Underwriting Pulmonary Functions

The COVID pandemic has brought pulmonary issues to the forefront as we watch newscasts of ICU beds filled with patients on ventilators. COVID causes an inflammatory lung reaction that some people survive, while many others – over 800,000 COVID related deaths in the US at this point – do not survive the complications of the infection. This reality coupled with Asthma, Chronic Bronchitis, COPD (Chronic Obstructive Pulmonary Disease) are very serious conditions that can become life-threatening. So, how does an underwriter assess a GOOD pulmonary risk when one of these major impairments is involved in a diagnosis?

Covid & Underwriting Pulmonary Issues

Life Insurance Companies realized early in the pandemic that people with underlying lung diseases, even simple ASTHMA, were at a much higher risk for more serious infections. We have seen a significant improvement in underwriting assessments since the COVID vaccinations have become available. If your client has been vaccinated, it is A POSITIVE for underwriting!

a significant improvement in underwriting assessments since the COVID vaccinations have become available. If your client has been vaccinated, it is A POSITIVE for underwriting!

Medical Records & Underwriting Pulmonary Risk

Some of the biggest challenges we face in underwriting pulmonary risks are presented in the medical records we receive. The reimbursement guidelines for Health Insurance providers RESTRICT Pulmonary specialists to ordering tests ONLY WHEN A PATIENT HAS SYMPTOMS like Shortness of Breath (SOB), or Dyspnea on Exertion (DOE – difficulty breathing). Underwriters do not usually see pulmonary function studies performed on HEALTHY people. Lung function testing results for a patient suffering with any of these conditions may be extremely poor, and life insurance underwriters have no choice but to assess the risk using these IMPAIRED performance numbers. This is not the best-case scenario for the insured.

Some of the biggest challenges we face in underwriting pulmonary risks are presented in the medical records we receive. The reimbursement guidelines for Health Insurance providers RESTRICT Pulmonary specialists to ordering tests ONLY WHEN A PATIENT HAS SYMPTOMS like Shortness of Breath (SOB), or Dyspnea on Exertion (DOE – difficulty breathing). Underwriters do not usually see pulmonary function studies performed on HEALTHY people. Lung function testing results for a patient suffering with any of these conditions may be extremely poor, and life insurance underwriters have no choice but to assess the risk using these IMPAIRED performance numbers. This is not the best-case scenario for the insured.

