Life Insurance Product Options: What is Left to Sell?

Life insurance products and underwriting requirements have undergone tremendous changes in the last year (2020-2021) and historically low interest rates and COVID-19 have played a primary role. Every other week it seems we are getting another notice about a price increase, a product discontinuation, or an underwriting modification. It can be very confusing and has some asking, “what is left to sell”? The answer? There is still a wealth of life insurance product options available for your clients AND there are multiple carriers offering each.

In this ONEIdea, we are going to breakdown general characteristics according to product type. We will not discuss top pricing or carriers since these are based on age, underwriting class, and face amount. Please note that some of the products available may be different in New York.

face amount. Please note that some of the products available may be different in New York.

Term Insurance

Our carrier partners offer a variety of individual Term options. When running a Term comparison, it is important to carefully consider all options and look beyond just the spreadsheet cost to find the appropriate product for your client. Following are important things to consider:

- ease of application (E-apps);

- possible accelerated underwriting options; and

- available riders and future conversion options.

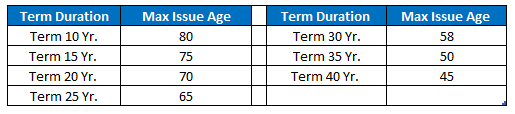

By looking beyond the lowest cost, you may find something that offers more options for your client to consider for a minimal increase in premium. The table below lists the max issue ages for each term duration (NY carriers may not have the same issue ages or product durations).

Current Assumption Universal Life

Current Assumption UL (CAUL) is a product that is primarily death benefit focused. Lower crediting rates have diminished the product’s competitiveness for cash value accumulation sales. Death benefit products use crediting rates set by the carrier which can be modified monthly. One of the benefits AgencyONE sees with these contracts is that they are typically built with longer LE type guarantees. A few of these products offer LTC or Chronic riders that can add important coverage for the client. While CAUL has been a common option in the past, currently only 5 of our carrier partners offer this product. One carrier’s product has an issue age up to 89, assuming the client qualifies, and one offers a Current Assumption Survivorship (CASUL) option.

Guaranteed Universal Life

Guaranteed UL (GUL) has been extremely popular over the last 20 years. AgencyONE has seen carriers go from offering multiple versions of GUL products to pulling the product line all  together. Given the current market you may be thinking GUL is no longer an option for your clients. Fortunately, 8 of our carrier partners still offer Guaranteed UL products (these do not count VUL or IUL products with lifetime guarantees). These GUL options can guarantee coverage up to age 121. They can also be run with shorter guarantee periods, short pay designs and some even have refund options. If you are considering a survivorship GUL option, 3 of those 8 carriers offer joint GUL coverage.

together. Given the current market you may be thinking GUL is no longer an option for your clients. Fortunately, 8 of our carrier partners still offer Guaranteed UL products (these do not count VUL or IUL products with lifetime guarantees). These GUL options can guarantee coverage up to age 121. They can also be run with shorter guarantee periods, short pay designs and some even have refund options. If you are considering a survivorship GUL option, 3 of those 8 carriers offer joint GUL coverage.

Indexed Universal Life

The most popular product type in the marketplace is Indexed Universal Life (IUL). When IUL was first introduced, the product was primarily designed for cash accumulation with limited guarantees. Over time, carriers broke up their product lines into two types:

- Accumulation IUL which worked best with minimum non mec face amounts and max funded premiums

- Death benefit IUL products that had a set level death benefit and used solved premiums usually to age 100 or 121

These products also had longer guarantees and, in some cases, could be guaranteed up to lifetime. Many carriers have also introduced an Indexed SIUL product. A few of these are very competitive in price and can also be guaranteed to age 121! The “best” product for your case depends on the funding period, goal, and riders needed.

Whole Life

AgencyONE has seen quite a few requests for whole life recently. This product is still strong and offers many guaranteed pay options. The guaranteed cash values can be attractive to clients who are more conservative. Many of our carrier partners (some are still Mutual) offer strong Whole Life products with various pay options: 10-pay, 12-pay, 15-pay, 20-pay, pay to 65, level-pay to age 100, and level pay to age 121.

Variable Life

Variable Universal Life (VUL) insurance continues to be popular with our agents and their clients. There are two types of variable products that are currently available in the marketplace. One version can be used to accumulate cash value. These accumulation VUL’s are used on younger clients and are meant to grow cash value for future income needs. The newer accumulation VUL products include indexed account options which may be beneficial during the income years. The second version is a Guaranteed VUL product. This option provides a guarantee up to lifetime and the option to accumulate cash value (if the expected performance is achieved). The guaranteed versions work well with 1035’s and short pay designs. There are also a few Survivorship VUL contracts to consider and two of them can be guaranteed, if necessary.

Hybrid LTC Products

Hybrids LTCs are great options to consider and compare to stand alone LTC products. While they have limited funding options (1 pay, 5 pay, pay to 65, and at some ages, a life pay is available), they can be written up to age 75. One of our carrier partners also offers a joint product for two lives with a lifetime benefit period.

they can be written up to age 75. One of our carrier partners also offers a joint product for two lives with a lifetime benefit period.

As you can see, there are still a variety of available products to suit almost any case scenario. The many riders and product features can help enhance and customize the product design for your clients.

AgencyONE’s Case Design Department is known for its product intelligence, diligently monitoring product changes and updates, and being readily available to help you answer specific questions and find the most appropriate product to meet your clients’ financial and insurance needs.