How To Help Clients Better Understand Your Insurance Design

Do you ever get a cool idea for an extra comparison page or presentation that may help close a case? Or perhaps it could answer an objection that your client may have? We frequently get calls from our AgencyONE 100 Advisors to discuss these ideas and produce ways to present them in a meaningful format to clients. While we are willing and able to create presentations in Microsoft Excel, I have found that another great resource is a product planning tool called Insmark. Insmark has been around for a long time, is familiar to many of you, and continues to assist in AgencyONE’s daily illustration work. This popular program has options that compare and contrast life insurance products for ease of presentation purposes. While Insmark has numerous options, this ONEIdea will feature the highlights and screenshots of the top 3 Insmark modules available to help clients better understand your insurance design. These are the 3 we use regularly at AgencyONE.

Do you ever get a cool idea for an extra comparison page or presentation that may help close a case? Or perhaps it could answer an objection that your client may have? We frequently get calls from our AgencyONE 100 Advisors to discuss these ideas and produce ways to present them in a meaningful format to clients. While we are willing and able to create presentations in Microsoft Excel, I have found that another great resource is a product planning tool called Insmark. Insmark has been around for a long time, is familiar to many of you, and continues to assist in AgencyONE’s daily illustration work. This popular program has options that compare and contrast life insurance products for ease of presentation purposes. While Insmark has numerous options, this ONEIdea will feature the highlights and screenshots of the top 3 Insmark modules available to help clients better understand your insurance design. These are the 3 we use regularly at AgencyONE.

InsMark Module #1 – Comparison of Other Investments Versus Your Policy

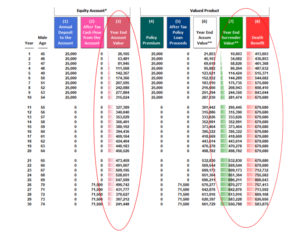

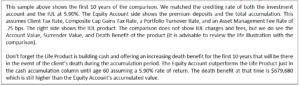

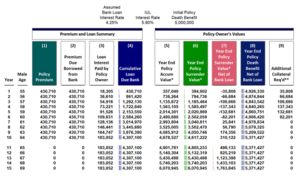

Our first Insmark featured module is a great option for showing clients a comparison between buying a minimum death benefit life insurance product used to accumulate cash value and depositing the premium money into an investment account. This is for the client who thinks the cash value and income will perform better in an investment account. Insmark sets up the numbers from each option side by side and you choose the type of investment (Tax Deferred, Roth, Brokerage), input rates of returns, management fees, sales fees, and tax rates. Following is a sample layout assuming a 45-year-old male client who contributes $25,000 per year for 10 years. Next, we will show income from ages 71-85. The income is solved in the life policy and then matched in the investment account.

InsMark Module #2 – The Premium Financing System

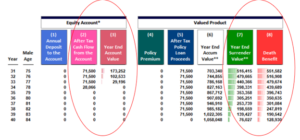

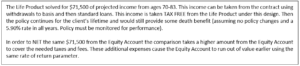

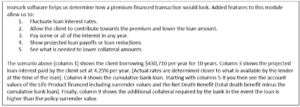

Our second most used module is one of my personal favorites since I handle many requests for premium financed illustrations. This helps compare a financed example to a traditional sale by showing the costs and extra requirements of a financed scenario. This module illustrates third party financed life insurance owned by an individual, a company, or a trust using any policy desired. The features included with this module are very flexible and customizable to your particular sale when it comes to exploring how financing tracks over a client’s lifetime. Choose the product, amounts of coverage, repayment options, product crediting and loan rates.

Below is a sample premium finance presentation on a 55-year-old male client who wants to premium finance a life policy over 10 years. The client will pay interest annually and then pay off the loan with out-of-pocket values over time during years 15 to 25. The assumed bank loan rate is 4.25% in all years. (For an actual Premium Finance case we would stagger the loan rate based on the lender’s current schedule or requirements).

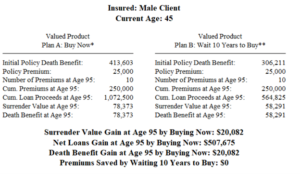

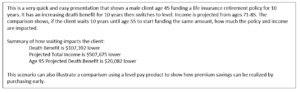

InsMark Module #3 – Cost of Waiting to Purchase Life Insurance

Please contact AgencyONE’s Case Design Department at 301.803.7500 for more information or to discuss a case.