There is More to That Snore: Underwriting Obstructive Sleep Apnea

A week doesn’t go by without the AgencyONE Underwriting Team encountering a file that includes a diagnosis of obstructive sleep apnea. We’ve all heard the Darth Vader jokes about wearing a CPAP mask, but what IS sleep apnea and why is it relevant to the underwriting process? In this ONEIdea, we will define obstructive sleep apnea, explain its diagnosis and treatment, and discuss the associated mortality concerns. There is more to that snore; preferred ratings for obstructive sleep apnea are possible assuming the client follows the recommended treatment and negotiations are successful with the targeted carrier partner.

A week doesn’t go by without the AgencyONE Underwriting Team encountering a file that includes a diagnosis of obstructive sleep apnea. We’ve all heard the Darth Vader jokes about wearing a CPAP mask, but what IS sleep apnea and why is it relevant to the underwriting process? In this ONEIdea, we will define obstructive sleep apnea, explain its diagnosis and treatment, and discuss the associated mortality concerns. There is more to that snore; preferred ratings for obstructive sleep apnea are possible assuming the client follows the recommended treatment and negotiations are successful with the targeted carrier partner.

What is Obstructive Sleep Apnea?

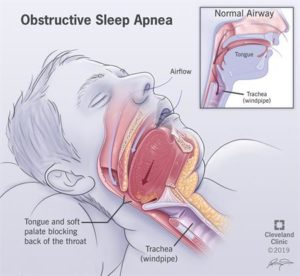

Obstructive sleep apnea (OSA) is a breathing disorder that occurs during sleep. There is actually more than one type of sleep apnea, but the most common one and the focus of this discussion is obstructive sleep apnea. Obstructive sleep apnea is the result of blocked airflow (obstruction); usually caused by the collapse of soft tissue in the back of the throat (upper airway) and tongue during sleep. Some of the most common symptoms of OSA include daytime fatigue, loud snoring, witnessed episodes of stopped breathing, headaches, and elevated blood pressure.

It may come as no surprise that OSA is found to be more prevalent in men. The Mayo Clinic reports that men are TWO TO THREE TIMES more likely to have obstructive sleep apnea as compared to women. Some additional risk factors for developing obstructive sleep apnea include older age, obesity, smoking, and even alcohol or sedative use. The condition frequently goes undiagnosed and is considered a cardiac risk factor for sudden death…while you sleep.

How is Obstructive Sleep Apnea Diagnosed?

OSA is traditionally diagnosed by a polysomnography (sleep study) completed in the comfort of your own home or at a sleep medicine facility. The at-home testing is obviously less involved, but still measures breathing, oxygen levels, snoring, and possibly even limb movements. A polysomnography at a sleep facility is more extensive and requires more sophisticated equipment. The equipment measures the breathing patterns, oxygen, limb movements, as well as the activity in the heart, brain, and lungs. In either testing environment, the sleep study generates a report that is interpreted by a physician to diagnose OSA and determine the severity of the condition. The physicians who analyze the results are ultimately looking for how many apneic events there were (pauses in breathing during sleep) and how significantly the oxygen levels decreased. Those results are then translated into an obstructive sleep apnea diagnosis of mild, moderate, or severe.

How is Obstructive Sleep Apnea Treated?

Once a physician has determined the severity of the obstructive sleep apnea, they can make treatment recommendations. Lifestyle modifications can be made if the OSA is related to weight, alcohol intake, and/or sleeping positions, especially if it is only mild in severity. In other situations, an oral device or surgery may help open the obstructed airway. However, the “Gold Standard” treatment for moderate and severe obstructive sleep apnea is PAP (positive airway pressure). The most commonly used PAP device is a CPAP (continuous positive airway pressure) system. The CPAP machine provides warmed and humidified air, in a continuous pressure, adjusted to the user’s OSA severity to effectively keep the airway open while sleeping. The CPAP mask covers your nose and mouth, which can take some getting used to, but it works…and can save your life….and your relationship!

can be made if the OSA is related to weight, alcohol intake, and/or sleeping positions, especially if it is only mild in severity. In other situations, an oral device or surgery may help open the obstructed airway. However, the “Gold Standard” treatment for moderate and severe obstructive sleep apnea is PAP (positive airway pressure). The most commonly used PAP device is a CPAP (continuous positive airway pressure) system. The CPAP machine provides warmed and humidified air, in a continuous pressure, adjusted to the user’s OSA severity to effectively keep the airway open while sleeping. The CPAP mask covers your nose and mouth, which can take some getting used to, but it works…and can save your life….and your relationship!

