The Potential Loss of Step-Up in Basis & Life Insurance

The potential loss of step-up in basis is very real with President Biden’s The American Families Plan proposal that was released on April 28, 2021. While this is a proposal and NOT law (yet), I am sure that it will be the subject of hard negotiations on Capitol Hill for the foreseeable future. I cannot resist the opportunity to make a few points about how properly structured life insurance can provide significant planning solutions to the tax impact of the proposed plan with respect to the potential loss of step-up in basis.

Click here for the full Fact Sheet as presented by the White House (excerpt below). Toward the end of the White House’s document, you will find the tax reform that is proposed by the Biden Administration to pay for the benefits of The American Families Plan.

Life Insurance Is An Asset

Life insurance is a very valuable asset. It enjoys an automatic step-up in basis at the time of death because the benefit is paid income tax free and can be excluded from the taxable estate if properly owned. Let’s ignore that for just a second.

estate if properly owned. Let’s ignore that for just a second.

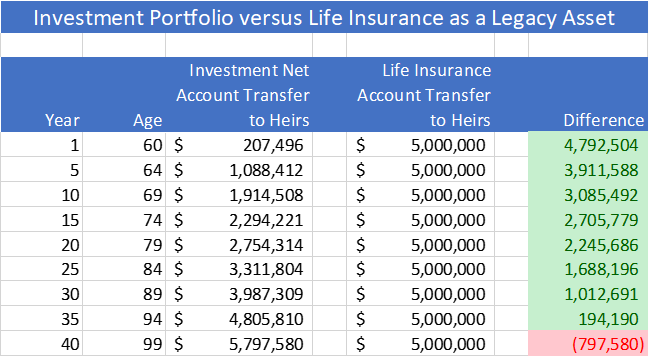

Assume that a wealthy 60-year-old individual has a choice to either purchase investment assets (stocks, bonds, alternatives, etc.) or a $5,000,000 guaranteed life insurance contract. The life contract will come with a commitment of approximately $200,000 per year for 10 years.

In the investment account, the portfolio generates both capital gains and dividend distributions. This would be taxable to high income earners under the Biden Plan at ordinary income rates of 39.6%, plus a 3.8% Medicare tax. Reinvested dividends and capital gains increase the basis of the portfolio each year and should be tracked accordingly. The portfolio will also experience untaxed capital appreciation over time until death. It would be taxed at the same 43.4% rate to the heirs under the proposed White House Plan.

Unique Qualities of Life Insurance

Life insurance is unique in that the death benefit is paid income tax free and enjoys an automatic step-up in basis for the full benefit paid at death, regardless of basis.

We have provided a summary analysis based on the hypothetical facts laid out above. You will see the benefit of life insurance as a wealth transfer asset is not only guaranteed after the 10 premium payments, but exceeds the net wealth transfer to heirs until the very later years of life. In fact, based on our assumptions, the crossover point is age 96. (This DOES NOT account for any state estate taxes or inheritance taxes which may be due.)

We have assumed that the investment portfolio earns a 5% total return with a 2.5% capital appreciation and 2.5% reinvested income (dividends and capital gains distributions). A more detailed analysis is provided here.

Life Insurance as an Uncorrelated Asset

The other important attribute of life insurance is that it is a completely uncorrelated asset to any other economic events that could affect financial markets. Imagine if a client passed away in 2003 after the tech bubble, or in 2008 during the great recession, or in March of 2021 during the initial market correction of the COVID-19 pandemic. All of those corrections were approximately 30 to 40% market corrections. Individuals do not choose when they pass away, and the markets do not care …. and neither does life insurance. It is worth its full value and is fully liquid exactly when it pays the expected benefit.

Life Insurance – properly owned and structured

Life insurance proceeds can be further excluded from the insured’s taxable estate. If the taxpayer would be subject to estate taxes, life insurance should be owned in an irrevocable trust and outside the taxable estate of the individual or couple. The analysis conducted in this presentation would be substantially the same because a trustee would have to liquidate securities or other assets to pay for the needs of trust beneficiaries. A trust does not enjoy a step-up in basis regardless of the current White House administration’s proposal, unless it owns life insurance – which is always fully liquid at face value.

The product shown in our analysis is a fully guaranteed universal life policy with 10 premium payments. Other products, without similar guarantees, may provide a lower premium and further enhance our analysis. Equally, Whole Life products may have a higher premium but provide a growing death benefit due to paid up additions, delivering more death value as a result. AgencyONE is product neutral and has access to over 30 insurance companies in our portfolio. Our goal is to assist advisors in making recommendations that serve the best interest of their clients.

Please contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case.

The American Families Plan – Excerpt

Households making over $1 million—the top 0.3 percent of all households—will pay the same 39.6 percent rate on all their income, equalizing the rate paid on investment returns and wages. Moreover, the President would eliminate the loophole that allows the wealthiest Americans to entirely escape tax on their wealth by passing it down to heirs. Today, our tax laws allow these accumulated gains to be passed down across generations untaxed, exacerbating inequality. The President’s plan will close this loophole, ending the practice of “stepping-up” the basis for gains in excess of $1 million ($2.5 million per couple when combined with existing real estate exemptions) and making sure the gains are taxed if the property is not donated to charity.

Finally, high-income workers and investors generally pay a 3.8 percent Medicare tax on their earnings, but the application is inconsistent across taxpayers due to holes in the law. The President’s tax reform would apply the taxes consistently to those making over $400,000, ensuring that all high-income Americans pay the same Medicare taxes.