In this day and age, living with a chronic illness like Diabetes is much more manageable than ever before. The technology that brought us improved medical care for this disease has also inspired technological improvements and data access tools that are profoundly changing “what” the Life Insurance Industry offers and “how” it is offered.

John Hancock revolutionized the insurance industry with the introduction of their

VITALITY program which generated significant levels of post-issue client engagement by incentivizing and rewarding those insureds who maintain a healthy lifestyle with PREMIUM DISCOUNTS (and more). Nearly 1 out of every 2 policies issued by John Hancock includes their Vitality PLUS rider* and, as of September 2019, they have provided nearly $6 MILLION in premium savings.**

John Hancock Introduces ASPIRE!

If you have ever written business for a client living with diabetes OR had a client with a family history of diabetes, you need to read this ONE Idea. This ONEIdea details an important opportunity for you to better SERVE your clients and offer REAL-TIME support and protection AFTER the insurance sale is made.

John Hancock has added a new platform,

ASPIRE, to their Vitality Program. ASPIRE personalizes the post-issue journey for clients living with diabetes, providing a point system tailored to this health condition. John Hancock has also teamed with the company

Onduo which provides individuals living with Type 2 diabetes DAILY support in managing their unique healthcare needs through blood glucose monitoring, online tools and coaching from nutritionists and medical professionals. While this does not replace traditional medical care, it does offer clients meaningful guidance and accountability in between appointments.

This is a custom pathway in which clients can accrue points and be REWARDED with up to 25% in PREMIUM SAVINGS and more.

Protect Clients Who Have Not Been Diagnosed….Yet

The ASPIRE program should be discussed with ALL your clients, not ONLY those currently living with diabetes. According to the most recent CDC statistics, more than half of Americans diagnosed with diabetes in 2015 were between the ages of 45 and 64.

When the Vitality rider is added to a John Hancock policy, clients complete an annual Vitality Health Review (VHR). If your client is diagnosed with diabetes at ANY TIME the policy is in-force, they can update the VHR and automatically gain access to ASPIRE and all its benefits.

John Hancock has traditionally been competitive in their underwriting of clients living with diabetes. They have PREFERRED criteria for clients over the age of 60, and currently offer a one table upgrade when the Vitality GO or Vitality PLUS rider is elected.

Let’s Take a Look at a Sample Client:

- Mr. Smith, 50-year-old, non-smoker

- $1,000,000 of Protection UL ’19 coverage

- Type 2 diabetes diagnosis 6 months ago

- Treated with Metformin

As a tech company executive, Mr. Smith travels frequently for business. His diabetes diagnosis was a wake-up call, and it forced him to prioritize his health. Obesity is a significant risk factor in the development (and progression) of diabetes. Mr. Smith knew that his weight was not doing him any favors. As such, his first lifestyle change was to adopt a healthier diet and engage in cardiovascular-focused exercise at least three times each week. He hasn’t met his goal weight, but Mr. Smith has successfully lost 20 pounds since being diagnosed with diabetes. John Hancock would classify his current combination of diabetes and build at 150% or Table 2. At 150%, his premiums on a $1,000,000 Protection UL ’19 policy guaranteed to age 83 and run to age 100 are

$15,916 per year! However, by adding the Vitality PLUS rider to his policy, Mr. Smith benefits from an automatic

upgrade to STANDARD rates! Additionally, since Mr. Smith is living with Type 2 diabetes, he can take full advantage of the John Hancock

Aspire program. Even while traveling for work, Mr. Smith has the guidance and support he needs right at his fingertips to successfully manage his diabetes day-to-day. Through Aspire, Mr. Smith also qualifies for a minimum of one year free with Onduo!

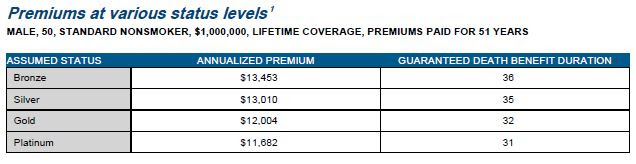

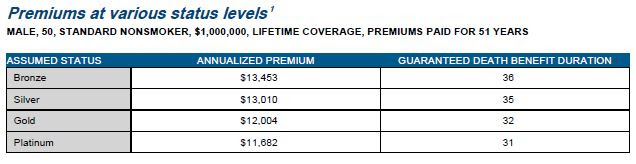

The table below outlines the potential cost savings at each of the Vitality levels Mr. Smith could achieve. If Mr. Smith reaches Platinum status, he would save over 25% each year! The key is in Mr. Smith’s hands. It is up to him to take advantage of the tools and resources available through Vitality, Aspire, and Onduo to unlock the benefits that are rightfully awarded for a continual commitment to his health.

This presentation is not intended to predict actual performance, and not all benefits and values are guaranteed. The assumptions on which the non-guaranteed elements are based are subject to change by the insurer, including the Status Qualification requirements. Actual results may be more or less favorable. This presentation is not valid unless presented with a complete basic illustration which explains guaranteed and non-guaranteed elements. Additional illustrations showing various Assume Statuses can be obtained from your insurance producer.

1. Please consult your financial representative as to how premium savings may affect the policy you purchase. Paying a premium that differs from an originally illustrated amount could reduce the duration of you policy’s Death Benefit Protection feature or impact other features of you policy. Premium savings are in comparison to the same John Hancock policy without the Vitality program. Premium savings over the life of the policy will vary based upon policy type, the terms of the policy, and the level of the insured’s participation in the John Hancock Vitality program.

While we don’t usually highlight a specific carrier in our underwriting ONEIdeas, we have made a very noteworthy exception here. John Hancock’s Vitality rider and Aspire are excellent programs that benefit the client by offering the possibility for significant savings in premiums while also increasing satisfaction by offering the client individual control.

Technology and data are quickly changing the life industry and ultimately the experience of your clients who are purchasing life products. Many of our carrier partners are harnessing these tools to modernize the application process and customize underwriting requirements in an effort to expedite, personalize and improve the insurance buying experience for the client.

AgencyONE possesses the underwriting expertise, carrier relationships and access to cutting edge programs to help you successfully place your clients’ cases – healthy or impaired!

* and ** as reported by John Hancock Vitality as of September 2019.

Please call AgencyONE’s Underwriting Department at 301.803.7500 for more information or to discuss a case.

|