Consider Cash Value Life Insurance for your Client’s Supplemental Income Needs

Countless articles exist about Cash Value Life Insurance and how it can offer supplemental income for your clients. AgencyONE has even written some – Cash Value Life Insurance, the Gift that Keeps Giving. While these articles are great at focusing on accumulation and future projected income, some forget about the protection aspect of the life insurance equation altogether. For accumulation, income, AND protection designs to be successful, you must FIRST determine your client’s insurance need. This important first step will help AgencyONE design a protection plan that allows your clients to protect what matters most to them. Additionally, in the event of an early death, the proceeds can fully fund the accumulation goal while traditional investments cannot. The insurance need may dictate a specific or a minimum Non-MEC (Modified Endowment Contract) premium level to assist in maximizing the cash value. The overall case can be built with Whole Life, Indexed Universal Life (IUL), Variable Universal Life (VUL) and/or Term. A well-designed life insurance program can utilize multiple product lines simultaneously.

A Multiple Insurance Solution Design

After you determine the protection aspect of the policy for your client, you will next explore the accumulation options. A common objection from clients about cash accumulation designs is that they can realize better returns through their investment account. This may or may not be true depending on the design of the policy, the client’s goals, and the portfolio allocation of the client’s account. Instead of just talking about the comparison – AgencyONE can provide a report which shows a side-by-side method for comparing and contrasting these options. We can run scenarios based on the desired projected income stream from the policy and customize the compared investment account for:

- Composition;

- Rate of return; and

- Projected tax rates.

It is important to remember that the life policy distributes the values tax free while the equity account has annual taxable amounts due and a higher distribution requirement to match the net life insurance distribution. This report will include the taxable amounts during the accumulation and distribution phases.

Sample Reports

Let’s look at the first of two sample reports. Both use a 39-year-old male client with a preferred rating. Mr. Male Client wants to contribute $50,000 per year for 10 years and then take an income stream for 10 years from ages 65-74. The AgencyONE Case Design team ran this report with two different product solutions – Whole Life and IUL. For purposes of comparison, the investment account options will remain constant with a:

- 6.5% ROR (4.5% Equity Account Growth and 2% Equity Account Dividend);

- 35% Tax Rate;

- 15% Portfolio Turnover Rate; and

- Management Fee of .75%.

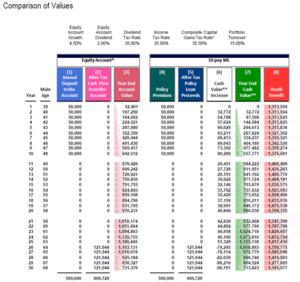

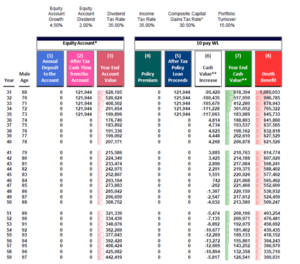

Comparison 1: Using a 10 pay Whole Life Contract vs an Equity Account

The first three columns show the Equity Account. (Annual Deposit, After-Tax Income, and Year-End Account Value). Columns 4-8 show the life product (Premium, After-Tax Loan Proceeds, Cash Value Increase, Year-End Cash Value and Death Benefit). Whole Life provides an immediate initial death benefit of $1,313,504 which far exceeds the accumulated benefit of $52,401 in the Equity Account in year one. The Whole Life solution is run using the carrier’s current dividend rate and solves for the 10 years of income starting at age 65. Even with the exact projected rates and returns on this report, the Death Benefit of the Whole Life product exceeds the accumulated value of the Equity Account in year 30 by $454,598 and the projected income solve (withdrawal to basis then loans) from the Whole Life is $121,944 per year!

On the second page of the report below, we see that both options can continue at the projected rates after the income period is complete. The Equity Account will exceed the Death Benefit of the Whole Life around age 95.

This report is ideal for explaining the concept to your clients, but the important selling point should be the higher initial death benefit and tax-free growth that the design offers! The rates in this report are constant and do not reflect changes in performance and dividend rates. Key items to note on the Whole Life product are that:

- It is based on current dividends; and

- The policy must be managed to stay inforce to prevent a taxable issue at lapse.

See the full report showing taxable amounts in the Equity Account.

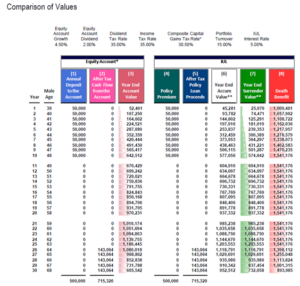

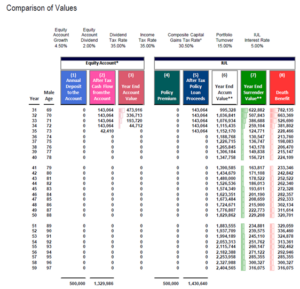

Comparison 2: Using a 10 pay Accumulation Based Index Product

The sample design above uses an Accumulation IUL solution with a Death Benefit run at a minimum Non-MEC level showing an increasing option B for 10 years. In year 11 we switch to level. Similar to the Whole Life contract we show an initial Death Benefit of $1,009,401 compared to the $52,401 accumulated benefit in the Equity Account. The projected income taken from the Indexed UL is $143,064 per year (withdrawal to basis then loans).

The second page of the report below shows a different result compared to the Whole Life option. Since the IUL income solve is higher, your client would need to take more from the Equity Account to match the net number from the life insurance. In this scenario the Equity Account runs out of money in year 35 while the IUL continues under the 5% ROR. See the full report showing the taxable amounts in the Equity Account.

Indexed UL is a good option for you and your client to consider but it should not be chosen JUST based on the higher projected income solve. This product has a fixed 0% floor and a high par rate that can fluctuate based on how a carrier adjusts them over time. These are hypothetical projections based on the same rate of return every year which will NEVER happen. It is imperative that you and your client fully understand how this product credits and performs – especially as compared to the Equity Account. The strengths of the IUL are a fixed 0% floor and the option to take tax-free income. Please be aware – that the amount of income may need to be adjusted over time AND additional premiums may be needed to keep the contract inforce.

This ONE Idea is not meant to rate one product over another when comparing against the Equity Account. However, it is meant to provide you with an effective way to show your clients the benefits of tax-free income and how they might have another income source in addition to their other current options. Depending on your clients’ objectives and risk tolerance, AgencyONE has numerous solutions to plug into these comparisons. Our Case Design team will help you select the best options for your client. Please review the full comparisons we have attached and look at additional rates to compare and review the cost of insurance pages to ensure you have all the information you need for your client presentation.

Please contact the AgencyONE Case Design Department at 301.803.7500 for more information or to discuss a case.

If you’d like to read more of our ONE Ideas, you can find them on the homepage of our website under Updates/Blog or under the Sales & Marketing tab on your personal advisor Dashboard.