Life Insurance – Protection Against the Unknown

If there was ONLY ONE insurance company to choose from and you were the ONLY CUSTOMER buying their life insurance and interest rates were 0%, it would be VERY EASY to calculate the cost of life insurance. However, things are NEVER that simple!

cost of life insurance. However, things are NEVER that simple!

The primary purpose of life insurance is protection and, at its simplest, might look something like the following:

- Let’s assume that an individual makes $100,000 annually and wants to make sure that his or her family can depend on that income for 10 years in the event of premature death. Ignoring interest or other earnings, the individual would need to fund a $1,000,000 benefit.

- The only logical way for that individual to fund the benefit would be to deposit $1,000,000 into an account and wait until he or she passed away.

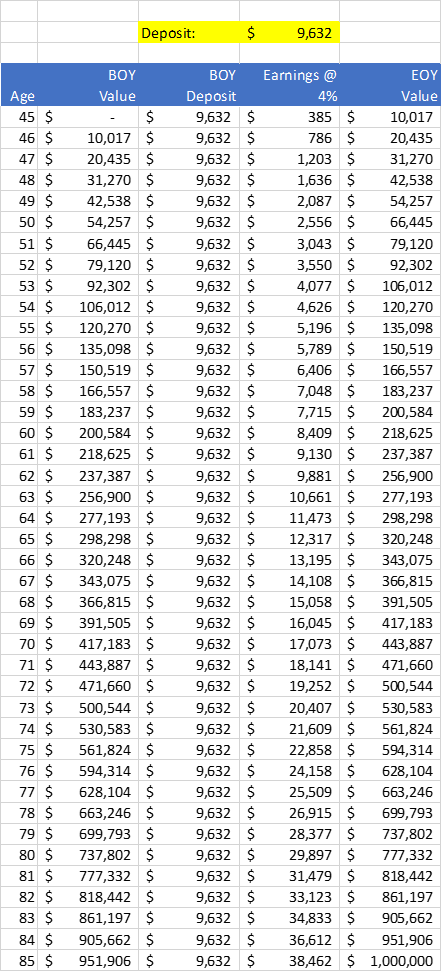

That is an extreme and inefficient example of life insurance. In the real world, money makes money (usually), and financial calculations allow us to make forecasted projections. A 45-year-old client (assume female) who wants to leave $1,000,000 to designated heirs could calculate the payments needed to make that happen. So, for example, the client wants to establish an account that contains $1,000,000 by the time she is 85 years old. Assuming a 4% after tax return, the client would need to deposit $9,632 annually into that account. This is not dissimilar to how one might make retirement planning forecasts.

That is an extreme and inefficient example of life insurance. In the real world, money makes money (usually), and financial calculations allow us to make forecasted projections. A 45-year-old client (assume female) who wants to leave $1,000,000 to designated heirs could calculate the payments needed to make that happen. So, for example, the client wants to establish an account that contains $1,000,000 by the time she is 85 years old. Assuming a 4% after tax return, the client would need to deposit $9,632 annually into that account. This is not dissimilar to how one might make retirement planning forecasts.

The problem with this plan is that nobody, including this client, knows when she might get hit by that proverbial bus or when she will pass from old age. THAT IS WHY PEOPLE BUY LIFE INSURANCE – TO PROTECT AGAINST THE UNKNOWN!!

If our client gets hit by that bus at age 55 – 10 years after the account is established – the family would NOT receive $100,000 per year for 10 years ($1,000,000), but rather a lump sum payment of $135,098. Hardly even one year’s income if you consider inflation. If that is a problem, then read on.

So, what inexpensive solution is available to solve this problem during our client’s working life?

Term Insurance

Using our example, Term Insurance provides the promise of a $1,000,000 lump sum – throughout the duration of the contract – and is triggered by the untimely death of an income provider – the insured.

the untimely death of an income provider – the insured.

If our 45-year-old female client in excellent health wants to guarantee that her family has $1,000,000 at her death (age 85), the cost would be approximately $3,345 per year. This is the cost of a 40-year term insurance policy for a 45-year-old female. The total expense would be $133,800.

As an alternative, we could run term numbers at varying term durations if the desired coverage amount were of shorter duration, for example:

- Term to age 80 (35 years) would cost: $1,882 – Total Cost = $65,870

- Term to age 75 (30 years) would cost: $1,358 – Total Cost = $40,740

- Term to age 70 (25 years) would cost: $1,090 – Total Cost = $27,250

- Term to age 65 (20 years) would cost: $ 790 – Total Cost = $15,800

It seems a small price to pay for a $1,000,000 benefit to the family, but why is it this term insurance is so cheap?

