Flexible Planning Options with Universal Life Insurance

Carriers and insurance professionals have illustrated Guaranteed Universal Life (GUL) for years with the assumption that the FULL premiums would be paid as originally illustrated (usually for a lifetime). These products, if funded as illustrated, are great solutions for many clients BUT what if your client needs to make changes or skip premiums at some point during the life of the contract? This is where a Guaranteed Universal Life product is not very user-friendly. Traditional Universal Life (UL) products were built to allow some cash value growth providing the client flexible premium options with less policy impact. The flexible planning options with Universal Life Insurance generally center around:

- a lower premium payment;

- a shorter premium payment duration; or

- an option that can be implemented in the event a premium cannot be paid in full or on time.

Premiums for UL products can also be increased in later years if goals change, which offers ANOTHER LAYER of flexibility.

UL FLEXIBLE PLANNING – SCENARIO ONE

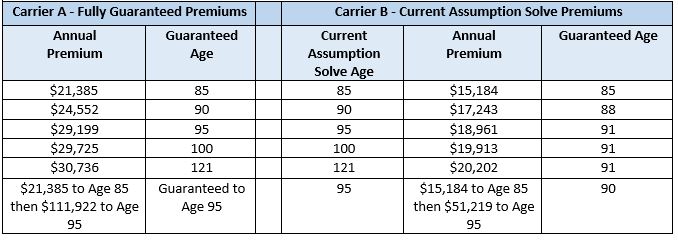

One of our carrier partners offers a unique product which is competitive on regular level premium solves, short pays, dump-ins AND provides the benefit of a longer LE based built-in guarantee. This product is a very good option to consider along with fully guaranteed products if you want to show your client an alternative option. To show added design flexibility, AgencyONE typically runs premiums to varying ages to show an accurate comparison.

Male, Age 65, Preferred UW Class, $1,000,000 Death Benefit

For clients who do not feel they need coverage illustrated up to age 121, they have the option to fund the policy using lower premiums. However, it is important to understand that some of the UL products lose quite a bit of guarantee which adds risk to the design. AgencyONE works with the advisor and client to determine the proper “premium to guarantee” combination. The stepped option offers further flexibility by allowing the client to increase premiums as needed to continue coverage and, in some cases, extend the guarantee. PLEASE NOTE that not all products offer the competitive catch-up option.

UL FLEXIBLE PLANNING – SCENARIO TWO

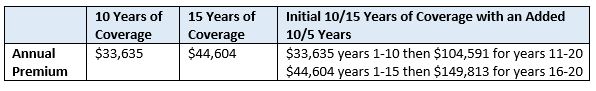

Some UL products can be designed to look like term contracts. AgencyONE recently had a case with a 76-year-old male client who wanted coverage for only 10 -15 years. Since a term contract option was unavailable for this client due to age, we got creative with a permanent product from one of our carrier partners. We solved for cash value in years 10 and 15. Our design underfunded the contract which resulted in the loss of the built-in guarantees. Without the guarantees, we dropped the crediting rate down to the minimum guaranteed rate and then solved for a current premium. The only changes that could impact the contract were the COI or Charges. The client accepted the risk and agreed to the option to increase premiums later for longer coverage if necessary.

Male, Age 76, Standard NT, $1,000,000 Death Benefit

UL FLEXIBLE PLANNING – SCENARIO THREE

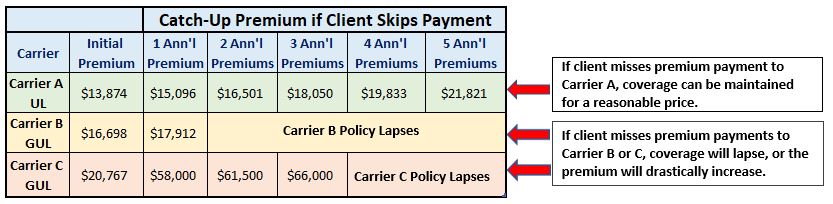

This final planning option offers a solution for the client who skips or misses insurance premium payments. The table below shows a UL contract from Carrier A compared to GUL contracts from Carriers B & C.

Male, Age 60, Best Class, $1,000,000 Death Benefit, Level-Pay

All three carriers assume the initial premium amounts are paid for 7 years and then zero premiums are paid for the indicated number of years in the above table (1-5) starting in year 8. The table shows the impact of missed premium(s) and the adjacent text explains how the products will be able to continue coverage. While there is a catch-up cost to maintain coverage, the UL product offers more “flexibility” through modifying premiums or face amount in the future. Most GUL products do not perform well with missed premiums because they have little to no cash value or possibly require sizable catch-up premiums in the future to maintain coverage.

Regardless of the flexible planning scenario your case falls into, AgencyONE’s Case Design Department possesses the expertise and product intelligence to assist you in achieving your clients’ financial planning goals while responsibly managing their risk.