Finding the Right Life Insurance Solution – Drilling Down

Our Case Design team worked on an interesting case with one of our AgencyONE 100 advisors. It started out very straightforward, but we soon discovered that finding the right life insurance solution for the clients would require drilling down beyond the initial request from the advisor.

Guaranteed Survivorship Solutions

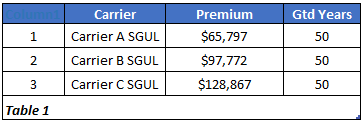

Mr. & Mrs. Smith, both 50 years old, were looking for $10,000,000 of Survivorship Guaranteed Universal Life (SGUL) coverage that would carry them to age 100 and offer full guarantees. AgencyONE presented 3 SGUL options for the clients to consider. Following are the results for this request:

As you can see, Carrier A had the most competitive premium with Carriers B & C coming in significantly higher in cost.

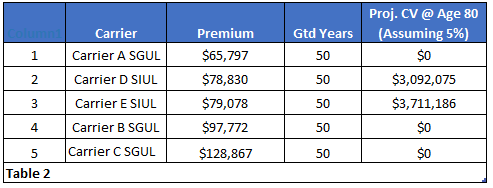

New Survivorship Solutions – Guarantees & Cash Value

We explained to the advisor that many of the newer survivorship contracts are built on INDEXED chassis which offer GUARANTEES AND projected CASH VALUES that might be of interest to Mr. & Mrs. Smith. Cash value is instrumental when flexibility or an exit strategy is required. However, it is important to note that accessing existing policy cash values will impact the guarantees and possibly hinder long term policy performance. In the next scenario, we added two fully guaranteed Survivor Index Universal Life (SIUL) contracts to the original mix. This offered more options for the clients to consider along with a greater level of flexibility:

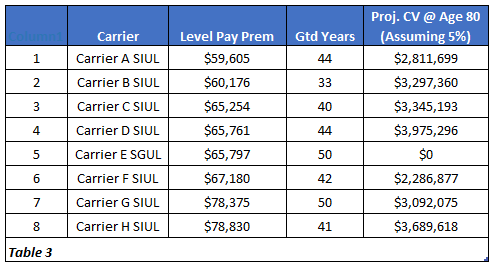

Premium To Length Of Guarantee

Adding SIUL contracts satisfied the requirement for age 100 guarantees with the bonus of cash values BUT it did not help lower the projected premium. Carrier A’s SGUL premium was still the lowest cost. Including SIUL to the SGUL comparison showed the upside of cash value – which is always a good option to offer clients. Could we show Mr. & Mrs. Smith even more? What could we do to keep a competitive guarantee while also including cash values? The ONLY way to find a lower premium is to forfeit some of the guarantees and rely on cash values to help carry the contract. The key to finding the solution to this case is identifying the right combination of premium-to-length-of-guarantee. After running the solves to age 100, AgencyONE benchmarked the premiums to the guarantee years to see how they compared. The list in Table 3 below shows the NEW top 8 reprice scenarios run to age 100. The IUL assumes a 5% annual return.

Now we are beginning to see a valuable comparison between the cost of the policies, the guarantees, and the cash value benchmarks. If the advisor chooses to go with the SIUL product, we will need to drill down further to see what index options are available and how they will look in ALL years.

Premium Pay Scenario

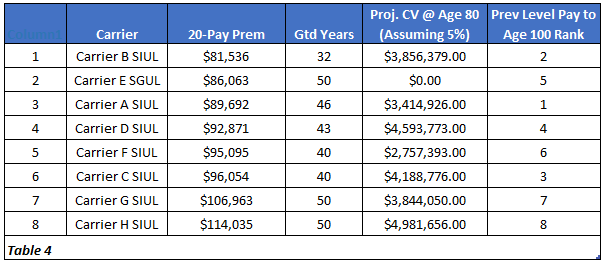

In passing, the advisor mentioned that Mr. & Mrs. Smith might just want to pay the premium for 20 years and be done with it. AgencyONE reminded the advisor that the order of the pricing and the length of the guarantee will depend upon the pay scenario. To illustrate, we re-ran the same 8 carriers from Table 3 as a 20-pay scenario to show how the carrier line-up would shift:

As you can see in Table 4, the top carriers moved around quite a bit on premium AND some of the guarantees were impacted. This new order is likely to change which carrier the advisor and clients select to write the coverage.

The advance product design used in this case shows the clients that you possess the ability to understand product nuances, can commit to doing the necessary homework, and, most importantly, are dedicated to their best interests! The AgencyONE Case Design team is committed to making sure that you have ALL the pertinent information so that you and your clients can make the most informed decision relative to obtain the right life insurance their financial and risk management needs.