most high-income taxpayers cannot contribute to a Roth IRA (so no real benefit there) while the Roth 401K options have been available for only 15 years and are not offered by all employers’ 401K plans.

The majority of people who have large balances in their 401K plans have either a traditional 401K or have converted partially, or in full, to a Roth, at a significant tax expense. Most consider the RMD a nuisance and an obligatory withdrawal, so that Treasury can get their “pound of flesh” and would rather let their money continue to grow in the accounts. The reality is that many high-net-worth clients would prefer to leave their 401K or IRA balances to the next generation but for the fact that they MUST take distributions at age 72. Is there a better solution and can we plan ahead?

An Alternative Solution

AgencyONE works on scenario planning with AgencyONE 100 advisors who have clients with large 401K or IRA balances. These clients want solutions to taking a large tax hit on a Roth conversion. The conversion could be done over several years to alleviate the “all at once” tax burden, but is there a better way?

A Roth conversion makes the most sense for taxpayers who will NOT have a federal estate or state inheritance tax. However, our analytics show that clients who are projected to pay a wealth transfer tax will be better off taking systematic distributions (RMDs or otherwise) over a period of time and, instead of completing a Roth conversion (which is part of a decedents estate for wealth transfer taxes), making gifts with those distributions to Irrevocable Trusts to purchase life insurance, generally 2nd to die, for maximum efficiency.

Life insurance inside of an irrevocable trust, can create a highly tax efficient wealth transfer as an alternative to the Roth conversion.

The proceeds from life insurance in an irrevocable trust:

- are exempt from federal and state inheritance taxes;

- are not subject to income taxes;

- are fully liquid at face value and not correlated to any other asset classes;

- receive an automatic step up in basis; and

- are protected from creditors and predators.

AgencyONE uses the latest analytic software to project scenario planning and presents various alternatives to guide your clients in their decision-making. The optimal solutions consider qualified plan assets and all other available assets to meet cash flow and wealth transfer objectives, including any charitable intentions. We welcome the opportunity to assist you and your clients.