How to Underwrite Pulmonary Embolisms

We often hear the term “blood clot” in association with a patient who has been lying in bed for a time after surgery. To prevent these clots from forming, clinicians encourage patients to get UP and OUT of bed as soon as possible. You have probably also heard the warnings and heeded the advice to get up and walk around when on a long flight—or exercise your calf muscles when sitting for long periods. All these actions are directed at avoiding the dangerous, and potentially deadly, formation of a blood clot. This ONE Idea discusses underwriting pulmonary embolisms (PEs), how clots become PEs and what it means for your clients who have a history of PEs.

HOW CLOTS BECOME A PULMONARY EMBOLISM

HOW CLOTS BECOME A PULMONARY EMBOLISM

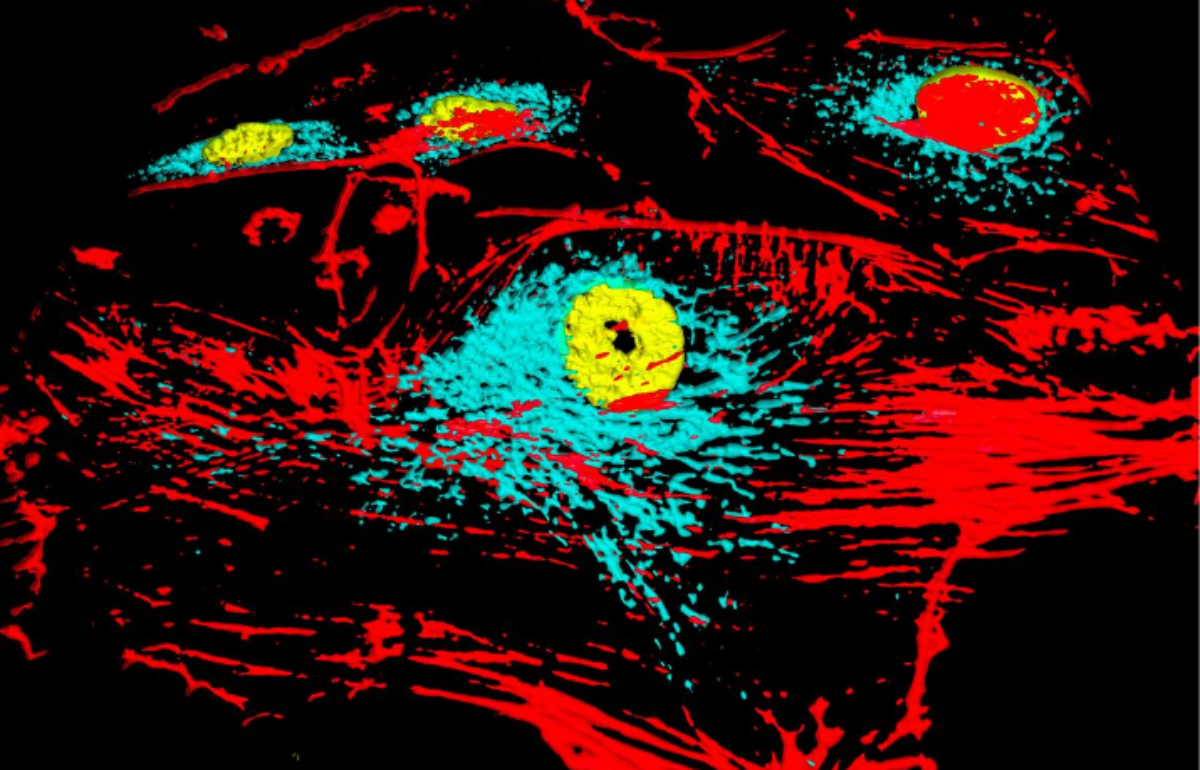

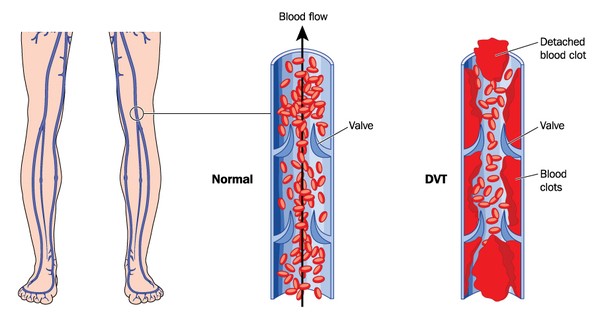

Gravity naturally pulls your blood down into your legs. Unless you help keep it circulating with muscle activity, you run the risk of “pooled” blood forming a clot (thrombus). Clots can form inside the smaller (superficial) blood vessels or the larger, deep veins in your legs (Deep Vein Thrombosis or DVT). A DVT can cause pain and tenderness at the affected area and an uneven swelling of your legs. DVT’s are treatable with blood thinners.

