Aortic Aneurysm – Can I Still Get Life Insurance?

This week’s ONEIdea is an ANATOMY LESSON on the AORTA that discusses how the artery works and what can happen to cause an Aortic Aneurysm. Many ask, “can I still get life insurance after being diagnosed?” The answer is “yes”, but it depends upon the specifics of the diagnosis, treatment, and follow-up care. The examples at the end of this article will help to illustrate how cases can vary from one client to the next and result in the successful placement of a policy…. or not.

The Anatomy of the Aorta

The AORTA is the largest artery in the body and the single major vessel that distributes the blood from the left ventricle of the heart. The Aorta is NOT just a blood delivery system but consists of several layers of muscle and sensory tissues that serve multiple functions to help monitor and stabilize blood pressures and heart rates.

The AORTA is the largest artery in the body and the single major vessel that distributes the blood from the left ventricle of the heart. The Aorta is NOT just a blood delivery system but consists of several layers of muscle and sensory tissues that serve multiple functions to help monitor and stabilize blood pressures and heart rates.

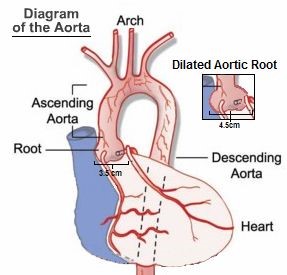

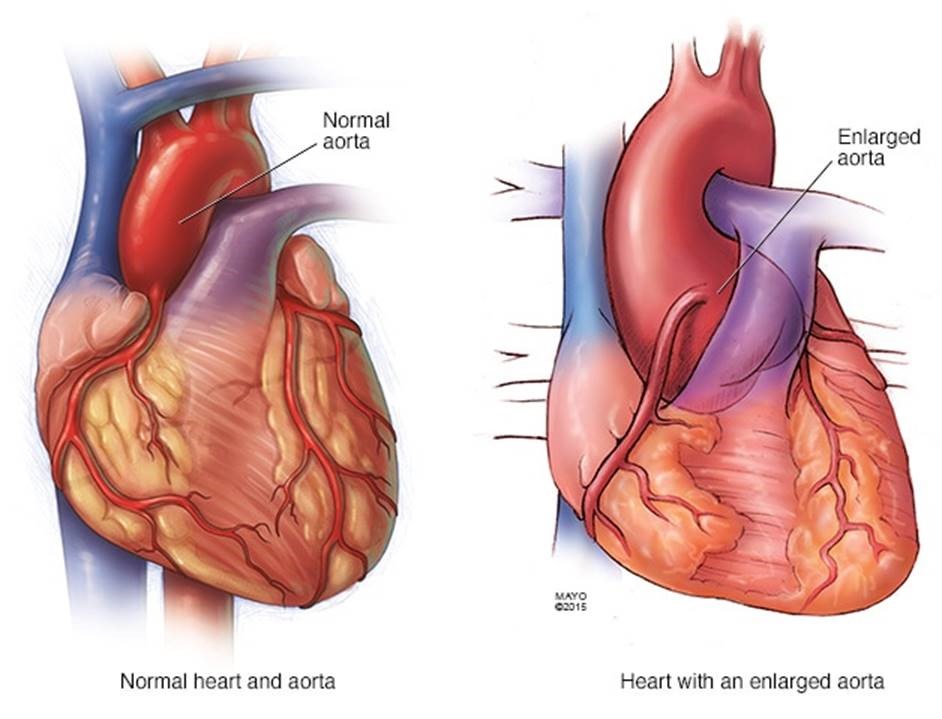

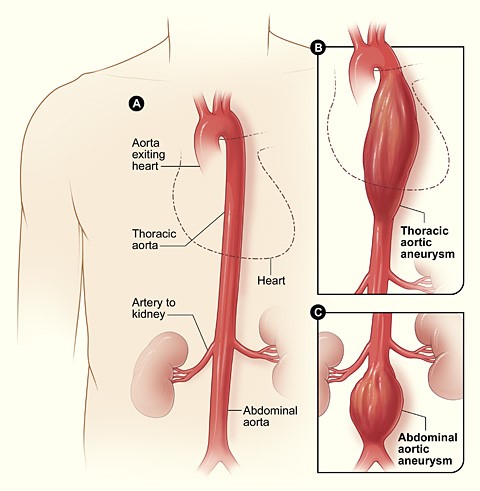

The anatomy of the Aorta is very simple and gives us reference points for problems, such as an Aortic Aneurysm, and areas of concern that most affect mortality considerations. The Aortic Root is the beginning of the Aorta where this major blood vessel arises from the heart (left ventricle). The Aorta “ascends” upward (naturally called the Ascending Aorta) then arches backward (The Aortic Arch) and turns downward to supply blood to the rest of the body through the Thoracic Aorta in the chest area and the Abdominal Aorta below the diaphragm. Major artery branches from points along the path of the Aorta supply blood to the brain and the rest of the body.

