Fake News – Life Insurance Expenses are 3-4 Times Higher than Other Savings Options

I have been doing financial planning analysis in numerous capacities for over 35 years and will admit that I do have certain biases toward properly structured life insurance plans that utilize accumulation products. With that said, I have NEVER implied that consumers should put money ONLY into permanent life insurance products but instead have recommended that consumers should have balanced portfolios of asset classes, products, and tax treatment buckets during their accumulation phase and during retirement.

BASIC FINANCIAL PLANNING CONCEPTS

Clearly, there are some basic concepts that every planner talks about with clients such as maximizing the employer match opportunity in a 401K. If someone works for a company that offers a  50% match on a maximum 6% employee deferral (a very commonly found 401K plan formula), not participating in this plan is a loss of an immediate 50% return on one’s money. Notice that I did not say because of the tax savings. There is that too, but it may not be the overriding driver because facts and tax circumstances will vary between individuals. I hope you will agree that getting a risk-free 50% return on one’s money is a “no brainer” for any individual regardless of their tax situation.

50% match on a maximum 6% employee deferral (a very commonly found 401K plan formula), not participating in this plan is a loss of an immediate 50% return on one’s money. Notice that I did not say because of the tax savings. There is that too, but it may not be the overriding driver because facts and tax circumstances will vary between individuals. I hope you will agree that getting a risk-free 50% return on one’s money is a “no brainer” for any individual regardless of their tax situation.

Creating a non-qualified, liquid emergency fund equal to 6-12 months of living expenses may be another priority for your clients. And another is to build up a non-qualified investment portfolio or contribute to a Roth IRA, if your clients qualify, to create tax free income streams for retirement.

There are many other life circumstances that warrant the purchase of some type of insurance. These include buying inexpensive term insurance when your clients are a young family or have a mortgage or other debt. Or disability insurance to cover, likely, your clients most valuable asset – their ability to generate an income. As your clients age, they may need long-term care insurance so they can preserve assets or want to purchase permanent life insurance to leave a legacy for their children or grandchildren. Keep in mind that life insurance expenses are not always costly depending on what kind you choose.

There are a myriad of wealth and risk management tools that play into the life cycle of an individual, all of which may be important albeit a very individual decision – no two people are the same. I would like to share with you, however, why I feel that a well-constructed Non-Modified Endowment Life Insurance Contract (Non-MEC) can be a welcome addition to a retirement portfolio for your client.

DEBUNKING FALSE CLAIMS ABOUT LIFE INSURANCE

I read an article recently titled Careful Buying Life Insurance as Fiduciary Rule Takes Effect. The article was published in 2017 by Kiplinger, but the same false claims have been and will continue to be made as Reg BI, which became effective in June 2020, is implemented.

The portion of this article I would like to discuss is in the adjacent box.

I will dedicate the balance of this article to debunking the above statement mathematically and otherwise, regardless of how the financial advisor gets paid. The Cost of Insurance and life insurance expenses are only the first of the three negatives that the author mentions.

I wrote an article in October 2019 which discussed why life insurance is really not too expensive and I would like to go through the math again using a different product this time. For this article, I am focusing on life insurance products that offer cash accumulation. I would also ask that anyone who disagrees with my analysis to please let me know. I do not think that my math is wrong, however, I have been wrong before and welcome being educated.

- “You are paying for the underlying insurance, which you might not need down the road.” When you fund life insurance to supplement other retirement plans and create tax-free retirement income, you are not concerned about the amount of insurance you are purchasing; you are paying the highest premium possible for the lowest amount of insurance allowed under Federal tax laws. If you need life insurance for death benefit protection purposes, there are other low-cost product options, but presently we are talking about life insurance products that offer cash value accumulation. When you see the math, it may not matter whether you need the insurance or not. The cost of insurance as compared to the fees paid to your financial planner (who charges you an annual percentage of the assets you allow them to manage and advises you to buy term life insurance when another product may be more appropriate), are very low. Stay tuned.

- “Additionally, the fees can be three to four times higher than other savings options. The costs quickly add up and will eat away at your returns.” This is just flat out WRONG if the policy is designed and managed properly and, again, stay tuned – I will prove this below.

- “there is a surrender value if you change your mind in the first five to 10 years, depending on the policy”. I believe that the author meant to say “surrender charge” – but that is just one more example of the many inaccuracies in this article. If you change your mind (or need money) in the first 5 to 10 years after investing in your 401K plan, are under the age of 59½, and take money out, do you know what happens? Penalties are assessed and taxes are incurred, and these may be worse than a surrender charge. Cash accumulation life insurance is not intended to be a short-term investment, but it can be more forgiving than any 401K, including allowing access to funds prior to age 59½ without penalty taxes for early distribution. As a final comment on this, there are life insurance policy riders that can waive surrender charges in the early years, but they come with an additional expense over the life of the contract. Discussing this rider option with clients is a worthy exercise.