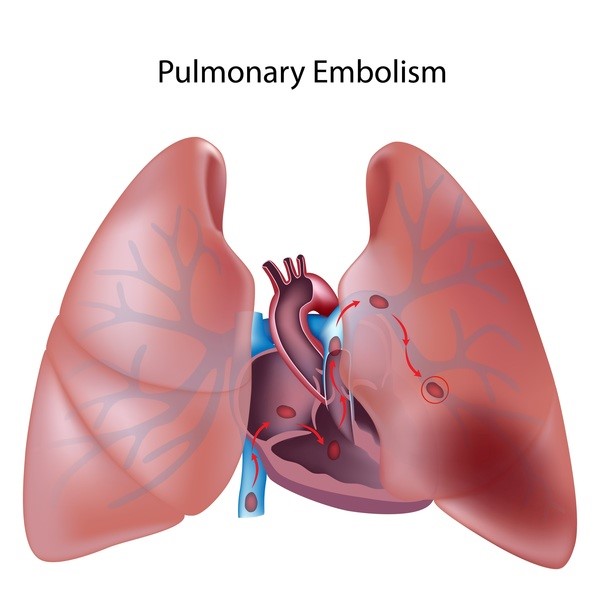

There is a high risk of “embolization” if large veins are involved. The REAL DANGER occurs when a piece of that clot breaks free and starts moving. This moving material is referred to as an EMBOLUS, which could be a blood clot, fat, plaque or even an air bubble. A pulmonary embolism (PE) results from a clot breaking off from another site, traveling through the venous system and lodging in the pulmonary arterial tree of the lungs, which is a life-threatening condition.

Pulmonary Embolism Symptoms, Mortality & Treatment

The mortality risk with PEs is very real with a nearly 30% mortality rate if untreated. Even when treated, the risk of death can be as high as 10%. Signs of a PE may include the sudden onset of chest pain, shortness of breath, a rapid heartrate and occasionally blood-tinged sputum. This is a SERIOUS health concern which must not be ignored and should be aggressively treated. Treatment includes hospitalization for intravenous anti-coagulation treatment for 4 or 5 days, followed by oral blood-thinners for anywhere from 3 to 6 months.

UNDERWRITING PULMONARY EMBOLISMS

When underwriting clients with a history of PEs, AgencyONE looks at the following:

- Underlying cause: recent surgery, cancer, clotting disorder, smoking, pregnancy, birth control, or other disease

- Damage done by the PE: any evidence of pulmonary heart disease or pulmonary hypertension

- Treatment: was the client treated properly and seen for follow-up by the appropriate physician(s)

- Recurrence: number of episodes

Carriers typically require a 6 month postpone period with PEs. A STANDARD offer is possible assuming the client experiences a full recovery, has no resulting heart or lung damage or other underlying conditions and continues treatment as specified by his/her physician(s).

As with any impairment, when underwriting PEs, carriers view these histories in varying ways.

CASE STUDY

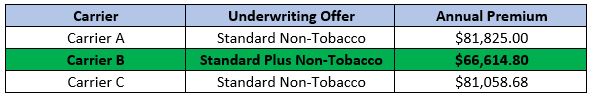

Mr. Darling is a successful 53-year-old businessman seeking $20,000,000 of 20-year term life insurance coverage. Mr. Darling has a history of recurrent DVT – the first in 2011 and second in 2015. The first occurrence was deemed unprovoked (no identifiable cause) and resulted in a PE. Mr. Darling was treated with anticoagulants for a period of approximately three months and recovered without issue. In July 2015, Mr. Darling was on a lengthy transatlantic flight and experienced a DVT provoked by his prolonged and cramped seated position. Luckily, this second occurrence did not result in a pulmonary embolism. Again, Mr. Darling was treated with anticoagulants, but was able to discontinue treatment after approximately one year. Mr. Darling is an otherwise healthy, active individual with no significant medical impairments. His love of playing rugby was a factor in his decision to stop his anticoagulant treatment. Currently, Mr. Darling only requires anticoagulants as a preventative measure when going on long flights. Given the length of time since Mr. Darling’s last DVT and his need for anticoagulants on only one occasion, AgencyONE’s goal was to negotiate and deliver BETTER than Standard Non-Tobacco rates. We targeted three carriers informally and successfully negotiated a Standard Plus Non-Tobacco offer from Carrier B! Mr. Darling formally applied and placed coverage with Carrier B saving him nearly $15K per year!

The AgencyONE Underwriting Department is ALWAYS FOCUSED on you and your cases and works diligently to accurately underwrite and place them with the CORRECT carrier at the RIGHT price. Underwriting expertise and carrier intelligence and relationships are key to providing you and your clients with the superior service for which AgencyONE is known.