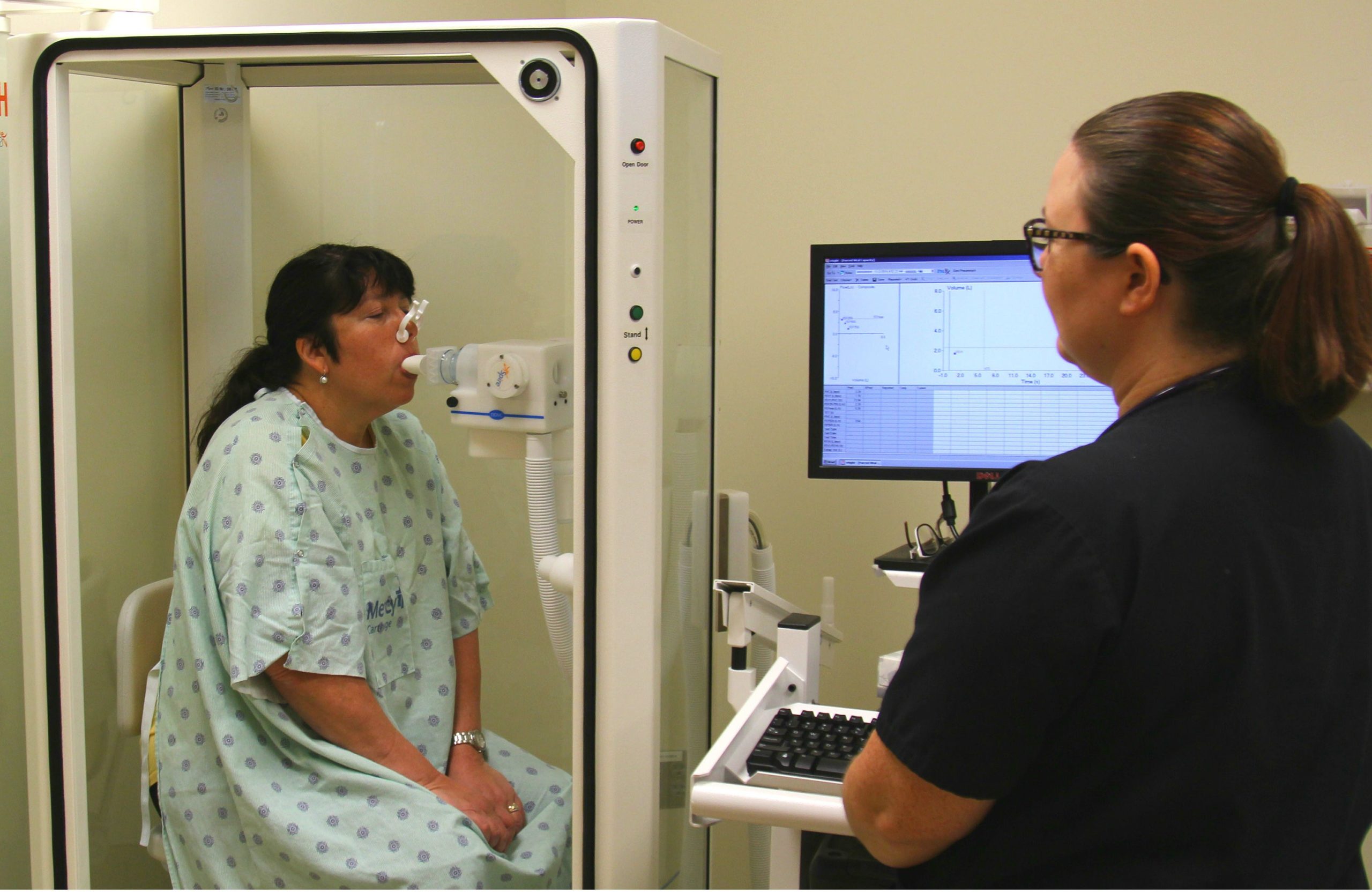

Pulmonary Function Testing

The IDEAL situation is to provide the underwriters with GOOD pulmonary function test results performed while the client is HEALTHY. In some situations, AgencyONE will request that another pulmonary test be taken by the client’s physician or by a Paramed. AgencyONE’s underwriters work closely with Attending Physicians to help them understand the differences between INSURANCE (mortality) Medicine and their usual CLINICAL Medicine. With the PATIENT in front of them, the Physician has the advantage over the underwriters who ONLY see the medical records presented to them and must work with just that information. Attending Physician Statement (APS) chart notes often give an extremely LIMITED picture of the patient. AgencyONE’s ultimate goal is to paint a COMPLETE picture for the underwriter.

will request that another pulmonary test be taken by the client’s physician or by a Paramed. AgencyONE’s underwriters work closely with Attending Physicians to help them understand the differences between INSURANCE (mortality) Medicine and their usual CLINICAL Medicine. With the PATIENT in front of them, the Physician has the advantage over the underwriters who ONLY see the medical records presented to them and must work with just that information. Attending Physician Statement (APS) chart notes often give an extremely LIMITED picture of the patient. AgencyONE’s ultimate goal is to paint a COMPLETE picture for the underwriter.

Pulmonary Function Testing – Instruction

Life Insurance underwriters focus on lung function testing which can be assessed with simple pulmonary function testing (PFT’s) that requires blowing into a tube for less than 10 seconds. The basic testing instruction is simple: “Take a deep breath and BLOW as hard as you can for as long as you can.” Simple and clear instruction brings TECHNIQUE into the equation and can help to influence the actual test results. What if the client takes a deep breath but does NOT blow as hard or as fast as they can?

Understandably, someone who does not make a determined and considerable effort to EXHALE forcefully could generate lower than normal test results in that especially important FIRST SECOND of the test. However, it should be noted that people with truly impaired lung function cannot significantly improve performance numbers even with a better technique.

Pulmonary Function Testing – The Math

Life insurance underwriters focus on FEV1, the Forced Expiratory Volume of air exhaled in the FIRST SECOND of the test, and then the FVC, the Forced Vital Capacity which is the number of the TOTAL lung volume of air exhaled when finished blowing. Simple math then considers the FEV1/FVC ratio. A NORMAL person should be able to exhale 70% of their lung volume in the first second. Less than 70% becomes a concern.

the Forced Vital Capacity which is the number of the TOTAL lung volume of air exhaled when finished blowing. Simple math then considers the FEV1/FVC ratio. A NORMAL person should be able to exhale 70% of their lung volume in the first second. Less than 70% becomes a concern.

AgencyONE is happy to discuss ANY lung function case you have had a problem or concern with in the past.

Case Study – Underwriting Pulmonary Function Impairment

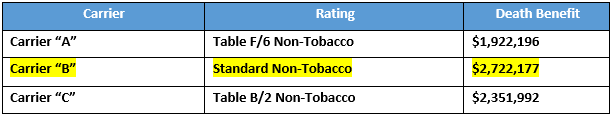

Ms. Lopez is a 69-year-old female with a history of moderate persistent Asthma. Her last pulmonary function studies were completed three years ago. At the time, she was dealing with a seasonal cold which, unsurprisingly, resulted in very POOR test results. AgencyONE advised the producer and his client that it was imperative that she complete current pulmonary function testing. The Agency ONE Underwriting Team worked with the client’s Pulmonologist to schedule new testing and emphasized to the client that her efforts in the VERY FIRST SECOND of the pulmonary test would DETERMINE her risk rating class. Ms. Lopez needed to try to EMPTY her lungs in that very first second. On her first attempt, Ms. Lopez performed similarly to the testing from three years ago; not well. Her second attempt was significantly better. On her third attempt, Ms. Lopez found her stride and presented NORMAL pulmonary functions. As noted earlier, someone with lung disease cannot generally improve lung functions just by changing technique.

Ms. Lopez’ case was strategically targeted to three carriers. AgencyONE was working with a sizeable 1035 exchange of $460,000 and looking to secure as much death benefit as possible. The current pulmonary function testing did not do much to change Carrier A’s view of the risk. They were stuck at Table 6 due to Ms. Lopez’ prior results. Carriers B and C were satisfied with the updated testing and were able to consider a more favorable offer. Tapping into crediting opportunities, AgencyONE was able to negotiate a STANDARD offer with Carrier B. Solving for the death benefit, utilizing the $460,000 of 1035 monies, and assuming an annual premium of $50,000, AgencyONE was able to secure over $2.7MM of coverage with Carrier B!

AgencyONE’s Underwriting Team consistently offers experienced, knowledgeable, and extraordinary underwriting to their AgencyONE 100 Advisors and clients and provides the best offers available in the marketplace.