Is Your Client’s IRA an IOU to the IRS?

It seems that a lot of financial pundits are talking and writing about taxes and widening budget deficits lately, specifically about the impact of taxes during retirement. Over the summer, many of them have caught my eye. I am not sure why suddenly people are realizing that tax efficiency is critical to long-term financial success for both clients and the advisors that help them.

In the beginning of July, a story in Financial Services Online succinctly summarized the problem by stating below that “the only way to decrease the budget deficit is to increase taxes, decrease spending or both”.

Given the financial challenges facing the United States today, I just cannot see a significant decrease in spending happening, so that leaves an increase in taxes or some combination of both. OR we can continue to do what we have done in the past – just kick the can down the road. Given current estimates by the Congressional Budget Office, the “debt held by the public at the end of 2034 would total $50.7 trillion, or 122% of gross domestic product”. That is 10 years from now!!! Is that sustainable without painful tax increases or spending cuts?

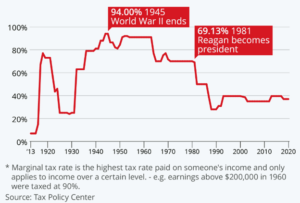

As a visual reminder, below are the historical highest marginal tax rates since 1913. Tax rates have not been this low since the great depression – 90 years ago and were north of 60% during much of that period.

According to the Investment Company Institute, at the end of Q1 – 2024 there was almost $40 trillion in retirement account assets in the United States with about $14.3 trillion in IRAs and $11.1 trillion in defined contribution plans, such as 401Ks. The balance of the $40 trillion is comprised of Defined Benefit (DB) Plans, Government DB Plans and Annuity Reserves.

According to the Investment Company Institute, at the end of Q1 – 2024 there was almost $40 trillion in retirement account assets in the United States with about $14.3 trillion in IRAs and $11.1 trillion in defined contribution plans, such as 401Ks. The balance of the $40 trillion is comprised of Defined Benefit (DB) Plans, Government DB Plans and Annuity Reserves.

It is the most God-awful “gotcha” in the history of mankind. We have been told to fund our 401Ks for an entire career and then advised to roll them into IRAs when we changed employers or retired. Now all these contributions PLUS years of investment earnings will be fully taxable at potentially higher income tax rates.

$25.4 TRILLION!

Do you think that the Treasury Department sees this as a revenue opportunity?

I don’t know about you, but I am doing everything humanly possible to increase my position in my Roth 401K, Roth IRAs and equities-based life insurance cash values, all of which can provide tax free income in my not-too-distant future. I will no longer defer income in today’s relatively favorable tax environment and create more taxable income for my future.

On June 29, Kiplinger published an article emphasizing the nature of the problem which gave me the title of this ONEIdea.

There are additional consequences of the taxable income created by an IRA or a 401K distribution.

“These taxes can have a cascading effect in retirement. Not only do they reduce the amount of assets you have to spend on maintaining your lifestyle and all the potential health care expenses that retirement brings, but they can also increase other costs, such as the tax on your Social Security benefits and the amount you pay in Medicare premiums.”

In fact, expert Ed Slott, in a recent interview with ThinkAdvisor, is quoted as saying “it would almost be malpractice for any financial or tax advisor to ignore the coming tax storm” which is a big part of his message in his new book, The Retirement Savings Time Bomb Ticks Louder.

With the tax storm consistently being predicted, why do so many advisors continue to ignore the problem? If a hurricane was imminent, would you tell your clients to NOT seek shelter? Would YOU stand in the middle of the impending storm? There are solutions available but many financial advisors either refuse to embrace them or would prefer to NOT talk about them – and yes – I am talking about properly designed, permanent life insurance (especially equities based variable life insurance) which should be part of an overall tax efficient portfolio and an integral part of the retirement planning equation.

Following are key items to focus on regarding optimally designed permanent life insurance:

1. Cash value can be allocated to equities, bonds, cash, and alternative investment asset classes (assuming that the policy is a variable life solution) inside of the tax-deferred wrapper that is life insurance.

2. Investments that comprise the cash value in a life insurance policy can be bought and sold (and reallocated) without capital gains or any taxation thereof.

3. Dividends from the equities and interest payments from the bonds and other fixed-income assets are NOT taxable as ordinary income.

4. The sum of all contributions made to life insurance (the basis) can be withdrawn income tax-free BEFORE any gains.

5. ALL gains can be borrowed against at a ZERO or very low-interest rate.

6. Distributions from life insurance are NOT considered earnings toward the income test for the taxation of Social Security and for Medicare premium calculations.

7. ALL or MOST of the Death Benefit can be accessed, income tax-free, as a living benefit through a Long-Term Care or Chronic Illness Rider, if elected, in the event the need arises.

8. In many states, the cash value of life insurance is protected from creditors.

9. Cash value of life insurance is not considered for Federal Student Aid in the FAFSA forms.

10. Death benefits are income tax-free to the beneficiaries and are 100% liquid exactly when needed by the beneficiaries, regardless of financial market cycles.

I will conclude with this; on June 24th, Andy Watts wrote an article entitled “Capture a Piece of $600 Billion by Maximizing Tax Alpha for Clients” whereby he references a Russell Investments’ “2022 Value of an Advisor“ study which unveiled a pivotal insight: “advisors who adeptly assist clients in implementing tax-intelligent investing strategies can effectively differentiate their practice”.

He goes on to say that:

“Russell Investments further elaborates on the consequences of neglecting tax considerations. Investors in non-tax-managed U.S. equity products, encompassing active, passive and ETFs, found themselves relinquishing an average of 2.14 percent of their returns to the clutches of taxation. In stark contrast, those who entrusted their investments to tax-managed funds witnessed a significantly lower tax burden, forfeiting just 0.92 percent of their returns. This stark contrast translates into an impressive 1.20 percent gap in annual savings. In monetary terms, this equates to an astounding $600 billion opportunity for advisors to demonstrate their prowess by capturing tax alpha for their clients.”

Imagine if we could reduce the remaining .92% confiscation by taxes to ZERO? How much of the additional $600 billion would you be able to keep under your care and advisement? Is that not a reason to consider variable life solutions for your clients?

While Mr. Watts does not specifically discuss this, there are advisory focused, no-load, equity-based life insurance solutions in the market today. I own two of them and can help you understand how these solutions can benefit your clients. If you and/or your clients owned these products, your clients AND your practice would be better off as a result. These need to be part of your basket of solutions, unless, as Ed Slott says, “you want to be accused of malpractice by ignoring the coming tax storm”.

For more detailed information on this subject in the context of tax drag versus cost of insurance and likely the most eloquent analysis that I have read on this subject, please click here. Bobby Samuelson does a great job of breaking this down.

If you took nothing else from this article, it should be that TAXES are front and center. The advisor that is doing RIGHT by his client has complete transparency into his client’s taxes, is taking into account tax cost ratios when making recommendations and reviewing portfolios, and is recommending solutions that address present and future taxes.

Please contact the AgencyONE Marketing Department at 301.803.7500 for more information

or to discuss a case.