End of Term Insurance STICKER SHOCK!

Have you ever had a client who came to the end of their level term insurance period and then got a renewal notice that made them happy? More than likely, they were very upset and called you expressing “End of Term Insurance Period STICKER SHOCK!”

LEVEL TERM PREMIUM TO ANNUAL RENEWABLE TERM

Most carriers change from a level term premium during the term guarantee period to an annual renewable term (ART) rate, considering the insured’s attained age at that time. The problem? Since there is no new underwriting upon renewal, the carrier charges rates that are reflective of a much higher risk profile. This higher risk profile translates to possibly a lot more money AND the “End of Term Insurance Period STICKER SHOCK!” The reality of course, is that most clients who are still healthy enough and need continued coverage, (at the advice of their insurance advisor), will not pay the increased premium and WILL subject themselves to underwriting to obtain “freshly underwritten rates” that are more reflective of their health status for another guaranteed term policy. If they are not healthy, and feel they need life insurance coverage going forward, they will exercise their conversion privilege OR continue to pay an ever-increasing premium at the high (ART) rates.

Since there is no new underwriting upon renewal, the carrier charges rates that are reflective of a much higher risk profile. This higher risk profile translates to possibly a lot more money AND the “End of Term Insurance Period STICKER SHOCK!” The reality of course, is that most clients who are still healthy enough and need continued coverage, (at the advice of their insurance advisor), will not pay the increased premium and WILL subject themselves to underwriting to obtain “freshly underwritten rates” that are more reflective of their health status for another guaranteed term policy. If they are not healthy, and feel they need life insurance coverage going forward, they will exercise their conversion privilege OR continue to pay an ever-increasing premium at the high (ART) rates.

SOCIETY OF ACTUARIES STUDY

A May 2021 study, commissioned by the Society of Actuaries from SCOR Global Life USA Reinsurance Company (SCOR), may provide some answers and shed light on many issues affecting the direct writing carriers today. Of note and the purpose of this ONEIdea is that it may explain many of the pricing and conversion option decisions being made as a result of some of the findings and how you can advise your clients.

A May 2021 study, commissioned by the Society of Actuaries from SCOR Global Life USA Reinsurance Company (SCOR), may provide some answers and shed light on many issues affecting the direct writing carriers today. Of note and the purpose of this ONEIdea is that it may explain many of the pricing and conversion option decisions being made as a result of some of the findings and how you can advise your clients.

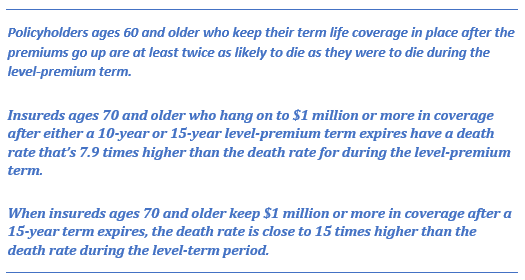

Allison Bell’s June 4th article for Advisor Magazine entitled “When Term Life Policyholders Leave the Level-Premium Bubble” notes two significant statistics from the SCOR study and concludes that “consumers who face a huge premium increase turn out to be good at judging their health”.

Ms. Bell notes that:

Indeed, when a consumer reluctantly pays for “substandard rates on an increasing basis”, they often know the end is near.

A PERSONAL STORY

When my aunt was in hospice some years ago and in her final days of life, it coincided with the expiration of a 20-year term policy that she had purchased. In fact, her 21st year renewal billing statement was sitting in her mailbox when I was visiting her. My uncle asked if he should pay the increased premium, to which I, of course, replied with an emphatic “YES”! The premium was almost 5 times what her level premium had been, but it was the best “investment” my uncle ever made since the company was obliged to pay the death claim a few days later.

statement was sitting in her mailbox when I was visiting her. My uncle asked if he should pay the increased premium, to which I, of course, replied with an emphatic “YES”! The premium was almost 5 times what her level premium had been, but it was the best “investment” my uncle ever made since the company was obliged to pay the death claim a few days later.

TERM CONVERSION PREDICAMENT

This same predicament is being felt by insurance companies, and has been for some time, on conversions. Most clients who know that they are not healthy and can still convert their policies will do so, to avoid the uncertainty of an increasingly burdensome premium requirement at the end of the term period.

Claims experience from many, if not most, insurance companies has not been favorable on term conversions for many of the same reasons….consumers are good at judging their own health and often know something is “not right” with their health.

Claims experience from many, if not most, insurance companies has not been favorable on term conversions for many of the same reasons….consumers are good at judging their own health and often know something is “not right” with their health.

It is no wonder that carriers DO NOT WANT customers to do what the industry calls “late term conversion” and have taken steps to change their conversion period or limit the products available for conversion. More and more we are seeing long term durations limit the years in which a client can convert a policy or, alternatively, limit the product options available to a client for conversion. Most often, the product limitations are very expensive and take into consideration impaired mortality.

In a recent conversation with a carrier who will remained unnamed, I was told point blank that they favored early conversions, but “late term conversions” were a real problem for them.

It is also no wonder why life settlement companies are so interested in buying policies from consumers just prior to the term expiration period and converting them to a permanent policy. Settlement companies are investors, and they are looking for returns – BIG returns. So, much to the insurance company community’s chagrin, it makes sense that life settlement companies are looking for clients who do not want their old term policies and are NOT in good health.

LOOK BEYOND PRICE

Today more than ever, advisors should look beyond price when making recommendations for term insurance to their clients. I cannot tell you how many times I have received telephone calls from advisors asking if I can help them get an exception for a client whose guaranteed term period or conversion privilege has expired, and the client is not in good health, maybe completely uninsurable. The answer is “NO”. Insurance companies know that these cases are claims waiting to happen well before they priced for them.

Term conversion privileges vary greatly from company to company. When making term recommendations, look for the following:

- How long the conversion period is relative to the term period. Most carriers do not allow conversion for the full-term duration, in fact many carriers limit this option rather dramatically.

- Carriers that offer term products that allow conversion to ANY product they offer. Beware of a carrier who offers a conversion period but only allows that the client convert to a “conversion product”. These products are generally priced significantly higher than a fully underwritten product, often as high as 200% more in mortality charges.

- The availability of a conversion extension rider. If a carrier offers this rider, consider recommending it to your client with the understanding that it comes at an additional cost. This will offer your client options should they find themselves in impaired health as they near the end of their term guarantee period.

AgencyONE’s sales support team monitors and tracks carrier conversion data and can help you advise your clients and direct them to the best carriers and products according to their financial and insurance needs.

Please contact AgencyONE’s Marketing Department at 301-803-7500 for more information or to discuss a case.