Higher Taxes are Inevitable – The Tax Time Bomb

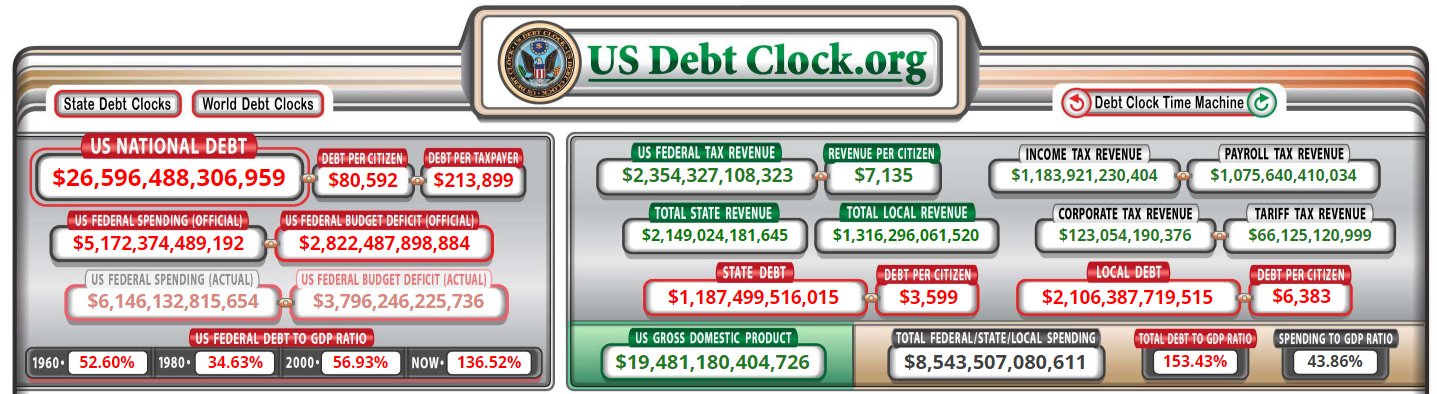

In the time that it took me to review the US Debt Clock on www.usdebtclock.org – all of 25 seconds – in order to snip the picture below to paste it into this article, the US National Debt went up by $1,000,000! If you have never seen this site, you should view it for a few minutes – you will find it either incredibly sobering or it will have you reaching for a drink. The US Debt Clock clearly illustrates the deficit problem. What’s the solution? More money. Higher taxes are inevitable – it is just a matter of time.

The Growing U.S. And Personal Debt

The debt per citizen is (was in those 25 seconds) $80,592 – EVERY man, woman and child in the United States owes that amount. Every newborn child owes that amount. What is even more remarkable is that the Debt per Taxpayer is $213,899 and that the US Debt to GDP ratio is at 136.52%. This is the highest debt to GDP ratio of ANY country in the world and in the history of time.

