An IUL with Guarantees to Life Expectancy

Guaranteed Universal Life (GUL) products continue to be the “go to” for many of our Advisors because they offer a guaranteed premium that, when paid in full and on time, provides a death benefit exactly as specified. Simplicity and reliability continue to be strong selling points for Advisors offering GUL contracts. Because GUL contracts are unaffected by policy crediting rates, internal charges or market performance, they consistently perform as designed. The concept of a policy that works like a term contract that can be designed to last as long as necessary is fairly easy for a client to grasp and considered very attractive.

IUL with competitive guarantees

There is however a significant downside to GUL policies – they lack the opportunity for cash value build-up. This means much less flexibility to skip premiums if necessary and less opportunity for an exit strategy. Protection-focused Indexed UL (IUL) products look to bridge that divide and provide competitive guarantees along with the upside of index-linked performance. In exchange for guarantees to or just beyond life expectancy (ages 85-95), a protection IUL product illustrated at a GUL product’s premium and a modest rate of return can provide significantly more cash value and projected coverage that runs longer than a GUL product. The “win-win” is more flexibility for your client and possibly higher targets for you, the Advisor.

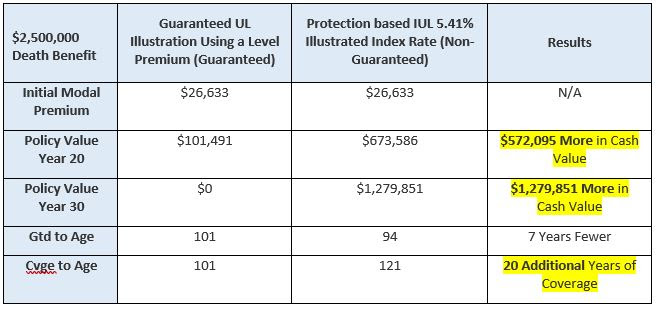

To help show these values in an easy to compare format one of our carrier partners added an agent-only page to their quote system. This comparison offers a quick look using the GUL premium in their Protection based IUL product. AgencyONE recently had an opportunity to assist one of our Advisors in presenting this additional choice to their client. Our underwriters negotiated an outstanding offer with this carrier partner for a 52-year-old male client, Preferred Non-Tobacco, wishing to have $2,500,000 in coverage. The original request from the Advisor was for a GUL product with coverage that would last up to age 101. The GUL contract met the client’s needs and fell within budget, but it lacked the flexibility offered by an alternative protection-focused IUL product with the same premium. The following table illustrates the benefits of both options:

Significant Cash Value

The IUL contract projects significantly more cash value than the GUL contract which allows the client flexibility to skip a premium payment down the road, make a withdrawal from the policy, surrender, or exchange the contract should the need arise. The alternative IUL product presented in this ONE Idea provides a guarantee to age 94 which is beyond the client’s life expectancy. Presented with the options, the client felt confident switching to the alternative IUL product knowing that even modest index returns would generate significant cash value.