Underwriting Kidney Disease & Life Insurance Exam Prep

Your client’s life insurance case has been submitted and the underwriting process is almost complete! The client’s insurance exam has been done but NOW you find out that the medical offer from the carrier has CHANGED from PREFERRED to POSTPONE and includes a REQUEST for TWO additional urine specimens! NOW WHAT?

AgencyONE says it all the time….NOT properly preparing your clients for the life insurance exam can result in adverse findings leading to underwriting delays and higher premiums! While not every abnormal lab result can be prevented, proper life insurance exam preparation can help avoid some of these last-minute hiccups in the process.

KIDNEY DISEASE & PROTEINURIA

Our focus for this ONEIdea is on abnormal levels of PROTEIN IN THE URINE which is termed: PROTEINURIA. Protein is one of the most common abnormal findings on urine test results.

We have all kinds of proteins in our body, with the main protein being albumin. They play an important role in controlling our body’s fluid levels, building bone and muscle, transporting hormones, vitamins and nutrients, and preventing infection. Your KIDNEYS are responsible for removing waste and extra fluid from your body. In a healthy individual, proteins pass through this filtration process and are circulated back into the blood stream, with only minimal amounts being eliminated through the urine.

Proteinuria (or albuminuria) is simply the presence of HIGHER than normal levels of these proteins found in the urine. This is an indicator that the kidneys are not filtering properly and may suggest kidney disease. Underwriters can’t ignore these findings and must investigate further.

UNDERWRITING KIDNEY DISEASE

Kidney damage or disease can be caused by a variety of reasons. In life insurance underwriting, the most common causes we see are uncontrolled high blood pressure, diabetes, heart disease and, familial or chronic kidney disease.

In cases of CHRONIC kidney disease, underwriters look for:

- underlying cause;

- blood profile(s) to assess Glomerular Filtration Rate (GFR) and creatinine levels over time;

- serial urinalysis and/or creatinine clearance measurements;

- history of treatment; and

- complications, if any.

The underwriting of chronic kidney disease comes down to exactly how HIGH the protein levels are in the urine, the GFR, and how well-managed the underlying condition is (example blood pressure or diabetes control). Clinically, kidney disease is STAGED from levels 1 through 5 (with Stage 5 representing end-stage kidney disease).

EXAM PREPARATION & KIDNEY DISEASE

If your client has CHRONIC kidney disease, no amount of “insurance prep” is going to significantly change the outcome of their exam. HOWEVER, AgencyONE strives to make sure you and your client understand the POSSIBLE causes of TRANSIENT ABNORMALITIES on the insurance exam and HOW your clients can AVOID them.

If your client has CHRONIC kidney disease, no amount of “insurance prep” is going to significantly change the outcome of their exam. HOWEVER, AgencyONE strives to make sure you and your client understand the POSSIBLE causes of TRANSIENT ABNORMALITIES on the insurance exam and HOW your clients can AVOID them.

TEMPORARY elevations of protein in the urine can be caused by:

- dehydration;

- strenuous exercise (particularly if the kidneys are bounced around, as with running);

- fever;

- emotional stress;

- exposure to extreme cold; and

- supplements such as protein/creatinine, or high-protein diets like KETO (this is largely debated).

It is very important that you tell your client to DRINK PLENTY OF WATER and AVOID rigorous EXERCISE for at least 48 hours leading up the insurance exam. If your client is or has recently been ill, he or she should reschedule the exam. Exams should be scheduled in the morning, particularly if your client is required to fast; this helps keep the stress levels low in the body. The importance of drinking water is reflected in a more recent ONE Idea titled “PLEASE…DRINK THE WATER Or It’s Going to Cost You!“.

Make every effort to ENGAGE your clients in the underwriting process. REMIND them that the insurance exam results help determine their rate class and the amount of premium they will have to pay. SHARE the insurance prep exam tips, which can be found on the AgencyONE website or WATCH our quick, 2-minute AgencyONE Exam Prep Video. Both are listed on your Advisor Dashboard under the Underwriting drop-down. Then, ask your clients to RETRIEVE their own lab results as a “report card” to see how well they did.

CASE STUDY

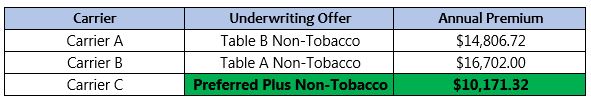

Ms. Thomas is a healthy, active 40 year old female who applied for $2,000,000 of Indexed Universal Life (IUL) insurance coverage with Carrier A. She had no known medical impairments and seemingly fit Best Class criteria. Ms. Thomas completed her insurance exam and the lab results revealed ELEVATED PROTEIN LEVELS in her urine (proteinuria), but with no clinical explanation for the abnormality. Carrier A approved her case at Table B Non-Tobacco rates using credits. Our presumed Best Class case became a Table B due only to protein in the client’s urine at the time of the exam.

AgencyONE notified the producer of the offer and suggested a repeat urinalysis and reinforced the importance of effective preparation per our exam prep guidelines. Ms. Thomas completed a repeat urinalysis with her primary care physician and the results were completely within normal limits; no protein!

We submitted the results of the second urinalysis to Carrier A for review but they were unwilling to improve the Table B offer. Because of the previous abnormal urine results, they were not comfortable improving the offer until a physician’s evaluation and more specialized lab testing had been completed to rule out any/all concerns. Seriously?

AgencyONE’s Underwriting team remained confident that a favorable offer could be secured elsewhere without the need for additional medical intervention. Did we mention that the client’s own doctor didn’t find additional testing prudent??

We submitted the case to two additional carriers for informal review. Carrier B offered Table A while Carrier C, agreed that the exam findings appeared to be an anomaly, offered BEST CLASS right out of the gate! A formal application was submitted and the case was placed at Best Class, exactly as the client deserved. Finally!

We have no doubt that Ms. Thomas is a healthy individual who does not have an underlying condition but this scenario illustrates how important insurance exam preparation is to the life insurance application and underwriting process. One abnormal result can derail the entire case, even in your healthiest of clients!

Even in the most difficult underwriting situations, AgencyONE’s Underwriting team is available with solid expertise and know-how to ensure that ALL of your cases are placed with the RIGHT carrier at the BEST available PRICE.