Pre-Sunset Planning Opportunity – Get Ahead of the Massive Increase in Federal Estate & Gift Tax Exemption

Introduction

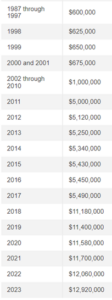

I have been doing this a long time, in fact, so long that I remember when the Federal Estate Tax exemption was $600,000 per individual taxpayer and there was no such thing as portability, where a surviving spouse can use the unclaimed exemption of a deceased spouse. That was in 1997 and the exemption had not changed in 10 years, since 1987.

Fast forward to 2024 where Bloomberg is predicting that the estate and gift tax exemption will increase from the current $12,920,000 to $13,610,000. That is $740,000 or a 5.73% increase due to the federal cost of living adjustment, otherwise known as an inflation adjustment. Now, while this is a prediction, the actual increase will likely not be that far off. The increase from 2023 to 2024 far exceeds the entirety of the exemption just over a quarter century ago! Additionally, the annual exclusion gift – the amount that an individual can gift to another without tax and without an IRS reporting requirement – will increase from the current level of $17,000 to $18,000!

While we may have one more increase from 2024 to 2025, the amount of which is yet unknown, as of January 1, 2026 we will have a 50% DROP IN THE EXEMPTION. This is due to the sunsetting provision of the 2017 Tax Cut and Jobs Act.

Many high-net-worth families have already been advised by legal, accounting, and financial\estate planning advisors that they should, at a minimum, consider gifting the “doubling” of the exemption prior to the sunset of 2026 either to children\grandchildren outright or to trust(s) for the benefit of said descendants. And many of these families have taken this advice, because, why not? Why would anyone that does not need the money not want to transfer the allowable tax-free amount under the current tax regime and forever remove that amount, plus all the growth on that amount, out of their taxable estate?

The only answer that I can come up with is that they are either ignorant of the fact that it is possible or, they prefer paying taxes. For those of us that would prefer not to pay taxes, this is a no-brainer.

Furthermore, on November 26, 2019, the IRS published regulations 20.2010-1(c), indicating that they would not “claw-back” the used exemption when the sunset occurs on January 1, 2026. So, for example, if today you gifted half of the available $12,920,000 exemption to a trust and filed your gift tax return, IRS Form 709, and assuming no future increases, the exemption dropped as set out by law to $6,460,000, the IRS could not say that you already made a $6,460,000 gift and you have ZERO exemption left. The gift made cannot be clawed back and you would still have whatever exemption is available at that time. It is important to note that as recently as April 27, 2022, the IRS published proposed regulations that, according to Price Waterhouse Coopers (PWC), “would impose some limits on the anti-claw-back regulations issued in 2019”. We will see what happens.

Furthermore, on November 26, 2019, the IRS published regulations 20.2010-1(c), indicating that they would not “claw-back” the used exemption when the sunset occurs on January 1, 2026. So, for example, if today you gifted half of the available $12,920,000 exemption to a trust and filed your gift tax return, IRS Form 709, and assuming no future increases, the exemption dropped as set out by law to $6,460,000, the IRS could not say that you already made a $6,460,000 gift and you have ZERO exemption left. The gift made cannot be clawed back and you would still have whatever exemption is available at that time. It is important to note that as recently as April 27, 2022, the IRS published proposed regulations that, according to Price Waterhouse Coopers (PWC), “would impose some limits on the anti-claw-back regulations issued in 2019”. We will see what happens.

The United States estate and gift tax regime is an often and hotly debated issue on Capitol Hill as the balance of power swings from isle to isle. This is likely one of the most controversial topics in our entire tax system and, as planners, we never know how to advise clients other than paying attention to the current law. As we sit here today, the IRS allows us to gift $12,920,000 per taxpayer (double that for married filers) and $17,000 annually without any reporting or filing requirements. The IRS\Treasury Department rarely enacts changes to tax law retroactively, hence what we know and do today should be solid planning.

The United States estate and gift tax regime is an often and hotly debated issue on Capitol Hill as the balance of power swings from isle to isle. This is likely one of the most controversial topics in our entire tax system and, as planners, we never know how to advise clients other than paying attention to the current law. As we sit here today, the IRS allows us to gift $12,920,000 per taxpayer (double that for married filers) and $17,000 annually without any reporting or filing requirements. The IRS\Treasury Department rarely enacts changes to tax law retroactively, hence what we know and do today should be solid planning.

