LTC/Chronic Benefits Using 1035 Funds

There is undeniable value and huge potential in doing policy reviews with your clients. This week’s ONE Idea drives that message home and is based on a case that resulted in success for both the client and the AgencyONE 100 Advisor.

Our advisor’s client, Mr. Smith, is an unmarried 49-year-old male with a current whole life policy. Unfortunately, the dividend projections on the policy will not be favorable for the near future and may impact the ability to reduce future premiums. The illustrated vanish – the point at which the dividends are high enough to cover the entire premium – is still a way off. As a result, the policy will require the client to continue paying premiums for many more years. After reviewing the policy’s annual statement and considering other options with his advisor, Mr. Smith asked if there was a way for him to stop paying premiums now. During additional fact finding, the AgencyONE 100 advisor discovered that Mr. Smith also has a parent who is currently on claim and using long-term care benefits. The client would like to see something that would cover Long-Term Care (LTC) for himself in the future, if needed.

Our advisor’s client, Mr. Smith, is an unmarried 49-year-old male with a current whole life policy. Unfortunately, the dividend projections on the policy will not be favorable for the near future and may impact the ability to reduce future premiums. The illustrated vanish – the point at which the dividends are high enough to cover the entire premium – is still a way off. As a result, the policy will require the client to continue paying premiums for many more years. After reviewing the policy’s annual statement and considering other options with his advisor, Mr. Smith asked if there was a way for him to stop paying premiums now. During additional fact finding, the AgencyONE 100 advisor discovered that Mr. Smith also has a parent who is currently on claim and using long-term care benefits. The client would like to see something that would cover Long-Term Care (LTC) for himself in the future, if needed.

Alternative Options to Inforce Whole Life Policy – 1035 with no Additional Premiums

Mr. Smith, a Georgia resident, is considered preferred best, has a 1035 of $384,000, and does not want to pay any additional premiums. Following are some options presented:

- 1035 only and solve for the maximum guaranteed death benefit. AgencyONE showed the advisor a guaranteed VUL since they are the most competitive on single premium designs. The carrier provided a death benefit of $2,060,000 which is fully guaranteed for lifetime.

- Addition of an underwritten chronic care rider. AgencyONE also suggested that $500,000 of the death benefit be used towards the chronic care rider. $500,000 of total benefit provides $10,000 per month for 50 months and lowered the death benefit solve to $2,028,000. Any LTC benefits used will drop the death benefit dollar for dollar.

The two options above are the quick and easy comparisons. Adding a Chronic/LTC rider can be a great way to provide living benefits along with the required death benefit. But… there are better ways to do this with a carrier who will split the 1035 into two contracts on the same client. This design is especially good for clients with larger 1035’s. Splitting the 1035 allows the client to fund two different policies that will complement each other.

Alternative Option – Splitting the 1035

In this scenario AgencyONE split $75,000 off the total 1035 ($384,000) to purchase a Linked Benefit Hybrid contract and used the remaining $309,000 to purchase a fully guaranteed policy with a death benefit of $1,658,000. Since this life policy does not have the chronic rider added, there will be no death benefit reduction from any future LTC claims.

The $75,000 paid-up Hybrid LTC contract is a true LTC contract with an indemnity payout. Since the client is younger, AgencyONE can start the benefit lower and add a 3% compound to the design to increase the benefit as the client gets older.

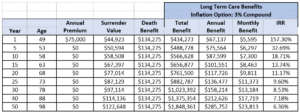

The hybrid/LTC policy buys an initial monthly benefit of $5,595 that increases annually with a 3% compound rider. It is a 6 year – 72-month benefit period with an available death benefit of $134,275 if the LTC benefits are not used. The graph below shows the guaranteed benefits available starting in year 1.

The hybrid/LTC product is a much better option for anyone who wants increasing future LTC benefits. There is also a surrender value available if the client chooses to walk away from the contract in the future. Where this contract really excels is in the monthly LTC benefit and total LTC benefit pool available. Remember, this is a monthly benefit for 72 months compared to the 50 months benefit available with the chronic care life insurance rider. The total pool available exceeds the life insurance starting in year 6 and the monthly benefit exceeds $10,000 in year 21. The benefit and total pool continue to grow annually for lifetime.

AgencyONE has two carrier partners who can internally split 1035’s for life and hybrid/LTC and a few other options for splitting 1035’s into two life contracts. Preliminary discussions must take place between AgencyONE and the advisor to determine the fact pattern details in order to provide the best possible value for your client.

This kind of insurance risk planning is made possible by advisors who maintain and foster relationships with clients, focus on policy reviews, and work with a BGA like AgencyONE that is customer service-minded and has a clear understanding of carrier solutions.

This kind of insurance risk planning is made possible by advisors who maintain and foster relationships with clients, focus on policy reviews, and work with a BGA like AgencyONE that is customer service-minded and has a clear understanding of carrier solutions.

Please contact the AgencyONE Case Design Department at 301.803.7500 for more information or to discuss a case.