Why is Obstructive Sleep Apnea an Underwriting Concern?

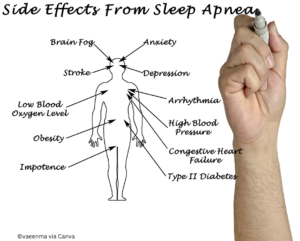

Obstructive sleep apnea isn’t JUST snoring. It is the CAUSE of the snoring. The mortality risks are real and based on the severity of the condition. The potential physical side effects are sleepiness during the day which may result in impaired driving abilities and trouble concentrating. The potential medical side effects are significant and include heart attack, stroke, abnormal heartbeat, heart failure, high blood pressure, etc. Severe OSA is associated with an increased risk of every single one of these events/conditions and, if left untreated, can result in death. Often you hear of someone, “dying quietly in their sleep” without a known cause. Was the culprit undiagnosed obstructive sleep apnea?

Obstructive sleep apnea isn’t JUST snoring. It is the CAUSE of the snoring. The mortality risks are real and based on the severity of the condition. The potential physical side effects are sleepiness during the day which may result in impaired driving abilities and trouble concentrating. The potential medical side effects are significant and include heart attack, stroke, abnormal heartbeat, heart failure, high blood pressure, etc. Severe OSA is associated with an increased risk of every single one of these events/conditions and, if left untreated, can result in death. Often you hear of someone, “dying quietly in their sleep” without a known cause. Was the culprit undiagnosed obstructive sleep apnea?

How is Obstructive Sleep Apnea Underwritten?

When underwriting OSA, underwriters are mostly focused on the following factors to determine the risk class:

- Sleep Study Results – Is the diagnosis mild, moderate, or severe obstructive sleep apnea?

- Treatment- Is treatment required? What kind of treatment was prescribed (oral device, CPAP, etc.)?

- Compliance- Is the treatment being followed as recommended and is it effective? For example, if the CPAP machine is being used, the device will generate a report that shows how often it is being used and if it is doing its job.

- Comorbid Conditions– Are there any other conditions present that contribute to the OSA risk? i.e., obesity, hypertension, coronary artery disease, atrial fibrillation, etc.

- Alcohol and/or Drug Misuse

Case Study

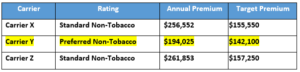

Mr. Vader is a 60-year-old non-smoking male seeking $4,000,000 of Variable Universal Life (VUL) insurance coverage for personal purposes. He stands 5’10” tall and weighs 240lbs. His medical history is significant for hypertension treated effectively with Lisinopril and hypercholesterolemia (high cholesterol) managed with Atorvastatin. He also has a mildly elevated fasting blood glucose but does not carry a diagnosis of pre-diabetes or type II diabetes. Last year, Mr. Vader’s wife complained about his snoring and mentioned that she witnessed frequent apneic events (stopped breathing) while he was sleeping. At the urging of his wife, Mr. Vader underwent a sleep study. His results confirmed a diagnosis of severe sleep apnea. The recommended treatment was a CPAP machine. A CPAP titration study was then completed to determine the appropriate CPAP pressure to effectively treat his severe sleep apnea. Mr. Vader has been fully compliant with CPAP treatment for the last nine months. Based on his complete medical history, AgencyONE targeted three carriers for informal consideration (Carrier X, Y, Z). Due to the recency of his OSA diagnosis and the severity, both Carrier X and Carrier Z assessed at Standard Non-Tobacco rates. However, AgencyONE successfully negotiated a Preferred Non-Tobacco offer with Carrier Y due to Mr. Vader’s well documented CPAP compliance. A formal application was submitted, and Mr. Vader placed, not $4,000,000 but, $5,000,000 of VUL coverage at Preferred Non-Tobacco rates. The outstanding offer AgencyONE negotiated was enough motivation for Mr. Vader to secure additional coverage!

$5MM VUL 10-Pay No Lapse Guarantee to Age 100

AgencyONE’s Underwriting Team consistently provides experienced and knowledgeable underwriting along with high-touch service to our AgencyONE 100 Advisors, all while delivering the best offers available in the marketplace.

Please contact AgencyONE’s Underwriting Department for more information at 301-803-7500 or to discuss a case.