Atrial Fibrillation – Part II: Understanding the Treatment Options

Nearly one out of every seven strokes in this country are attributed to undiagnosed and/or untreated chronic atrial fibrillation or complications that arise from the condition. We have written about AFib before and because cases continue to come across our desks at AgencyONE, we thought it time to offer an update to a previously penned ONE Idea entitled Underwriting Atrial Fibrillation. A lot has happened in our world since our last article, but one thing has not changed – atrial fibrillation remains the MOST common kind of heart arrhythmia worldwide. The CDC estimates that by 2030 12.1 million people will suffer from AFib. This week’s ONE Idea will explore the treatments we see in underwriting and include a Case Study for the client of an AgencyONE 100 Advisor.

Nearly one out of every seven strokes in this country are attributed to undiagnosed and/or untreated chronic atrial fibrillation or complications that arise from the condition. We have written about AFib before and because cases continue to come across our desks at AgencyONE, we thought it time to offer an update to a previously penned ONE Idea entitled Underwriting Atrial Fibrillation. A lot has happened in our world since our last article, but one thing has not changed – atrial fibrillation remains the MOST common kind of heart arrhythmia worldwide. The CDC estimates that by 2030 12.1 million people will suffer from AFib. This week’s ONE Idea will explore the treatments we see in underwriting and include a Case Study for the client of an AgencyONE 100 Advisor.

Definition, Causes, & Symptoms of AFib

Atrial fibrillation (an abnormal and sometimes very fast heart rhythm – arrhythmia) occurs when the pacemaker center of the atrium (the SA node) gets short-circuited or overridden by other heart muscle cells that fire random electrical signals. This random firing causes the contractions of the neighboring heart muscle cells instead of the uniform contraction process, which pushes blood flow into the ventricle. The upper part of the heart becomes much less effective and the lower part of the heart, the left ventricle, must work harder.

AFib can be caused by chronic conditions such as ischemic heart disease and/or high blood pressure. It can also result from temporary conditions such as hyperthyroidism, pericarditis, thoracic surgery, and acute alcohol intoxication (aka “holiday heart”). Symptoms may include palpitations and shortness of breath, although some individuals experience no symptoms at all. Episodes of atrial fibrillation can be paroxysmal (comes and goes) or chronic. Over time, this can lead to heart failure. However, the most common and most life-threatening concern with atrial fibrillation is the high risk of STROKE. AFib MUST be treated to lower this life-threatening risk.

AFib can be caused by chronic conditions such as ischemic heart disease and/or high blood pressure. It can also result from temporary conditions such as hyperthyroidism, pericarditis, thoracic surgery, and acute alcohol intoxication (aka “holiday heart”). Symptoms may include palpitations and shortness of breath, although some individuals experience no symptoms at all. Episodes of atrial fibrillation can be paroxysmal (comes and goes) or chronic. Over time, this can lead to heart failure. However, the most common and most life-threatening concern with atrial fibrillation is the high risk of STROKE. AFib MUST be treated to lower this life-threatening risk.

There are a variety of treatment options available depending on the symptoms, underlying cause, and length of time with the condition.

AFib Medications

Blood thinners (i.e., Warfarin) help to offset the risk of a stroke and in some individuals, anti-arrhythmic medications (i.e., Amiodarone) alone can bring the heart back to normal sinus rhythm. However, it is worth noting that the use of blood thinners carries its own risk. Besides the side effect of possible excessive bleeding, the use of blood thinners can cause fatigue, dizzy spells, weakness, and possible shortness of breath.

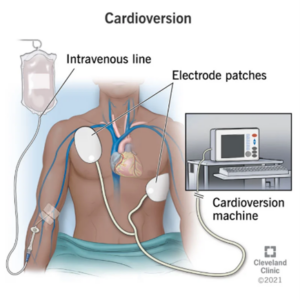

Electric CARDIOVERSION Treatment

Electric CARDIOVERSION Treatment

During a cardioversion, low electrical shocks are delivered to the heart through two electrodes with the goal of resetting the heart rhythm. It is often used to remedy tachycardia (a heartbeat that is too fast) or fibrillation (an irregular heartbeat). For some, it may require more than one treatment to restore a regular heartbeat. From an underwriting standpoint, some carriers may require a short postponement period following a cardioversion to ensure the heart remains in a normal sinus rhythm for a period of time.