THE MATH DOES NOT LIE

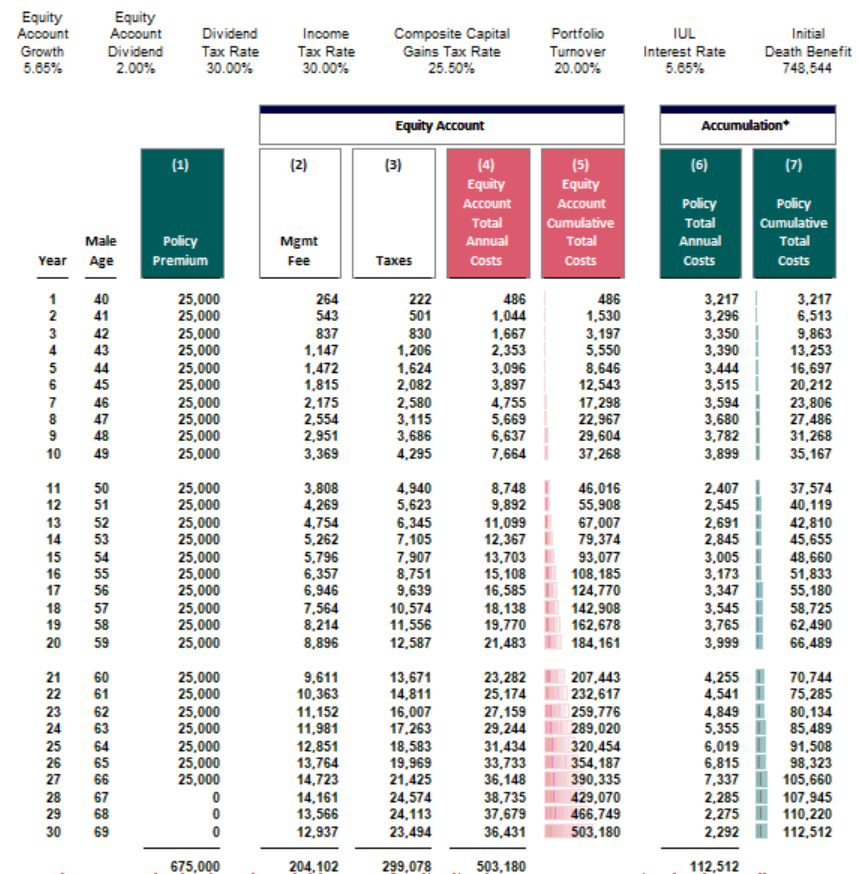

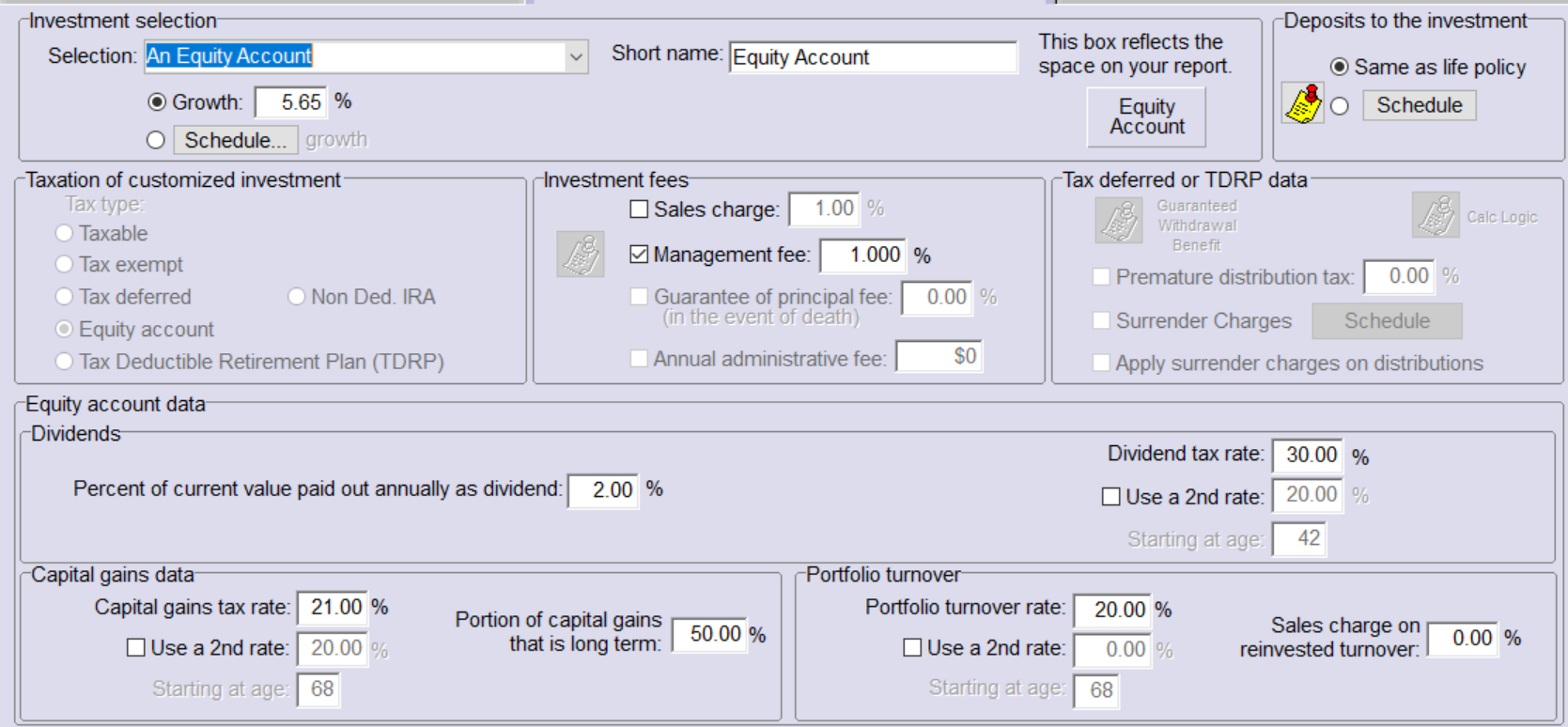

The table below illustrates the math. I have created a fictional 40-year-old man who, after meeting all other financial priorities, would like to save $25,000 per year for retirement savings purposes. The comparison is the cost of an Index Universal Life policy (properly structured and managed, with a low cost IUL chassis) versus a managed equity account which has a 1% annual cost drag (asset management fees and all underlying fund expenses). Certain income tax rates and return assumptions have been made including an additional 2% dividend return in the equity account to counter the argument that IUL policy does not factor in dividends. See input table below:

Management fees and expenses for the equity account over a 30-year period are $204,102 versus the total costs (loads, premium taxes, administrative expenses, life insurance expenses and yes, commissions) of the IUL policy at $112,512. That is 1.8 times greater! So when the author of the article and critic of life insurance says “Additionally, the fees can be three to four times higher than other savings options”, I need help understanding how the author arrived at this conclusion (please refer to another misinformed article by CNN Money)!

But that is not the whole story. The much larger expense is the client’s “financial life partner”, the Internal Revenue Service – Uncle Sam. Non-qualified equity accounts generate annual 1099s for reinvested dividends and capital gains. Over the same 30-year period, the tax drag is $299,078, bringing the total carry cost of an investment account to $503,180 – that is almost 4.5 times the total carry cost for the illustrated IUL policy!

I do not understand the categorical aversion to life insurance as an accumulation vehicle simply based on the “expense” argument. MATHEMATICALLY IT IS JUST NOT CORRECT.

