Top Tier Case Design – A 1035 Exchange with an Internal Split

One of our AgencyONE 100 Advisors recently began a relationship with a new client and while reviewing their current financial and insurance plan discovered that they owned an underperforming or outdated life insurance contract. While this existing contract was a good fit when it was issued many years ago, it no longer met the client’s needs. Insurance Review 101 tells you that your first option is to consider a 1035 exchange that might reposition the existing product’s cash value into a solution that better fits your clients’ current needs. While a single product exchange may be the best option, consider the possibility of 1035ing the existing product with a carrier that offers the option to split the 1035 funds into two different product types. This solution was covered in a previous ONE Idea from June 2022. It discussed using a 1035 split design to purchase BOTH a hybrid LTC policy and an Accumulation IUL policy to satisfy two current and very important needs for the client. Recently, one of our carrier partners introduced us to an option that takes this idea even further.

contract. While this existing contract was a good fit when it was issued many years ago, it no longer met the client’s needs. Insurance Review 101 tells you that your first option is to consider a 1035 exchange that might reposition the existing product’s cash value into a solution that better fits your clients’ current needs. While a single product exchange may be the best option, consider the possibility of 1035ing the existing product with a carrier that offers the option to split the 1035 funds into two different product types. This solution was covered in a previous ONE Idea from June 2022. It discussed using a 1035 split design to purchase BOTH a hybrid LTC policy and an Accumulation IUL policy to satisfy two current and very important needs for the client. Recently, one of our carrier partners introduced us to an option that takes this idea even further.

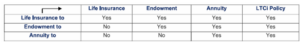

Rules Applying to a 1035 Exchange

Before we discuss this next option let’s talk about the rules that apply to a 1035 exchange. The rules follow the base insurance product of “like to like” and stipulate that:

Before we discuss this next option let’s talk about the rules that apply to a 1035 exchange. The rules follow the base insurance product of “like to like” and stipulate that:

1. The owner of the new policy must be the same as the owner of the old policy. The exception is with a survivorship policy where one of the insureds has died. The survivor can then 1035 exchange the cash value to an individual policy.

2. The Insured on the new policy must be the same as the insured on the old policy.

3. The proper products must be used – as illustrated in the chart below.

How Does an Internal Split 1035 Exchange Work?

An Internal Split 1035 Exchange is a process where 100% of the cash value from a life insurance policy is 1035 exchanged to another insurance company that offers the products the client needs. Upon receipt of the funds, the new insurance company “splits” the dollars into amounts needed to purchase the new policies. The cost basis and gain are applied pro-rata to each portion of cash value used to purchase the new products. Only a few carriers offer this option which must be handled in a “like-to-like” manner. This should not create a problem for the original owner/insured.

Let’s consider the option to use some of the 1035 proceeds to purchase a policy on a spouse. This scenario requires an additional purchase in order to be a viable option. Some of the 1035 exchange dollars can be split and exchanged into a non-qualified Single Premium Annuity (SPIA). The insured/owner of the original life policy will be the annuitant and owner of the new SPIA. The income generated from the SPIA can be used to purchase another product on the spouse. While the 1035 transaction is tax free, the income paid from the annuity WILL BE TAXED based on annuity rules (gain out first). The taxes can be minimized by being stretched out and paid annually according to the pay-out period used to purchase the new policy (10 yrs for example). Our carrier partner offers the option to obtain BOTH a life insurance policy and an annuity contract at the same time. (Please note that not all carriers will allow this option.)

into a non-qualified Single Premium Annuity (SPIA). The insured/owner of the original life policy will be the annuitant and owner of the new SPIA. The income generated from the SPIA can be used to purchase another product on the spouse. While the 1035 transaction is tax free, the income paid from the annuity WILL BE TAXED based on annuity rules (gain out first). The taxes can be minimized by being stretched out and paid annually according to the pay-out period used to purchase the new policy (10 yrs for example). Our carrier partner offers the option to obtain BOTH a life insurance policy and an annuity contract at the same time. (Please note that not all carriers will allow this option.)

Case Study

Joe and Jane are married and both in their 60’s. Joe has a current life policy with a $200,000 cash value of which $80,000 is cost basis. His current insurance needs have reduced substantially, while his concerns with protecting the couple’s retirement savings from potential LTC expenses have grown. Therefore, Joe is interested in purchasing LTC coverage for the couple and also wants some meaningful life insurance coverage. Joe and his advisor decide that an Indexed UL policy with a LTC rider would be the best fit for him. Jane prefers a solution that will offer a LTC benefit that will increase over time. She wants to purchase a Linked Benefit LTC policy using a 10-pay premium schedule.

- $100,000 or half of the 1035 exchange dollars will be used to purchase Joe’s IUL policy with the LTC rider. His pro-rata allocation of cost basis/gain will be $40,000 of cost basis and $60,000 of gain. Since this is a “like to like” exchange, both as insured and policy owner, this transaction will meet the requirements for a 1035 exchange.

- The remaining $100,000 will be 1035 exchanged into a non-qualified SPIA set up with a 10-year certain income stream. Again, the cost basis will be $40,000 and the gain will be $60,000. Since this is a “like to like” exchange, both as insured/annuitant and policy owner, this transaction will meet the requirements for a 1035 exchange. (Life insurance qualifies to be 1035 exchanged into an annuity)

- The annual income will provide the amount needed to pay the premium for Jane’s linked benefit LTC policy. Note that the income coming from the SPIA is not part of the exchange, therefore it can be used to pay for Jane’s linked benefit LTC policy.

- The insurance company may offer a streamlined process that will allow for an internal transfer of annuity income to pay the premium for the linked benefit LTC policy.

- The annuity income will be subject to taxation based on an exclusion ratio. In this example 40% is tax free and 60% is taxable. The process to withhold taxes on the income will vary. The carrier used may or may not have that option available.

The addition of a fixed annuity in the carrier portfolio adds flexibility and additional options for your clients to consider. If you have a 1035 case that needs multiple solutions, AgencyONE is happy to review your case to see if these options would benefit your client.

Please contact the AgencyONE Case Design and Annuity Department at 301.803.7500 for more information or to discuss a case.