Financial Analysis and Discussion

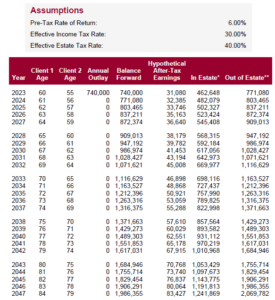

Assume that you and your spouse are 60 and 55 years old. Let’s take this to the next step and focus on what could be done with an increase in the gift tax exemption in 2024. Let’s only talk about that increase of $740,000. There are only two choices – do nothing and leave the money in your taxable estate OR transfer the funds to a trust for the benefit of your children\grandchildren. Of course, buying a new expensive boat is certainly another option, but that is not the point of this conversation. Let’s unpack this.

Let’s say that you have $740,000 in your name, sitting in cash, or treasuries or CD’s – something liquid and safe and let’s assume that you are earning 6% on those funds. Yes, I know, that is higher than the market today, but I am trying to make a point.

Let’s say that you have $740,000 in your name, sitting in cash, or treasuries or CD’s – something liquid and safe and let’s assume that you are earning 6% on those funds. Yes, I know, that is higher than the market today, but I am trying to make a point.

Option #1 – Do nothing, allowing the assets to remain in your name. This means that your $740,000 will continue to grow at 6% without market risk, assuming you will pay taxes at 30% annually on the interest earned, and the money will pass to your children upon death subject to a 40% estate tax. The below chart illustrates this numerically, in the “In Estate” column.

Option #2 – Transfer the funds to a trust and complete the gift that the IRS allows in 2024, file IRS form 709 to report the gift, pay ZERO tax on the gift and leave the funds in the same safe cash equivalent, earning 6% pre-tax.

As you will also see in the chart below, the only difference between the two is that Option #1 (In Estate) is 40% less than Option #2 (Out of Estate) because the IRS took it from your children when you and your spouse passed away.

While one could argue that Option #2 is a far better outcome than Option #1 for the beneficiaries, what if we could find a solution that enhanced your returns significantly without any risk to you, your trust, the trustee of the trust and your children\grandchildren? A solution does exist, and this is Guaranteed Variable Universal Life Insurance.

If you took $740,000 and made a single payment into a Survivorship Guaranteed Variable Universal Life (SGVUL) policy, the benefit to the trust is guaranteed to be $2,946,000 for the hypothetical married couple in our example. This solution guarantees that the trust will have exactly that amount in all years regardless of interest rates, inflation, market volatility, real estate volatility, etc… It is completely uncorrelated to any other asset class. This solution creates a 4-1 multiplier on the gift immediately and is guaranteed for life. The unique thing about GVUL, however, is that while guaranteed, the single premium can be invested in equities or other more aggressive investment options than cash equivalents to increase the return to the trust. An example will make this clear….

You will notice in the chart to the left that in year 2046 (the client’s age 83) the Death Benefit Out of Estate column begins to increase. This is because the underlying investments in the SGVUL policy have been invested for growth and we are projecting an 8% return. It is called the “corridor” or the required difference between the cash value and the death benefit to qualify for life insurance tax treatment under IRS Code Section 7702.

You will notice in the chart to the left that in year 2046 (the client’s age 83) the Death Benefit Out of Estate column begins to increase. This is because the underlying investments in the SGVUL policy have been invested for growth and we are projecting an 8% return. It is called the “corridor” or the required difference between the cash value and the death benefit to qualify for life insurance tax treatment under IRS Code Section 7702.

Cash value growth through reinvested dividend and capital gains, or rebalancing transactions that would otherwise trigger gains, inside a life insurance policy is not taxed annually. They are never taxed because the death benefit of life insurance is always tax free. It is also estate tax free if owned inside a life insurance trust. What is guaranteed however is that the death benefit will never be less than the $2,946,000 that is contractually provided.

A fair question is what happens if the clients (or more aptly said, the second to die) survives until age 90, or 95 or even 100? See side by side charts below for a comparison – it is an easy decision if the market(s) deliver what they have historically delivered. On a guaranteed basis for the life insurance, the crossover point is age 88 of the younger insured ($2,997,000 in the 6% cash equivalents out of the estate versus the guaranteed value of the insurance of $2,946,000). I believe that if this is a compelling comparison, then it would behoove the client to invest for aggressive growth because there is little or no risk to doing so and it has the potential of doubling or more the benefits to the trust and hence the beneficiaries of the trust.

It is the trustee’s fiduciary duty to manage the assets of a trust for the best outcome for the beneficiaries and I see no solution better than utilizing a SGVUL policy that significantly limits the downside risk.

There are several product solutions like this one, meaning SGVUL products, from a variety of highly rated insurance companies that are available in the market today. If this solution is suitable for the increase in the estate and gift tax exemption, then it is certainly suitable for any amount of money that a high-net-worth taxpayer would be willing to transfer today into a trust.

Please contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case.