While not illustrated here and for the record, the IUL policy also illustrates more after-tax income distributions during retirement despite the fact that the equity account is assumed to have a 2% greater total return than the IUL policy. Please contact AgencyONE for additional analytics on this case study if you would like the complete comparison report.

ONE FINAL REBUTTAL

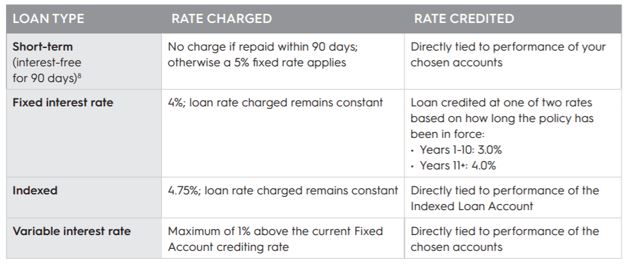

One final rebuttal to the article, because the error is so egregious, is that loan interest rates from Universal Life policies are NOT 7%-8%. You might see those interest rates with a Whole Life product, but not a Universal Life product, including Index Universal Life. In fact, after year 10, the net cost of a loan is ZERO on a current assumption basis. What this means is that the interest charged equals the interest credited on the loan amount. During the first 10 years, the spread is 1%. See below for additional loan types available in the particular IUL contract used for this comparison.

I agree with the author that life insurance offers the advantage that money can be borrowed from the policy 100% tax free. Essentially you borrow from yourself (or from your policy’s beneficiaries, if the loan is not paid back), BUT at very favorable rates versus inflated rates, as stated in the article.

I started this article by saying that what is best for the client is a mix of asset classes, products, and tax treatment buckets. A properly structured, low cost and well managed non-modified endowment life insurance contract can be a very effective supplement to the foundations of financial, risk management and retirement planning, which clearly include 401Ks, IRAs, money markets and other cash equivalents, term life insurance, etc…

I have tried to be balanced and transparent in my assumptions, statements, and comparisons during this analysis. I welcome any additional comments, corrections, or discussion on this subject.