Early Cash Value Rider – What is it & How Does it Work?

A recent case from one of our AgencyONE 100 Advisors provided an opportunity for our Case Design and Illustrations team to focus on early cash value (ECV) riders. An ECV rider has important applications depending upon your clients’ financial needs. So, what is an early cash value rider and how does it work?

Early Cash Value Rider – What is it?

An ECV rider can improve the surrender value of a contract in the early years. While most carriers offer a version of this rider, there are still a few that do not. Carriers that offer the rider usually include an increased charge on the contract that will impact future cash values and income streams. The addition of the rider will also change the compensation structure for the product by spreading the advisor’s compensation over a number of years and imposing a chargeback to the advisor in the first 4-5 years. These riders are commonly added to premium financed cases to minimize collateral requirements and occasionally added to business owned cases to provide liquidity. Lately, we have seen this rider added to individually owned polices as well.

Early Cash Value Rider Discussion

Early Cash Value Rider Discussion

A discussion about using these riders needs to happen early in the design process since each have their own requirements and exclusions. The case mentioned at the start of this article was an individually owned cash value product that was designed to provide income. The product was max funded for 10 years and illustrated to provide income from ages 71 – 85. The client applied for the product and obtained a Preferred Best underwriting offer. However, while discussing the final case design, the advisor and client decided they wanted full access to the cash value in the early years and asked that an ECV rider be added to see how it would impact the contract. Unfortunately, the original carrier did not offer an ECV rider which resulted in a new search for a carrier with a product solution that would meet the updated case requirements.

Consider the following when using an ECV rider:

- How is the contract owned? Some riders require the policy to be premium financed or business owned. Other ECV riders do not allow the use of individually owned contracts.

- At what level is the contract funded? Many of the riders require the premium to be maximum non mec based on the face amount. In a few instances lower level solves may be an option. For low level pays the cash value would be approximately 40-60% of the value based on the premium.

- How much value does the client want? Some riders only provide 50-80% of account value based on premium. Others can go as high as 100% but premium limits apply.

- Will the client pay level premiums or plan to skip/short pay? Many of these riders require a specific funding level and period to maintain the enhanced value. If the plan is to skip a year, the client would lose the enhancement.

- Enhanced values are only available on surrender of the contract. Early distributions from the policy are not based on the enhanced values. They are based on the original surrender values. Enhanced values cannot be used as a 1035 into a new contract.

- How does the addition of the rider impact the policy or design of the policy? Will the cash value or income be hurt by adding the rider? How much of a decrease is acceptable to the client?

- How is the advisor’s compensation impacted?

Had AgencyONE known upfront that the client wanted high early cash values on the policy, we would have approached the case using different search parameters and compared carriers offering the highest projected income with those offering a high Early Cash Value Rider as an option. Ideally, we want a competitive contract that offers a good blend of enhanced value and strong projected cash/income.

Early Cash Value Rider Applications

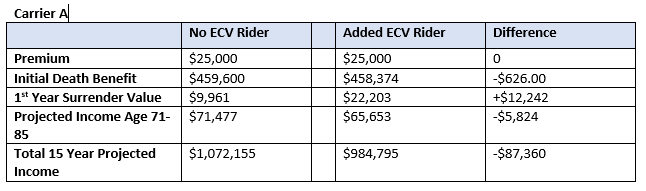

Initial Fact Pattern:

Male age 41, Preferred Best risk, $25,000 annual premium for 10 years, increasing death benefit for 10 years then switching to a level death benefit. Income allowed between ages 71 – 85.

The sample design below shows how adding the rider affects the death benefit, cash surrender value, and projected income.

The addition of the ECV rider reduces the income stream substantially – by $5,824 with Carrier A.

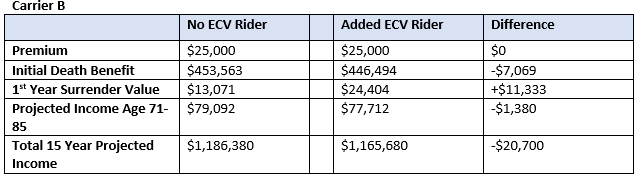

If we try the same fact pattern with a different carrier – Carrier B, we see less of an impact on projected income.

Early Cash Value Rider – Costs & Value Impact

Crediting rates were not considered in the numbers above. The main point is to show how the rider increases costs and impacts values – as in every case, some carriers work better than others. It is worth taking the time upfront to determine whether the rider is needed and, if so, to partner with the right carrier. The option that offers the MOST cash value enhancement with the LEAST amount of policy impact will provide the best solution for your client.

So, which way did the advisor and client go on the case featured in this ONEIdea? After reviewing additional carriers who offer ECV riders and showing how future values would be impacted by adding them, the client decided to forgo the riders and accept the original policy offered.

AgencyONE’s Case Designers are experts in product intelligence and work collaboratively with our AgencyONE 100 advisors to develop a design that will achieve the client’s risk and financial planning goals.