Your Clients NEED You Today More Than Ever

The recent office closings, shutdowns and teleworking as a result of the COVID-19 Virus (otherwise known as the Coronavirus) has created an environment where salespeople, such as insurance advisors, will potentially have limited opportunities to “see” clients for an undetermined period of time. Traditionally, most insurance professionals have been face to face with clients in order to complete needs analysis, present solutions and take insurance applications. How are you going to get that done during these times? How will your business survive? How will your prospective or existing clients fulfill their orders to purchase much-needed insurance?

The Medical Information Bureau (MIB) recently reported that life insurance application activity had increased by 5.6% for the month of February year over year after only a 0.4% increase during all of 2019. The largest growth age group was 0-44, increasing 7%, while age 60 and older increased by 6.4%. Whether this increase in buying activity correlates directly to the current pandemic or not is unknown, but we suspect that events such as this tend to make people more conscious of their own mortality and the well-being of families and businesses.

Consider the online insurance aggregator and comparison site, True Blue Life Insurance, which recently reported an unusual spike in insurance application requests after Kobe Bryant’s tragic death. On Sunday, January 26th, the same day as the helicopter crash, application requests increased by 58% and on the following Monday, they were up 61% as reported by Yahoo Money. The trend continued throughout the entire week at the end of which it normalized. Everyone “knew” Kobe and the tragedy hit home for many consumers.

Every year LIMRA reports that individual life insurance ownership is at all-time lows, while interest in the product is currently increasing for a variety of reasons, not the least of which is the current pandemic.

If you are sitting in your office wondering what you are going to do for the next 4 to 6 to 8 weeks, or maybe longer, and how your business is going to survive, it is time to take a good hard look at Vive.

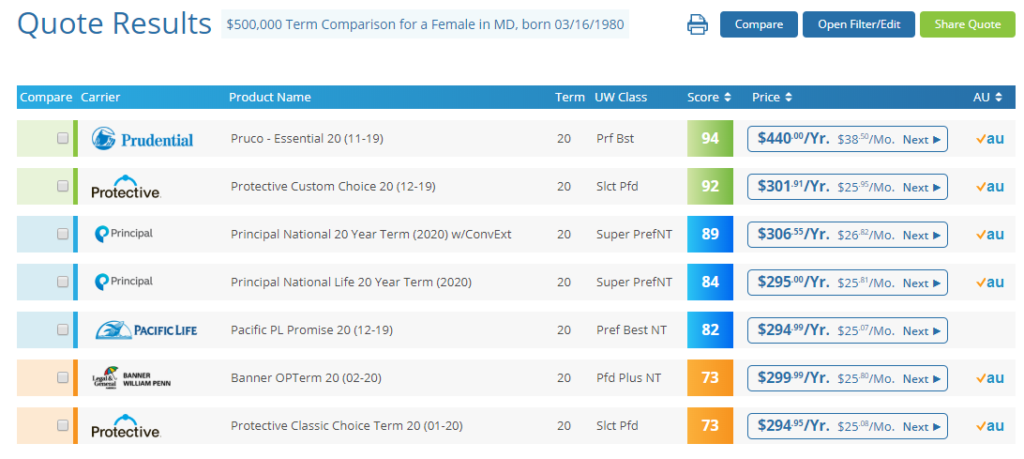

Vive is a needs analysis, quoting, risk assessment and online application platform that is exclusive to Partner firms of LIBRA Insurance Partners, the merger between LifeMark Partners and BRAMCO. The beauty of this platform is that it takes less than 5 minutes to provide a quote, complete a client interview and “drop a ticket”. Vive takes the algorithmic decision of whether a client qualifies for accelerated or algorithmic underwriting out of your hands. If a client qualifies, then no exams or fluids are required and the case automatically moves forward! If not, exams are scheduled and medical records are requested. This platform works across the entire technology spectrum, from mobile phone, to tablet, to laptop to desktop and provides a multi-carrier quoting and submission process.

Vive is a needs analysis, quoting, risk assessment and online application platform that is exclusive to Partner firms of LIBRA Insurance Partners, the merger between LifeMark Partners and BRAMCO. The beauty of this platform is that it takes less than 5 minutes to provide a quote, complete a client interview and “drop a ticket”. Vive takes the algorithmic decision of whether a client qualifies for accelerated or algorithmic underwriting out of your hands. If a client qualifies, then no exams or fluids are required and the case automatically moves forward! If not, exams are scheduled and medical records are requested. This platform works across the entire technology spectrum, from mobile phone, to tablet, to laptop to desktop and provides a multi-carrier quoting and submission process.Furthermore, the system provides a Vive Score, which weighs important factors beyond price. The Vive algorithm considers the following weighted factors:

- Carrier Rating – as defined by the Comdex Index

- Conversion Privileges – based on product availability and conversion parameters

- Product Features – such as competitiveness of premium grace periods and product riders

- Accelerated Underwriting Eligibility – whether a carrier offers Accelerated Underwriting with no exam, blood and medical history**

Vive aggregates all these factors to display an overall Vive Score for the product.

** The next generation of the Vive Score, which is under development, will also factor in speed of policy issue, as well as advisor and client experience.

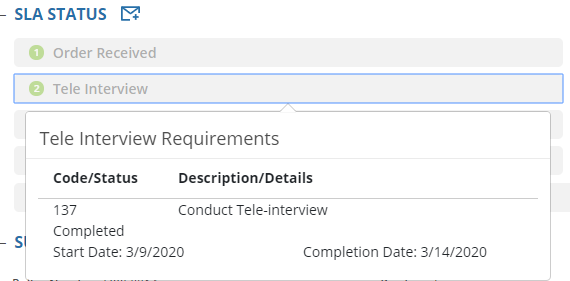

Finally, each carrier on the platform has agreed to certain Service Level Agreements (SLA’s) upon which the carrier is measured through the new business process and is displayed in the dedicated case management system for tracking purposes.

The Vive Platform provides an easier way for insurance advisors during COVID-19 to take care of their clients in today’s unsettling environment.

Please contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case!