Underwriting Pregnancy and Pregnancy-Related Conditions – More Complicated Than You Think!!

My client is currently pregnant and wonders if she can apply for Life Insurance now or should wait until after the child is born? We get asked this question on a fairly regular basis, so we thought that addressing the subject in this ONEIdea would be helpful to any of your formerly, currently, or future pregnant clients. The short answer is YES, your client CAN apply for life insurance assuming the pregnancy is NORMAL and without any complications; however underwriting pregnancy and pregnancy-related conditions may be more complicated than you think.

Pregnancy-Related Underwriting

Underwriters must view pregnancies through a different lens. Most people think of pregnancy as a 40-week gestation period. However, in the medical community and underwriting world, the term “pregnancy-related” refers to and includes the pregnancy, delivery, and postpartum period (even up to one year after delivery). Like any other “condition,” there are variables involved when underwriting a woman who is currently pregnant. Following are the basics:

- Age: Is she under age 35 or is this an “Advanced Maternal Age Pregnancy”?

- General Medical History: Does she have a history of any significant medical impairments outside of the pregnancy?

- Obstetric History: Has she had prior pregnancies? If so, were there any complications associated with them – i.e. gestational diabetes, preeclampsia, HELLP syndrome, ectopic pregnancy, etc.?

- Current Build/Vitals/Labs: Is her weight and blood pressure within limits deemed as healthy by her physician? Has her lab work been consistently normal for that of a pregnant woman?

Generally speaking, if your client has had no significant medical impairments, no history of any pregnancy-related complications – currently or with prior pregnancies – and has maintained a healthy weight and normal labs, then she is eligible to apply for life insurance coverage NOW. She would, very likely, be considered at the best possible qualifying class with most of our carrier partners.

If your currently pregnant client has a history of any significant medical impairments and/or pregnancy-related conditions (i.e. gestational diabetes), then our carrier partners will more than likely postpone her application until post-delivery. However, if there is any doubt, please do not hesitate to contact the AgencyONE Underwriting Team for assistance.

Additional Underwriting Considerations – When and How to Apply

In underwriting, a large WEIGHT LOSS or GAIN during pregnancy is averaged over the past 12 months. A first trimester application for insurance (less weight gain) may very well result in a more favorable underwriting outcome than a third trimester application. Additionally, applying for life insurance at later-stages of the pregnancy (i.e. third trimester) could present with ABNORMAL lab values; a direct result of the pregnancy. However, the underwriters cannot simply dismiss those abnormalities and may postpone the application and request repeat labs post-delivery. We have carrier partners who do consider currently pregnant applicants through their ACCELERATED UNDERWRITING Programs. Reach out to the AgencyONE underwriting team to help you target the best options for that consideration.

What is the mortality concern?

Pregnancy-related deaths are rare, but they are possible. In 2022, the CDC estimated that about 700 women die in the U.S. each year from pregnancy-related complications. An even more shocking statistic is that approximately 60% of those deaths are preventable! The most common causes of pregnancy-related deaths are heart conditions and stroke.

Pregnancy-related deaths are rare, but they are possible. In 2022, the CDC estimated that about 700 women die in the U.S. each year from pregnancy-related complications. An even more shocking statistic is that approximately 60% of those deaths are preventable! The most common causes of pregnancy-related deaths are heart conditions and stroke.

Postpartum Conditions

Postpartum depression and anxiety are another aspect of pregnancy that our underwriting team encounters often. Depending on the severity of the diagnosis, a history of postpartum depression may cause an even longer postpone period post-delivery (6 months to one year) until stability on treatment is achieved.

Postpartum depression and anxiety are another aspect of pregnancy that our underwriting team encounters often. Depending on the severity of the diagnosis, a history of postpartum depression may cause an even longer postpone period post-delivery (6 months to one year) until stability on treatment is achieved.

Let’s look at a case that AgencyONE recently underwrote on a pregnant client with a history of postpartum depression:

Case Study

Mrs. Preston is a 35-year-old successful businessowner seeking $2,000,000 of Variable Universal Life (VUL) coverage guaranteed to maturity. She has a 5-year-old daughter and is currently in the second trimester of pregnancy with her second child. Mrs. Preston is a very active, healthy woman with minimal medical history. She did experience a short period of mild postpartum depression after her first child was born. Mrs. Preston reached out to her primary physician when she started to experience mild depressive symptoms. She took a prescribed treatment of Zoloft for two months and was able to discontinue the medication with no ill-effects or continued depression.

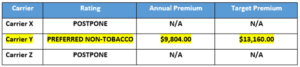

AgencyONE sent Mrs. Preston’s case, including a summary of her history, to Carriers X, Y, and Z. Both Carrier X and Z declined to offer coverage until the delivery of Mrs. Preston’s second child and receipt of a favorable postpartum follow-up. Given that Mrs. Preston’s postpartum depression symptoms were only mild, and she received prompt and effective medical advice and treatment, AgencyONE was able to negotiate a Preferred Non-Tobacco offer with Carrier Y. AgencyONE submitted a formal application and coverage was placed in force before the delivery of her second “bundle of joy”.

Pregnancy is a very exciting and joyous time in an expectant’s mother’s life and is a perfect time to start planning for the future with the purchase of life insurance coverage. AgencyONE’s underwriting department has the knowledge and expertise to underwrite the most complex cases and is a phenomenal resource to you when meeting with clients and questioning whether their medical history will allow you to deliver an offer that your client will agree to place.

Please contact AgencyONE’s Underwriting Department at 301.803.7500 with any questions or to discuss a case.