As per the bullets above, the price to insure the same 45-year-old female goes up exponentially the longer the term duration. For example, the total price differential to provide coverage between ages 65 to 75 (that extra 10 years) is $24,940 ($40,740 minus $15,800), while the total price differential between ages 75 to 85 is $93,060 ($133,800 minus $40,740). It is in the later years where the likelihood of death increases dramatically and impacts the cost of coverage, not during the first 30 years

This is where we get into the probability of the client surviving her term insurance coverage. The Bottom Line is – term life insurance is cheap because,

This is where we get into the probability of the client surviving her term insurance coverage. The Bottom Line is – term life insurance is cheap because, statistically, the insurance company will not have to pay the claim. In other words, the likelihood is that the insured will OUTLIVE the insurance coverage period.

statistically, the insurance company will not have to pay the claim. In other words, the likelihood is that the insured will OUTLIVE the insurance coverage period.

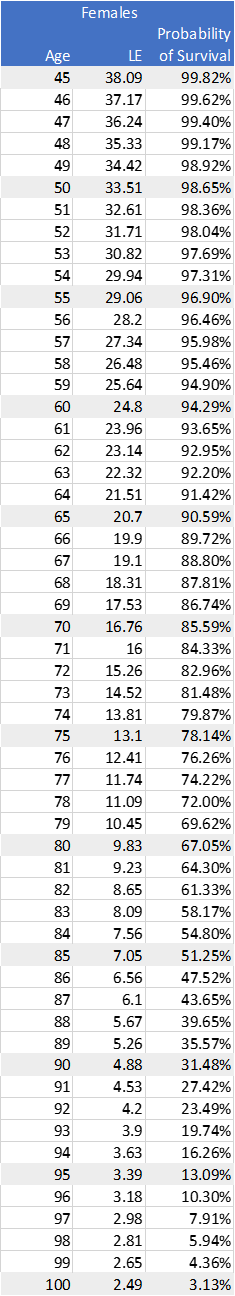

The adjacent table is an extract of data from the US Social Security Administration’s Period Life Table from 2019. Note that between the ages of 45 and 65, your client has a greater than 90% chance of survival. To say it a different way, 90% of the time your client will outlive her 20-year term insurance policy. However, by the age of 85 your client has approximately even odds of survival at 51.25%.

Contrary to what some think, Insurance IS NOT a rip-off. Remember, the concept of insurance is to protect against the unknown. No one knows when that “bus” is going to come and, at age 45, for a modest annual premium of $790, 10% of the insured women’s families were paid the $1,000,000 that they planned for during that 20-year period.

However, if you asked your client if she was willing to make a $15,800 bet (in $790 installments over 20 years) knowing that 90% of the time her family would NOT get their $1,000,000, do you really think your client would make that bet?

What about a $65,870 bet (in $1,882 installments over 35 years) with a 67.05% chance of loss, or a $133,800 bet (in installments of $3,445 installments over 40 years) with a 51.25% chance of loss?

Permanent Insurance – Term for Life

While 40-year term insurance is the longest guaranteed term duration available in the US market, there are “term for life” options available from a variety of insurance companies. They are more expensive, but if your client’s objective is to leave that $1,000,000 to her family, to follow our ongoing example, how would your client feel about a 97% success rate? If term to 100 was purchased at age 45, the total cost would be $323,400 (in $5,880 installments over 55 years) for the $1,000,000 benefit.

While 40-year term insurance is the longest guaranteed term duration available in the US market, there are “term for life” options available from a variety of insurance companies. They are more expensive, but if your client’s objective is to leave that $1,000,000 to her family, to follow our ongoing example, how would your client feel about a 97% success rate? If term to 100 was purchased at age 45, the total cost would be $323,400 (in $5,880 installments over 55 years) for the $1,000,000 benefit.

Purchasing life insurance is a very personal choice and it should fit into an overall financial plan and include the guidance of a qualified financial advisor. There are other considerations that a prospective insured should keep in mind as part of the overall planning process:

- liabilities\debts at the time of death such as mortgages, credit cards, etc.

- income needs of remaining family members and the duration of those needs

- other savings or assets that could be counted on for the family income\lifestyle needs which might reduce the amount of insurance needed

- taxes that may be due on the transfer of qualified plans (IRAs or 401Ks) or annuities to non-spousal beneficiaries

- other transfer taxes such as federal estate or state inheritance taxes that may be due within 9 months of death that would require liquidity

- legacy objectives to children or grandchildren

- charitable objectives

- others

Life insurance is 100% liquid, 100% income tax-free and 100% uncorrelated to any other asset class exactly when it is needed! Life insurance does not care if “the markets” are in a correction and down 10-20-30% on the day you die. It is an asset that, at life expectancy, yields approximately a 4% to 6% after tax return. Said differently, taxable investments would need to earn between 5.7% and 8.6% assuming a 30% tax rate. Life insurance de-risks portfolios and creates the assurance that heirs and other beneficiaries will have what they need to carry on after the death of a loved one.

AgencyONE’s holistic approach to risk provides an unbiased perspective and assists our AgencyONE 100 advisors and their clients in finding the right solutions in all circumstances.