Executive Bonus Plans CONTINUED

Last month’s One Idea from AgencyONE’s Case Design department discussed a planning option for businesses that is currently experiencing a resurgence in popularity – the Executive Bonus Plan. Executive Bonus Plans are an effective way to help retain key employees by using overfunded life insurance. November’s ONE Idea prompted calls from advisors who wanted to discuss designs and ideas for prospective cases using an Executive Bonus Plan.

EXECUTIVE BONUS PLAN – POLICY & AN LTC RIDER?

One of our AgencyONE 100 Advisors was quick to point out that I had not mentioned the inclusion of a Long-Term Care (LTC) rider on the underlying life policy. I opted NOT to add an LTC rider primarily because it would increase policy costs, and these increased costs would affect future cash values AND projected income amounts. Future benefits/values are impacted when taking income and LTC benefits from the policy at the same time. After talking with the advisor about her case, I checked to see how the addition of an LTC rider would impact the initial sale. It would be worth adding if the numbers made sense. LTC coverage is an extremely valuable benefit to many people right now. The client would receive a policy that provides death benefit, cash values AND/OR possible LTC benefits – MORE options and MORE value for the business owner client to offer the key employee.

EXECUTIVE BONUS PLAN – 2 CASES TO CONSIDER

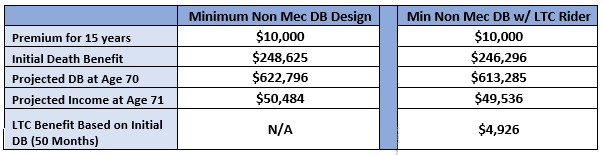

Let’s look at two cases that use the same premium and solve for a minimum non mec death benefit (DB). One is designed for maximum cash value and income while the other includes the LTC rider.

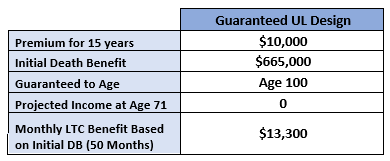

Looking at the values in the table above, I was surprised that they did not significantly drop with the addition of the LTC rider. It is assumed that cash value and income are still the main requirements, but what if we go a step further and design a plan using the same $10,000 premium but make it focused on death benefit as opposed to cash value and income. The higher DB will provide a larger pool of potential LTC benefits.

The above GUL design will provide the key employee with a fully paid-up policy after 15 years and has the option to accelerate the death benefit for LTC if needed in the future. This option is different than the original design from last month’s ONE Idea which used the restriction of cash value to help incentivize the key employee to stay with the company. The DB design does not have cash value but requires the payment of 15 premiums to become fully paid up. If the key employee wants the policy with ALL of its benefits, he/she will need to remain employed or continue to make the premium payments themselves upon departure from the company.

EXECUTIVE BONUS PLAN DESIGN – A PERSONAL CHOICE

EXECUTIVE BONUS PLAN DESIGN – A PERSONAL CHOICE

Selecting a plan focus is a very personal choice so, it is important to include the key employee in the decision process and allow him/her to determine which plan works best. As mentioned earlier, more options translate into more value for the key employee with the goal of increasing employee retention. Not everyone has the same planning goals.

AgencyONE works to collaborate with you and your clients to design the best possible solution to fit your clients financial and insurance planning goals.