Thinking Outside the Box – Split Policy Design

Our AgencyONE 100 Advisors consult us regularly about a variety of insurance and financial goals that they would like to accomplish for their clients. In many cases, one type of product or solution will do but, in others, we are required to widen our scope and consider the use of multiple products to deliver a personalized solution. We recently worked with an advisor on a very interesting split policy design short-pay scenario and thought that other advisors would be interested in learning about this case design as well.

GOAL – PRODUCT GUARANTEES & CASH VALUES

The client, Mr. Smith age 50, was run at Preferred NT for a face amount of $5,000,000. The first design was a level pay Guaranteed UL (GUL) to age 100 with an annual premium of $47,040 per year. Next, at the advisor’s request, AgencyONE looked at a 10-pay with guarantees to age 100. This scenario produced a different top carrier since some products perform better at a level pay compared to a short pay. The 10-pay guaranteed premium was $120,631 per year. While the GUL product had the most competitive premium, it had NO projected cash value – something the client and advisor decided was also necessary. Not many carriers have GUL with cash value that grows for the life of the contract. Guaranteed VUL was not an option for this client and a refund of premium rider was also not ideal since it requires that the client surrender the policy in years 20 or 25 thereby canceling the coverage. As an alternative option, AgencyONE explored a 10-pay Whole Life product which had both guarantees and projected cash values BUT the cost was $249,800 per year – almost double the 10-pay GUL premium that AgencyONE initially quoted!

SOLUTION – BLENDED PRODUCT DESIGN

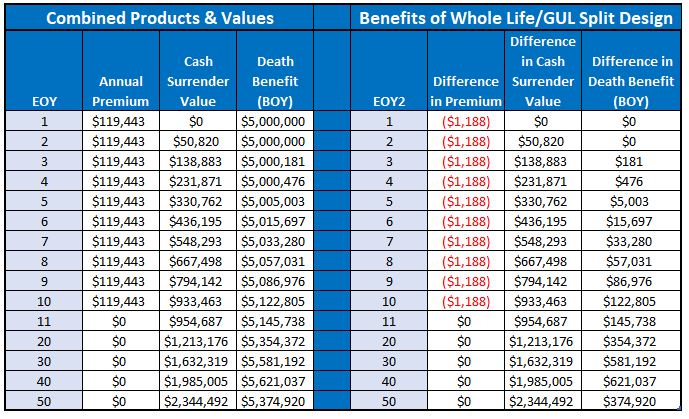

Since the client wanted guarantees AND cash value, AgencyONE looked at a blended design using BOTH GUL and 10-pay Whole Life. We priced out $2,000,000 of 10-pay Whole Life with a premium of $89,400 per year (for 10 years) and $3,000,000 of GUL on a level pay basis at $29,963 per year. The plan was to pay the ongoing GUL premiums using loans from the Whole Life contract in years 11-50. See the projected values below:

The BENEFIT of using this strategy is threefold:

- Your client gets an increasing death benefit;

- Your client gets access to future policy cash values; and

- Your client diversifies by spreading the risk over two carriers and two different products.

It is important to remember that the income stream used to pay the GUL premium is based on the carrier’s current dividend rate which should be monitored in the event of changes that could affect the performance of the policy. The table below shows the values for the 10-pay Whole Life, GUL, and the combination of the products. This blended strategy is $1,188 lower in cost each year for the first 10 years.

The beauty of the split policy design in this scenario is its lower cost, increasing death benefit, AND option to access available cash values if needed. The premiums are fully guaranteed but, it is important to remember that, the income needed to pay future GUL premiums needs to be MONITORED. It isdependent on the performance of the Whole Life policy and its projected dividends.

The beauty of the split policy design in this scenario is its lower cost, increasing death benefit, AND option to access available cash values if needed. The premiums are fully guaranteed but, it is important to remember that, the income needed to pay future GUL premiums needs to be MONITORED. It isdependent on the performance of the Whole Life policy and its projected dividends.

Thinking outside the box on life insurance design is an important part of AgencyONE’s philosophy. Our carrier knowledge and product intelligence ensures you receive the solutions best suited to your clients’ financial needs.