How the Aorta Works

When the left ventricle squeezes, blood is forced out of the heart across the Aortic Valve and into the Aorta at tremendous pressure. That pressure reading is known as your SYSTOLIC blood pressure (the FIRST number on a blood pressure reading). The Aorta must be strong and resilient to handle these pressures which can vary dramatically in any normal day. The layers of tissues that we mentioned before must all work together to strengthen the Aorta…. but sometimes they do not.

Aortic Aneurysm

If you think of the Aorta as a bicycle tube and tire (layers), if the outside liner is weakened, the inside tube pushes through….and enlarges…and can tear (dissection) the other layers. Years of high blood pressure, simple aging and wearing out, or genetic weakness (Bicuspid Aortic valve complications come to mind), can all cause a weakness and ballooning of the Aorta. The life insurance risk with a known aneurysm is very real, since a rupture of this ballooning major artery can mean death in minutes, potentially.

Aorta Size Matters

OK men, the statistics are in. 7-9% of men over age 65 have some sort of “enlarged” Aorta. Is this simple wear and tear or is there a life-threatening aneurysm involved? Because these enlargements, dilations, and aneurysms are typically asymptomatic, they are often found “incidentally” through a routine chest x-ray or another medical scan. Once discovered, they cannot be ignored by underwriters. This does NOT mean that an operation is imminent or even needed at all…just that the aneurysm or dilation needs to be watched to see if it is GROWING, which would indicate further weakness and more concern.

Underwriting an Enlarged Aorta

The diameter of a normal Aorta is like that of a garden hose (1-2cm). Underwriting “enlarged” Aortas requires attention to details like: is this a true aneurysm (involving all three layers of the aorta) or just a stretching/dilation? Because an enlarged Aorta is relatively common and the mortality is low, the underwriters start getting a mortality concern at 3.8 cm and above. A carrier may rate the case if above 4 cm and surgery may be involved at 5 cm as a very real danger exists for RUPTURE. It is NOT unusual for underwriting to “hedge” on providing quotes in these situations until a proven track record of stability (which may take years) is delivered to the underwriter or medical director. Clearly, the finding of an enlarged Aorta must be WATCHED with regular physician follow-up.

Screening Tests & Aortic Aneurysms

Screening Tests & Aortic Aneurysms

During 2020, at the height of COVID, doctors were not ordering, and patients were not getting as many routine screening tests. Patients, doctors, and institutions were all reserved about bringing “healthy” people in for testing. However, we WILL see an uptick in screening tests for the remainder of 2021 and throughout 2022 as we all move back to a “normal” medical care schedule.

Life insurance and financial planning experts know that any NEW medical test carries the possibility of an abnormal finding that could cause a DECLINE or a RATING on a life insurance application. AgencyONE has always encouraged clients who are actively involved in underwriting to SEE THEIR DOCTORS ONLY AS REQUIRED AND TO HOLD-OFF ON ANY ROUTINE TESTING, IF POSSIBLE, UNTIL UNDERWRITING IS COMPLETED. A test that shows a “suspicious” finding today will certainly require follow-up and it may take an extended time to get a negative finding to move forward with the needed life insurance protection.

Remember, the majority of Aortic Aneurysms are asymptomatic and usually discovered during a routine screening test. IF YOU HAVE CLIENTS WHO ARE INTERESTED IN LIFE INSURANCE, PLEASE ENCOURAGE THEM TO GET ALL THEIR COVERAGE/FINANCIAL PLANS FUNDED AND IN PLACE NOW, BEFORE THINGS BEGIN TO “NORMALIZE” AND SCREENING TESTS RESUME.

Aortic Aneurysm – Can I Still Get Life Insurance? Case Examples

In December 2020, a 70-year-old male with a family history of coronary artery disease was directed by his physician to get a routine Chest CT scan for a coronary Calcium score. The score came back 38 (essentially no concern at his age) but there was an incidental finding of a 4.2 cm Ascending Aortic Aneurysm. A follow-up echocardiogram verified excellent cardiac function allowing for a substandard offer rather than a postpone.

In January 2021, a 49-year-old male with occasional Gastro Esophageal Reflux Disease (GERD) (medically treated with antacids) which was causing chest discomfort was ordered by his Doctor, as a precaution, to have a routine chest CT for a coronary Calcium score. The Calcium score was “0” (perfectly normal) but an incidental finding of a 4.4 enlarged Aortic Aneurysm was found. Since no prior comparison films existed, the client was started on blood pressure medication and ordered to be seen in 6 months for a stress EKG and a new chest CT to determine if the aneurysm was growing. The life insurance CASE WAS POSTPONED due to the routine screening test with incidental positive Aortic Aneurysm finding AND the $1.5 million in permanent protection WAS NOT delivered to the client.

Advisors and clients who are knowledgeable about the underwriting process and have regular medical care and follow-up in place are an important part of obtaining accurate underwriting and successful policy placement. These things along with the receipt of complete medical records by the underwriter are vital and help make the assessment of risk more favorable.