Life Insurance: Fees versus Commissions – The Age-Old Battle

I am probably going to catch a LOT of grief for this article, but frankly, I really don’t care. I am trying to look at the numbers as impartially as I can and would welcome a math lesson if I have this wrong.

For the record, I am a BIG fan of a No-Load Variable Life solution that came to market over a year ago offered by a well-known insurance company. In fact, I like this product so much that I bought a policy for both my wife and myself and rolled some older fixed account cash value contracts into this policy via a 1035 exchange. I have been funding it regularly and understand how life insurance works better than most people. I have been in this business for 40 years and I do not need an advisor to either “sell me” or “advise me” on it – a big difference versus a consumer to whom we owe a fiduciary duty.

Bear with me because there are a lot of numbers and comparisons between a fully loaded, registered representative (FINRA) sold Variable Universal Life product and a No-Load\AUM fee-based life product from the same insurance company. My analysis will focus ONLY on life insurance and will not include annuities.

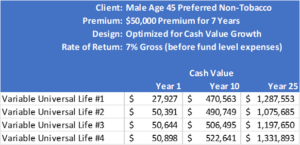

Let’s begin with a question. Which of these four life insurance products would you recommend if you thought ONLY of your client’s best interest? Remember, these products are all from the same highly rated mutual company, same underwriting class, same policy construction, etc. Please don’t say that you would not recommend any of them, you must pick one – play the game.

If I had to make a choice, I would recommend Scenario #4, all things being equal. It has more first year cash surrender value (in fact it is higher than the first-year premium) AND has more long-term cash value growth than the others over both 10 and 25 years. Full stop, it is the best solution for the client or in the client’s best interest. Right?

But all things are not equal.

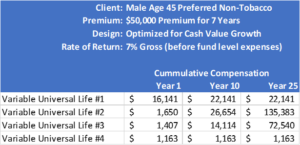

Same products, same question. Now which one would you recommend to your client?

Tougher question is it not? Now you must think about your own livelihood, your firm’s profitability and the value of your time and advice unless you charge fees that are NOT related to Assets Under Management, such as flat or hourly fees. You are in the service business, and you are constantly valuing your time and expertise. After all, you are in this profession to make an honest living, right?

So, let’s unpack this.

Scenario #1, as you can imagine, is a fully loaded, “high commission” solution.

Scenario #2 is a low load, advisory solution where the advisor charges a 1% fee on the AUM, which is the cash value of the policy.

Scenario #3 is the same low load, advisory solution where the advisor charges a .50% fee on the AUM.

Scenario #4 is also the same low load, advisory solution that pays a one-time concession to a Broker Dealer for registering the account (it is a security, after all) and to a registered representative\insurance agent for completing the application, facilitating the underwriting for the insurance, and servicing the account. You, as an advisor, do not collect anything unless you are part of that process or, of course, unless you charge a non-AUM related fee to your client.

A fair set of questions would have been if I had eliminated Scenario #4 and didn’t ask you to work for free. You don’t work for free, do you? I will bet that you charge an AUM fee that is somewhere between .50% and 1% (possibly more for lower size account clients).

If that is the case, then the compensation expense of an insurance contract is always more expensive over the life of the contract in an AUM model than in a front end loaded, commission-based model. In fact, it is a LOT more expensive and is reflected in the cash value of the policy. The cash value of Scenario #2 – the 1% solution is over $200,000 lower over a 25-year period. What if the clients lived to the age of 90 and we are looking at 45 years? The answer is that the cash value difference would be close to $2,000,000 lower. That is the magic of compounding but also the dirty little secret of the AUM based model.

[In the spirit of full disclosure, for all scenarios I used the actual fund expense fee of the S&P 500 Index fund available in the underlying fund options. Scenario #1 has a .26% fund level fee, while scenarios #2, #3 and #4 have a .18% fund level fee. If I could run an apples-to-apples comparison, the differences would be even greater!]

So which solution is “in the client’s best interest”? Fully front end loaded commission or low load with an advisor-based fee model? There really is no right answer and it goes back to the suitability issue of client time horizon.

I can remember when I was obtaining my securities licenses back in the mid-90’s and mutual funds had A, B and C shares. I had to get broker-dealer approval to sell C shares and “paper the file” because it was ALWAYS more expensive over the long term for the consumer to pay a lower front-end load with a trail fee (C-Shares). Life insurance is a long-term solution, but it needs to be managed, just like any other portfolio (IRA, 401K, Managed Non-Qualified Portfolio, etc.).

I would also like to make the comment that a well-managed and well-designed VUL solution by an investment advisor should substantially outperform one that is not managed, as so many are. Advisor Alpha is what many call this and what the advisor is being paid for via their commission or AUM fee. I will quote a Vice President from a well-known insurance company who told me that 60% of all subaccount values on a particular Variable Life product that they offer are sitting in the Money Market or Fixed account. This is unconscionable! It is also not dependent on how the advisor gets paid, because a fully front-end loaded solution could be equally serviced and managed. I have been doing this long enough to know that, at the end of the day, many agent\registered rep initiated variable life sales don’t fail because of the commission versus fee conversation. They failed because the agent\registered rep did not manage the account as they should have. They did not monitor the policy, make portfolio adjustments and rebalance accounts, which is part of the value or the “fiduciary duty” that the advisor owes the client, and that the client is paying for.

Merriam Webster explains in their definition of fiduciary the following:

Fiduciary relationships are often of the financial variety, but the word fiduciary does not, in and of itself, suggest pecuniary (“money-related”) matters. Rather, fiduciary applies to any situation in which one person justifiably places confidence and trust in someone else and seeks that person’s help or advice in some matter. The attorney-client relationship is a fiduciary one, for example, because the client trusts the attorney to act in the best interest of the client at all times. Fiduciary can also be used as a noun referring to the person who acts in a fiduciary capacity, and fiduciarily or fiducially can be called upon if you are in need of an adverb. The words are all faithful to their origin: Latin fīdere, which means “to trust.”

Let me repeat the most important phrase – “fiduciary applies to any situation in which one person justifiably places confidence and trust in someone else and seeks that person’s help or advice in some matter”. It does not contemplate how that person gets paid, but it does put financial advisors in a position to act in the best interest of the client at all times, as the definition suggests.

Assuming we are doing our jobs to the best of our ability and in the best interest of the clients, let’s stop bickering about how we get paid and let’s start taking care of clients. OH, and let’s focus our regulatory efforts on training and character building because there are a lot of unscrupulous people in our profession. I have seen them on the insurance side and on the investment banking side, having been part of both worlds during my career.

I thought that this was a timely discussion as the insurance industry gears up to do battle with the Department of Labor on their third attempt at best interest\fiduciary legislation.

Please contact AgencyONE’s Marketing Department at 301.803.7500 for

more information or to discuss a case.