Ablation

If medications and cardioversion are not effective in treating AFib, the next approach is typically a minimally invasive procedure called an ablation. After cardiac “mapping” (an electrophysiology study) to pinpoint the source of the heart’s electrical misfiring, a catheter is threaded through a large blood vessel up into the heart. The catheter emits energy to destroy (ablate) the tissue that is causing the arrhythmia. An ablation is effective on the first attempt approximately 60% of the time. However, a second procedure can sometimes be required. Underwriters are again focused on TIME and stability AFTER the procedure.

Although there can be great success with these more common forms of AFib treatment, some individuals still experience long-standing and persistent atrial fibrillation. This has led to the innovation of another treatment called the Hybrid Convergent procedure.

Hybrid Convergent Ablation

This relatively new treatment (clinical trial in 2020) is a two-step minimally invasive procedure designed to treat longstanding persistent atrial fibrillation – 70% of patients with AFib are considered to have this condition. The first step, performed by a cardiac surgeon, involves creating a small incision in the chest wall allowing access to the OUTSIDE of the heart muscle for atrial wall ablation. Step two (approximately 8 weeks after the first step) involves a catheter ablation to the INSIDE of the heart and is performed by an electrophysiologist.

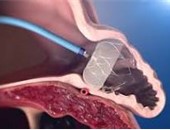

The Watchman

The Watchman

This alternative treatment is for individuals who cannot tolerate prolonged use of blood thinners which typically have been the only treatment used to eliminate blood clots. The Watchman is a small “parachute-shaped device” (not much larger than a quarter) which is inserted into the left atrial appendage (the specific area inside the atrium that is most prone to blood clot formation) to effectively close off the area. The device has been shown to be as effective in eliminating the risk of blood clots in the left atrial appendage as blood thinners. The Watchman can be used only for those with non-valvular atrial fibrillation.

AgencyONE underwrites our Advisors’ cases based on the actuarial statistics and while atrial fibrillation is a rather common cardiac arrhythmia, it does require TIME to show that the prescribed treatments are working. At AgencyONE, we often work directly with the cardiologists to clarify patient records and perhaps offer additional testing options that may help carrier underwriters view these cases in the most favorable way.

AgencyONE underwrites our Advisors’ cases based on the actuarial statistics and while atrial fibrillation is a rather common cardiac arrhythmia, it does require TIME to show that the prescribed treatments are working. At AgencyONE, we often work directly with the cardiologists to clarify patient records and perhaps offer additional testing options that may help carrier underwriters view these cases in the most favorable way.

Case Study

Mr. Elliott Thomas is a 59-year-old married man nearing retirement and hoping to secure a linked-benefit policy. He is sufficiently covered as far as traditional life products go but wants the additional reassurance that a linked-benefit policy can provide for himself and his family.

Mr. Thomas is 5’9” tall and weighs 200 pounds. He has a history of persistent atrial fibrillation which was initially treated with antiarrhythmic medication, but the treatment was not considered effective. Mr. Thomas underwent a successful cardioversion in June 2022. There was a discrepancy in Mr. Thomas’ medical records saying that he had required not one, but two cardioversions. The AgencyONE underwriting team reached out to Mr. Thomas’ physician directly for clarification. His physician responded to our team with a detailed letter confirming that the client required only ONE cardioversion, as we had expected. Mr. Thomas’ heart has remained in normal sinus rhythm since the procedure, and he has experienced no complications.

Aside from the atrial fibrillation history, Mr. Thomas has hypertension (well controlled on Lisinopril) and takes a statin as a preventive measure to keep his cholesterol at optimal levels. He has no history of coronary artery disease. Mr. Thomas is otherwise very healthy and engages in exercise three to four times a week (jogging, cycling, swimming, tennis).

Even with the atrial fibrillation history, Mr. Thomas successfully qualified for a very competitive linked-benefit product from one of our A+ carrier partners that provides a $5,000 per month LTC benefit which increases annually at three percent. Mr. Thomas was able to use a portion of a recent inheritance ($75,638.72) for an attractive single-pay scenario. The product is cash indemnity with benefits and premiums fully guaranteed.

AgencyONE’s Underwriting Team is equipped with the product intelligence and underwriting expertise to assist with ALL of your clients’ insurance needs. We are ready, willing, and able to help with matters of mortality AND morbidity!

Please contact the AgencyONE Underwriting Department at 301.803.7500 for more information or to discuss a case.