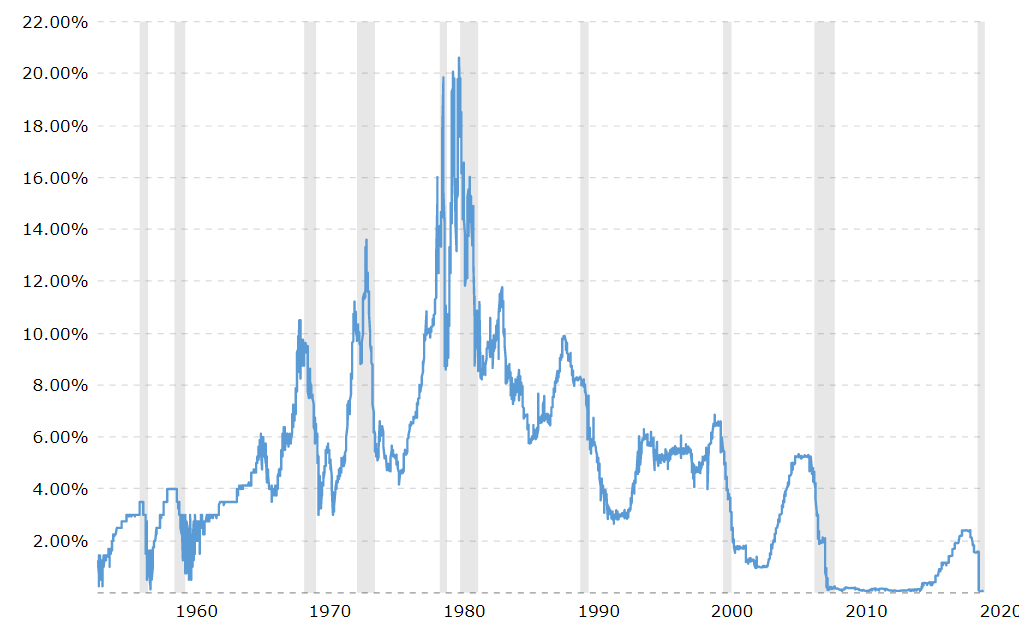

The interest alone on the National Debt is the 4th largest item in the entire US Budget at $337 BILLION per year – and this is during a historically low interest rate environment. The fed funds  rate is essentially zero today, actually 0.1%. Will it remain at zero forever? I believe we all know that it cannot as there are many other implications of an extended Zero Interest Rate Policy (ZIRP). What if interest rates went up to the historical average? Then what?

rate is essentially zero today, actually 0.1%. Will it remain at zero forever? I believe we all know that it cannot as there are many other implications of an extended Zero Interest Rate Policy (ZIRP). What if interest rates went up to the historical average? Then what?

The Daily Average of the Fed Funds rate dating back to July 1, 1954 is 4.77%. What will happen to the National Debt (item number 4) on the US Budget when interest rates revert back to the Daily Average?

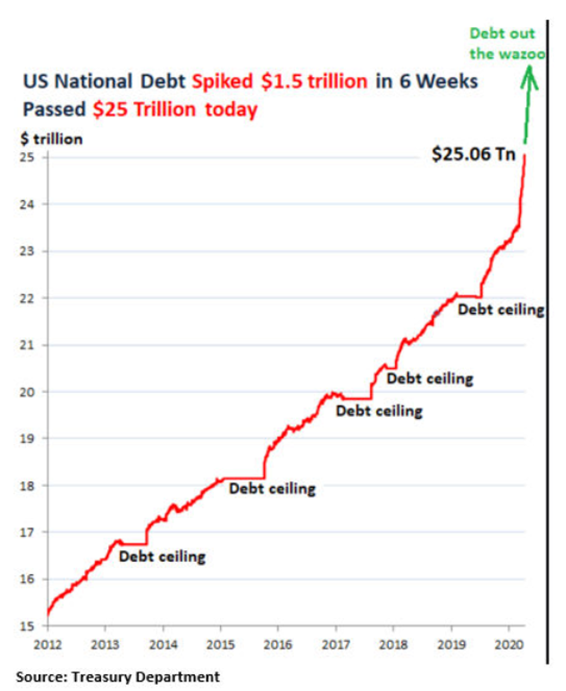

AND while I am writing this article Congress is considering piling on another TRILLION plus onto the National Debt in the next COVID relief package.

The ONLY WAY to dig out of a deficit situation like this is to either raise revenue or reduce expenses. Often, the answer is BOTH reduce expenses AND increase revenue.

The ONLY WAY to dig out of a deficit situation like this is to either raise revenue or reduce expenses. Often, the answer is BOTH reduce expenses AND increase revenue.

In an environment that is consumed with our current pandemic, record unemployment, and a very strained economic situation, cutting expenses seems very difficult. And in the same environment, our current revenue collection opportunity will be impacted for some time since revenue is based on employment payroll and income taxes.

Are Higher Taxes Inevitable?

Yes, higher taxes are inevitable because as Gary Halbert of Halbert Wealth Management in his article National Debt Tops $26.5 Trillion, 2020 Deficit Could Hit $6 Trillion suggests with his green line on the graph above, we have – “debt out the wazoo”.

Not all Americans will experience higher taxes, but rather, those that can “afford” them will be taxed more until we can bring some balance to the very difficult deficit situation in which we have gotten ourselves.

Financial advisors would be well served to have meaningful conversations with their clients about acting now relative to their estate planning. More specifically, conversations should focus on moving assets out of their estate while the Federal Gift Tax Exemption is at $11.58MM per individual or $23.16MM per couple. The time to move money into trusts or through intra-family transfers is NOW before that exemption is reduced.

The other area that we see becoming much more popular is the creation of so-called “tax-free buckets” of money. Clearly, Roth’s will be very popular but, as we have written several times lately, well structured, low cost non-modified endowment life insurance contracts can provide identical benefits while offering some additional benefits without income limitations.

As I finished writing this article, I received the following via email, Advisors Prep Client for Potential Tax Increases. Clearly, I am not the only one thinking and writing about this.

AgencyONE is uniquely positioned to help you provide solutions to your wealthy clients in both of these areas. Please contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case.