The Best Laid Plans of Mice & Men: Generational Wealth Planning

“This fabled golden era, this special world of luxury and privilege that the Vanderbilts created, lasted but a brief moment. Within thirty years after the death of the Commodore Vanderbilt in 1877, no member of his family was among the richest people in the United States…. When 120 of the Commodore’s descendants gathered at Vanderbilt University in 1973 for the first family reunion, there was not a millionaire among them.” – Arthur T. Vanderbilt II.

Fortune’s Children: The Fall of the House of Vanderbilt

When Cornelius Vanderbilt died at age 82, he left the bulk of his fortune, estimated at more than $100 million in 1877, to his son William. Generational wealth, often viewed as a family legacy, is surprisingly fragile. Without intentional planning, even substantial fortunes, like that of the Vanderbilts, can vanish in a few generations. How can this happen?

The Problem

The best-laid schemes o’ mice an’ men,

Gang aft a-gley,

An’ lea’e us nought but grief an’ pain,

For promis’d joy.

Modern English translation – “The best laid plans of mice and men often go awry, and leave us nothing but grief and pain, for promised joy”.

As Scottish poet Robert Burns aptly notes in his 1786 poem To a Mouse, ‘The best-laid plans of mice and men, often go awry’. For many families, well-constructed wealth transfer strategies fail to deliver the intended legacy, leaving grief and disappointment instead.

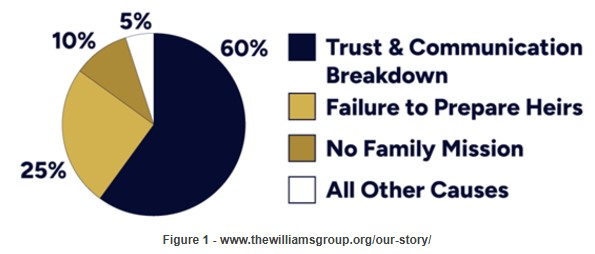

As generational wealth professionals, in collaboration with attorneys, accountants, and other financial advisors, our best intentions for clients “gang aft a-gley”. In fact, they go awry so often that one must question if there is a better way to accomplish generational wealth planning. According to a 20-year study of 2,500 families by The Williams Group and another extensive study of 750 families by the Miami of Ohio School of Business, fully one-third of generational wealth transfers fail beyond the first generation. Research from a variety of sources indicates that the failure rate can be over 90% by generation three.

When looking for causes of this, the Williams study concluded that only 5% of the failures were the result of poor governance, legal, tax, or investment advice. The other 95% was caused by:

- Breakdown of family communication and trust – 60%

- Inadequately prepared heirs – 25%, and

- Failure to establish a family mission – 10%.

The Importance of Purposeful Planning

Suppose only a 5% failure rate lies in governance, legal, tax, and investment advisory services. In that case, we must become more purposeful in our planning by addressing the reasons noted above for 95% of planning that fails. Isabel Miranda, JD, Managing Partner at Pearlman & Miranda, LLC with offices in Newark, New Jersey, and New York, New York defines purposeful planning as “expressing your wishes in a way that is driven – not by tax laws and financial wealth – but by enduring wealth. Purposeful planning is about your family and the values and philosophy that you engender and embody.” I interpret this as a focus on a family’s core values, shared experiences, sound financial stewardship, and charity to others. Mrs. Miranda continues by stating “to accomplish this, we need to work with our clients to capture their essence in a meaningful way and reflect that in their estate plans.”

Bob Larkins, CLU, ChFC and Accredited Estate Planner (AEP) in Dayton, Ohio comments that “generational wealth planning is not a legal exercise, it’s not a financial exercise; it’s an emotional exercise with legal and financial consequences”. I would emphasize that these legal and financial consequences, if gone awry, can be devastating to individual family members and entire families.

Generational Execution – A Long Game

When planning for many generations, possibly hundreds of years, with tools such as multi-generational or dynastic trusts, due diligence is required to ensure that the wishes of the founding family members are honored well past their lifetime and that the connection to their value system and desires be maintained. It is critical that long-term governance be considered.

“An independent corporate trustee can play many extremely important roles for perpetual family enduring wealth” states Al W. King, III, the Co-Founder, Co-Chairman, and Co-CEO of South Dakota Trust Company. He goes on to say that “the independent corporate trustee not only assists the family with many of the administrative tasks associated with a perpetual trust but also acts as a great mentor, sounding board, and arbitrator for the family. Additionally, an independent corporate trustee located in one of the modern trust states (i.e., DE, NV, SD, or WY) can provide a family and its perpetual trusts with tax benefits, asset protection, control, and flexibility regarding trust investments and distributions, assist with the promotion of family values intergenerationally, privacy and much more.”

Independent corporate trustees for a perpetual trust generally operate within a “directed trust” fiduciary structure which provides a collaborative relationship among the family, family advisors, beneficiaries, and the independent trustee. Multiple trustees/fiduciaries and managers assume duties generally assigned to a single trustee. This structure leverages specialization of function regarding trust investments, distributions, custody, and administration combined with active family and family advisor involvement. Consequently, an independent corporate trustee can protect a family’s goals and purpose in perpetuity.

Dynastic Planning

Athos, Porthos, Aramis, and d’Artagnan’s motto “all for one and one for all” in the famous Alexandre Dumas novel, The Three Musketeers, simply means that every individual acts for the benefit of the group, and the group should act for the benefit of every individual.

Most planning involves each family in a generation creating a trust or series of trusts for the benefit of their direct descendants, as each family unit will have unique needs, goals, and circumstances, leading to a distinct but often shared family mission.

Multigenerational or Dynasty trusts will ultimately hold a multitude of family assets such as business interests, managed investment portfolios, family homes, commercial real estate, life insurance, and other assets, for the benefit of the intended beneficiaries of said trust. These assets, which are protected from creditors and shielded from wealth transfer taxes, will serve as the income-generating tool for distributions to trust beneficiaries.

There is another factor to consider, however, which is just math.

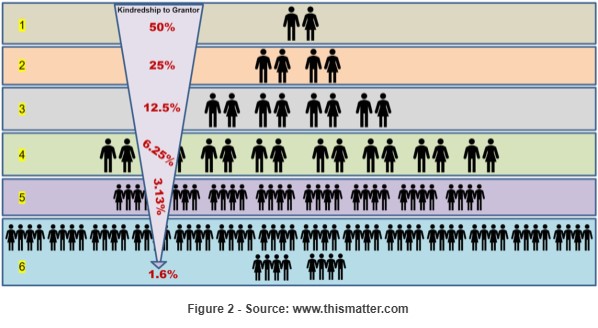

As the chart above indicates, after several generations, the beneficiaries will no longer be closely related to the grantor. A child of the grantor will be related 50%, a grandchild, 25%, a great-grandchild, 12.5%, so that by the 6th generation, the beneficiary only has a 1.6% relationship with the grantor, and that relationship continues to halve with each successive generation. Intentionality as to governance, the communication of family values and mission, and the preparation of heirs are critical to long-term success.

By the same reasoning, the trust income or property must be divided among more and more beneficiaries. If the grantor and each beneficiary have 2 children, then there will be 64 beneficiaries in the 6th generation. Unless there is adequate governance and stewardship and a constant replenishment tool, the wealth, as with the Vanderbilts, will dissipate.

The Family Treasury – Constant Replenishment

The Family Treasury, which is an Insurance Limited Liability Company, takes the Three Musketeers motto into the multigenerational family setting. It is established for the sole purpose of executing the “all for one and one for all” mindset.

Trusts can invest a portion of their assets, via capital contributions, into a “Family Treasury” which does nothing more than own life insurance on all living members of the family, by birth or by marriage, in equal amounts. Over the generations, each family trust benefits equally from the life insurance proceeds. The life insurance serves as the great equalizer for the benefit of the “all” by replenishing wealth for subsequent generations.

Why life insurance?

- Life insurance is a non-correlated asset relative to the other investments in the family portfolio.

- It is always worth 100% of face value at the death of the insured regardless of market cycles (equities, debt, real estate, commodities, etc.).

- It is converted to cash at death providing immediate liquidity.

- Cash value grows on a tax-deferred basis and can be invested in a variety of asset classes (equities, bonds, cash equivalents, etc.) if desired.

- Cash value can be used as collateral for borrowing purposes.

- Death benefits are income tax-free and, if properly owned, estate tax-free.

In this setting, the descendants who are investment bankers and neurosurgeons are as “valuable to all” as the descendants who are elementary school teachers and Peace Corps volunteers. Family members can be empowered to pursue their life’s goals and passions without fearing great wealth disparities over the generations and can contribute in their own unique way to the family mission, value system, and stewardship.

With Purposeful Planning, Generational Execution, and a Family Treasury, the chances of generational wealth, both enduring wealth and financial wealth, increase dramatically.

For more information on The Family Treasury or to discuss a case, contact Gonzalo Garcia at 301.910.1234 or gonzalo@agencyone.net. Our goal is to work in a collaborative way with other legal, tax, trust, financial, and insurance advisors.

This week’s ONE Idea will focus on OneAmerica’s current Hybrid/LTC options available to our AgencyONE 100 advisors. They include individual and joint life products that offer excellent premium design flexibility. The products have a unique option for a lifetime benefit period and are the only product that allows for ratings on the client. For clients who are 65-85, OneAmerica also has an annuity-based option called Annuity Care which is appealing to older age clients. (Find the Asset Care Product Overview

This week’s ONE Idea will focus on OneAmerica’s current Hybrid/LTC options available to our AgencyONE 100 advisors. They include individual and joint life products that offer excellent premium design flexibility. The products have a unique option for a lifetime benefit period and are the only product that allows for ratings on the client. For clients who are 65-85, OneAmerica also has an annuity-based option called Annuity Care which is appealing to older age clients. (Find the Asset Care Product Overview